Assessing MongoDB After Its 65.9% 2025 Surge and Rich Growth Multiple

- If you are wondering whether MongoDB is still a smart buy at today’s price, you are not alone; this stock has become one of the most talked about names in software.

- After a sharp 24.4% jump over the last week, a 14.1% gain over the past month, and a 65.9% climb year to date, the market clearly sees something it likes, but those moves also raise questions about how much upside is left from here.

- Recent headlines have focused on MongoDB’s expanding role in modern application development and its growing ecosystem of cloud partnerships, reinforcing its reputation as a go to database platform for high growth digital businesses. At the same time, commentary around elevated valuations in high growth software and shifting expectations for interest rates has added a layer of volatility for stocks like MongoDB.

- Despite all that excitement, MongoDB currently scores just 0/6 on our valuation checks, suggesting the stock looks expensive on traditional metrics for now. In the sections that follow we will walk through the main valuation approaches investors are using today and point to a more nuanced way of thinking about value that really ties the whole story together at the end.

MongoDB scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: MongoDB Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and discounting them back to the present. For MongoDB, the 2 Stage Free Cash Flow to Equity model starts with its latest twelve month free cash flow of about $360 million and then applies analyst forecasts and longer term growth assumptions.

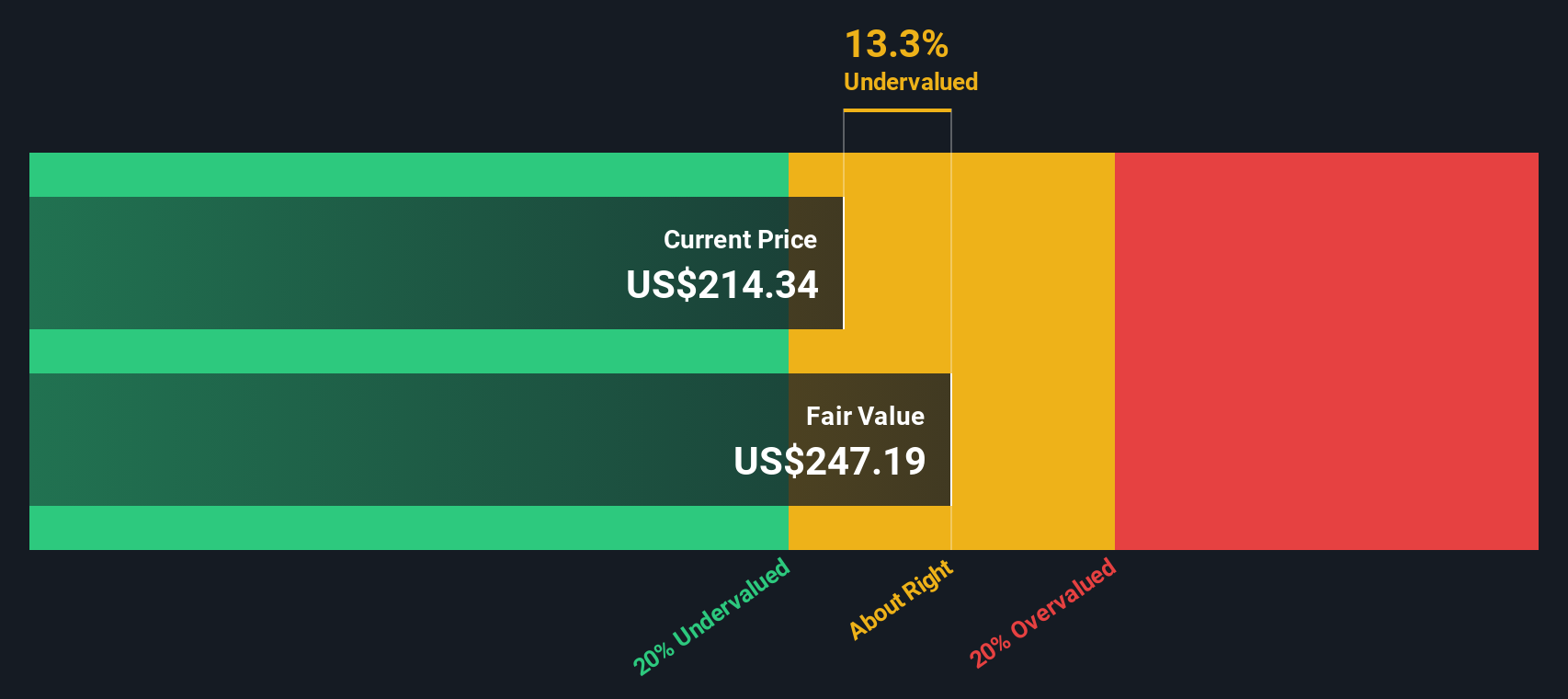

Analysts see MongoDB’s free cash flow rising to around $377 million in 2026 and $449 million in 2027, with Simply Wall St extrapolating stronger growth after that, reaching an estimated $1.02 billion of free cash flow by 2030. All of these projected cash flows are discounted back to today using a required rate of return, which yields an estimated intrinsic value of roughly $231.80 per share.

Compared with the current share price, this DCF implies MongoDB is about 75.1% overvalued. This suggests that investors are paying a steep premium for future growth that may already be fully priced in.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MongoDB may be overvalued by 75.1%. Discover 910 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: MongoDB Price vs Sales

For high growth software businesses that are not yet consistently profitable, the price to sales ratio is often the most practical valuation yardstick, because revenue is more stable and less distorted by heavy investment in product and go to market.

In general, investors are willing to pay a higher sales multiple for companies with faster, more durable growth and lower perceived risk. Slower growing or more cyclical businesses tend to command lower, more “normal” multiples. Today, MongoDB trades at around 14.26x sales, which is more than double the broader IT industry average of roughly 2.51x and also well ahead of its peer group, which sits near 6.79x.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating what multiple MongoDB should trade on, given its growth outlook, profitability profile, industry, market cap and key risks. On that basis, MongoDB’s Fair Ratio is about 10.37x sales, which is lower than the current 14.26x. That gap suggests investors are paying a premium above what those fundamentals justify right now.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

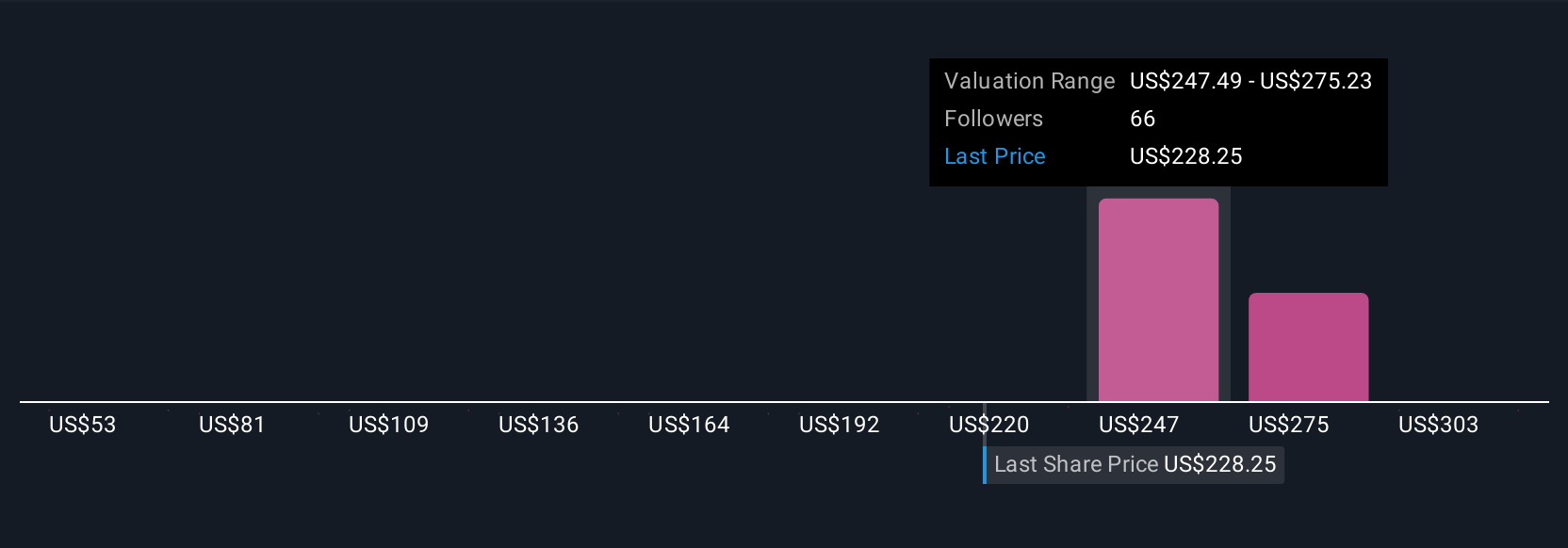

Upgrade Your Decision Making: Choose your MongoDB Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page where you connect your view of MongoDB’s story to a set of numbers, including your assumptions for future revenue, margins and earnings, and the fair value that drops out of those forecasts. A Narrative starts with your perspective, for example that AI driven demand and Atlas adoption will keep revenue growing near the current 18% rate with margins lifting toward 4%. It then converts that story into a transparent financial forecast and a fair value estimate you can compare to today’s share price to decide how MongoDB fits into your investment approach. Because Narratives on Simply Wall St are updated dynamically as new news, earnings and guidance come through, they stay aligned with reality. You can easily see how different investors arrive at very different fair values, from roughly $222 for more cautious outlooks to about $428 for more optimistic views that expect durable growth, expanding profitability and a premium multiple.

Do you think there's more to the story for MongoDB? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報