Does the Recent Slide in Kraft Heinz Share Price Offer a Long Term Opportunity?

- Wondering if Kraft Heinz is a quietly mispriced staple or a value trap in plain sight? This breakdown will help you figure out whether today’s share price makes sense for long term investors.

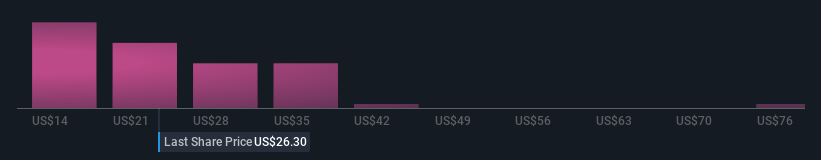

- Despite being down 18.7% year to date and 14.2% over the last year, Kraft Heinz has seen a modest 3.6% lift over the past month, suggesting sentiment may be starting to stabilize after a tough stretch.

- Recent headlines have focused on Kraft Heinz reshaping its portfolio and leaning harder into higher margin, branded products. Moves like these often matter more for long term value than quarter to quarter noise. At the same time, management’s focus on debt reduction and disciplined capital allocation has reassured some investors who worry about balance sheet risk in a higher rate environment.

- On our framework, Kraft Heinz scores a 4 out of 6 on undervaluation checks. This places it firmly in the “potentially interesting” bucket and makes it worth digging into the different valuation lenses we will cover next, before circling back to an even more powerful way of thinking about fair value at the end of the article.

Find out why Kraft Heinz's -14.2% return over the last year is lagging behind its peers.

Approach 1: Kraft Heinz Discounted Cash Flow (DCF) Analysis

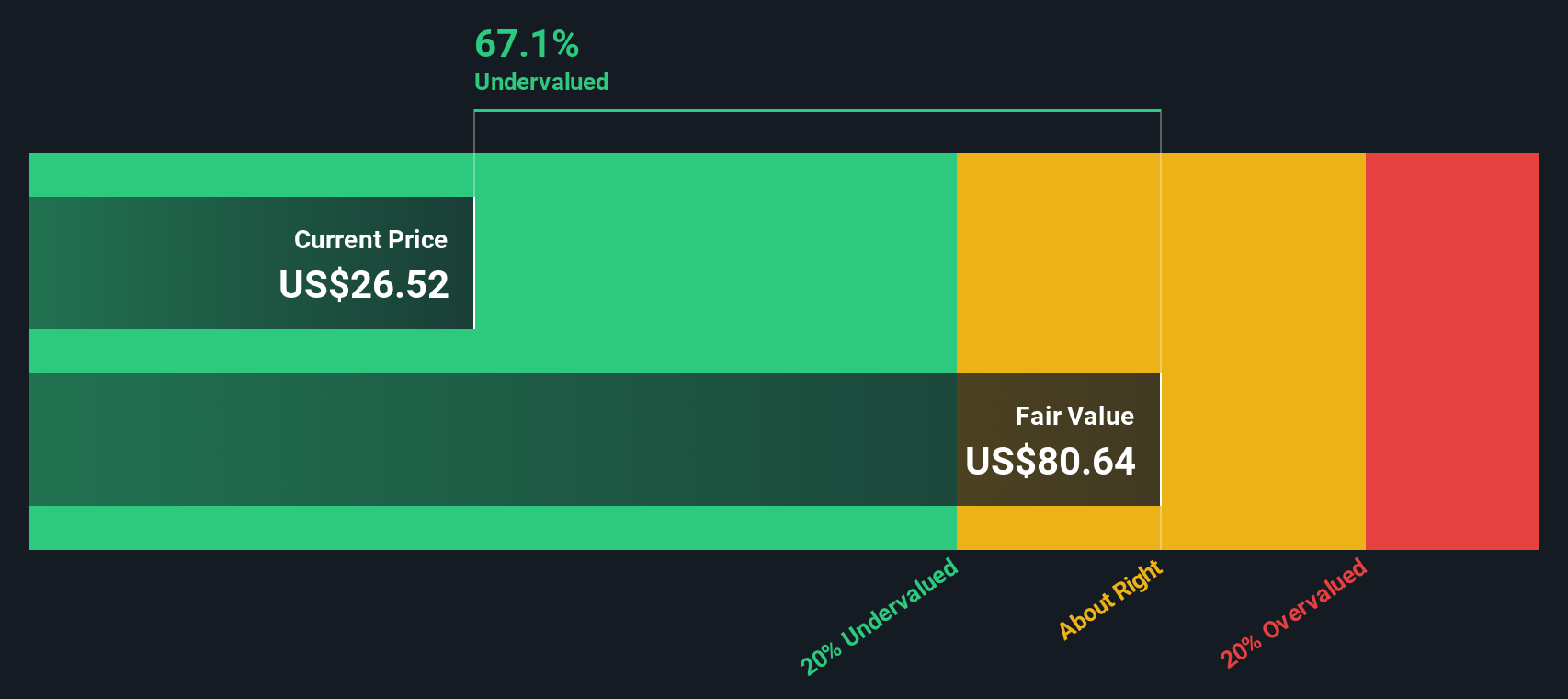

The Discounted Cash Flow model takes Kraft Heinz’s future cash flow projections and discounts them back to today, aiming to estimate what the business is worth right now in dollar terms.

Kraft Heinz generated about $3.5 billion in free cash flow over the last twelve months. Analyst forecasts, combined with Simply Wall St extrapolations, indicate free cash flow rising gradually over the next decade to roughly $4.0 billion by 2035, with interim projections such as around $3.2 billion in 2026 and $3.3 billion in 2028. These figures are used in a 2 Stage Free Cash Flow to Equity model, which places a higher weight on nearer-term cash flows and then tapers growth assumptions further out.

On this basis, the model arrives at an estimated intrinsic value of about $68.79 per share. With the DCF suggesting Kraft Heinz is trading at a 63.6% discount to this value, the shares appear materially undervalued on a cash flow basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kraft Heinz is undervalued by 63.6%. Track this in your watchlist or portfolio, or discover 917 more undervalued stocks based on cash flows.

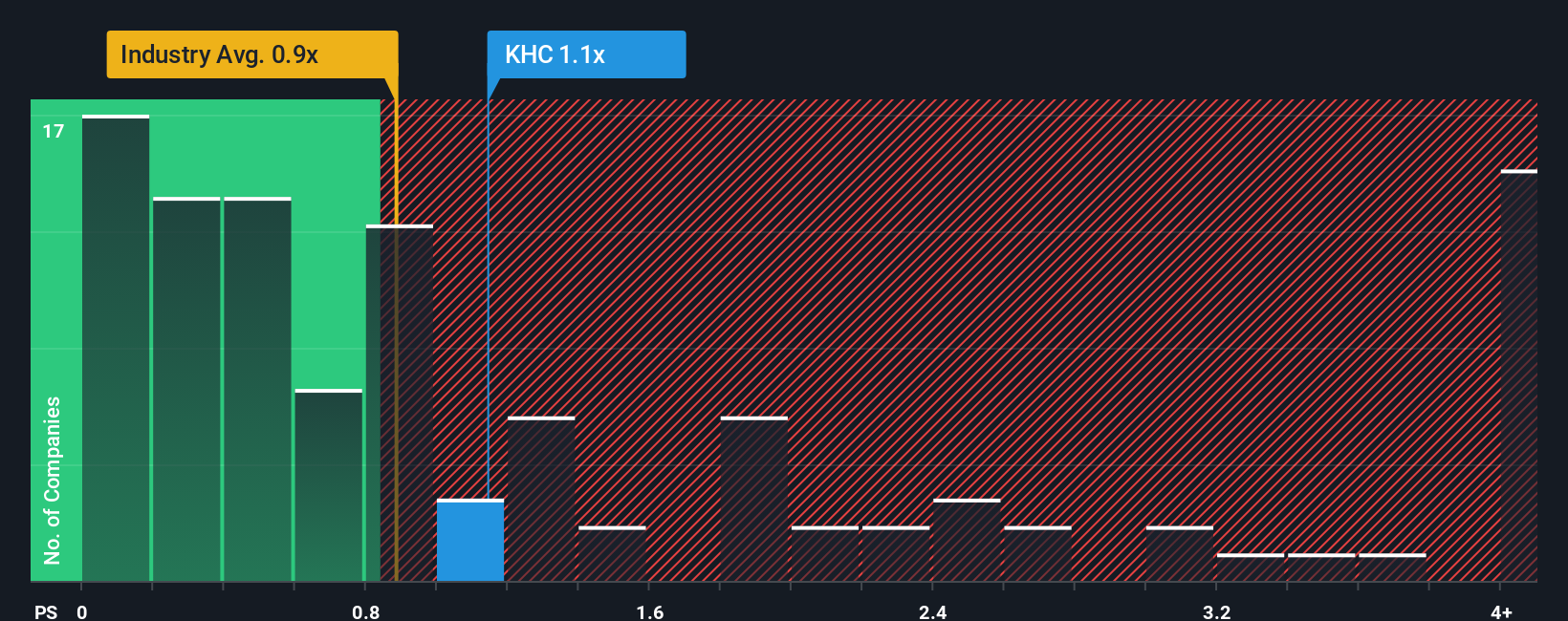

Approach 2: Kraft Heinz Price vs Sales

For a mature, profitable consumer staples company like Kraft Heinz, the price to sales multiple is a useful way to judge value because revenue tends to be relatively stable and less affected by one off earnings swings. Investors typically pay a higher sales multiple when they expect stronger growth and see lower risk, and a lower multiple when growth is modest or the outlook is more uncertain.

Kraft Heinz currently trades on a price to sales ratio of about 1.18x. That sits above the broader Food industry average of roughly 0.75x, but below the peer group average of around 1.78x, suggesting the market is assigning it a mid range valuation relative to comparable names. Simply Wall St’s proprietary Fair Ratio for Kraft Heinz is 1.39x, which reflects what investors might reasonably pay given its growth profile, profit margins, size and risk characteristics.

Because the Fair Ratio explicitly incorporates these fundamentals rather than just comparing raw multiples, it offers a more tailored benchmark than simple peer or industry comparisons. With the current 1.18x sitting below the 1.39x Fair Ratio, the shares appear modestly undervalued on a sales multiple basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kraft Heinz Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to connect your view of Kraft Heinz’s future to a concrete forecast and fair value. On Simply Wall St’s Community page, you can outline your story for the business, plug in your assumptions for future revenue, earnings and margins, and the platform will turn that story into a dynamic valuation that updates as new news or earnings arrive. This allows you to compare Fair Value to the current share price and decide whether Kraft Heinz looks like a buy, hold or sell. You can also see how other investors’ Narratives differ, from more bullish views that lean into emerging market growth and brand reinvestment, to more cautious outlooks that focus on weak core markets, execution risks and lower price targets, all within an accessible, easy to use framework that sits behind the millions of Narratives already shared by the community.

Do you think there's more to the story for Kraft Heinz? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報