Bitmine Immersion Technologies (BMNR) Is Up 6.0% After Massive ETH Treasury Build And 2025 Earnings Release

- Bitmine Immersion Technologies, Inc. has reported full-year 2025 results showing revenue of US$6.10 million and net income of US$348.58 million, while also declaring an annual dividend of US$0.01 per share payable on December 29, 2025.

- Alongside these results, the company has continued building one of the largest Ethereum treasuries globally, amassing more than 3.73 million ETH and expanding its role as an Ethereum-focused crypto-treasury and services business.

- With shares rising over the past week, we’ll explore how Bitmine’s aggressive Ethereum accumulation ahead of the Fusaka upgrade is shaping its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Bitmine Immersion Technologies' Investment Narrative?

To own Bitmine Immersion Technologies, you really have to believe in Ethereum as an asset class and in Bitmine’s ability to turn a huge, volatile crypto hoard into a viable business model. The latest earnings, headline net income and first dividend are important, but they mostly reinforce what the stock already trades on: Bitmine’s US$12.1 billion crypto and cash pool, including 3.73 million ETH, and its pivot toward staking and services. Short term, the key catalysts still sit around Ethereum’s Fusaka upgrade, progress on the Made in America Validator Network and any further acceleration in token accumulation. At the same time, the stock’s very large drawdown from its summer peak, heavy recent dilution and sizeable unrealized losses on ETH keep financing and sentiment as live risks. This week’s bounce with Ethereum’s recovery suggests the news is directionally supportive, but it has not removed the core uncertainties.

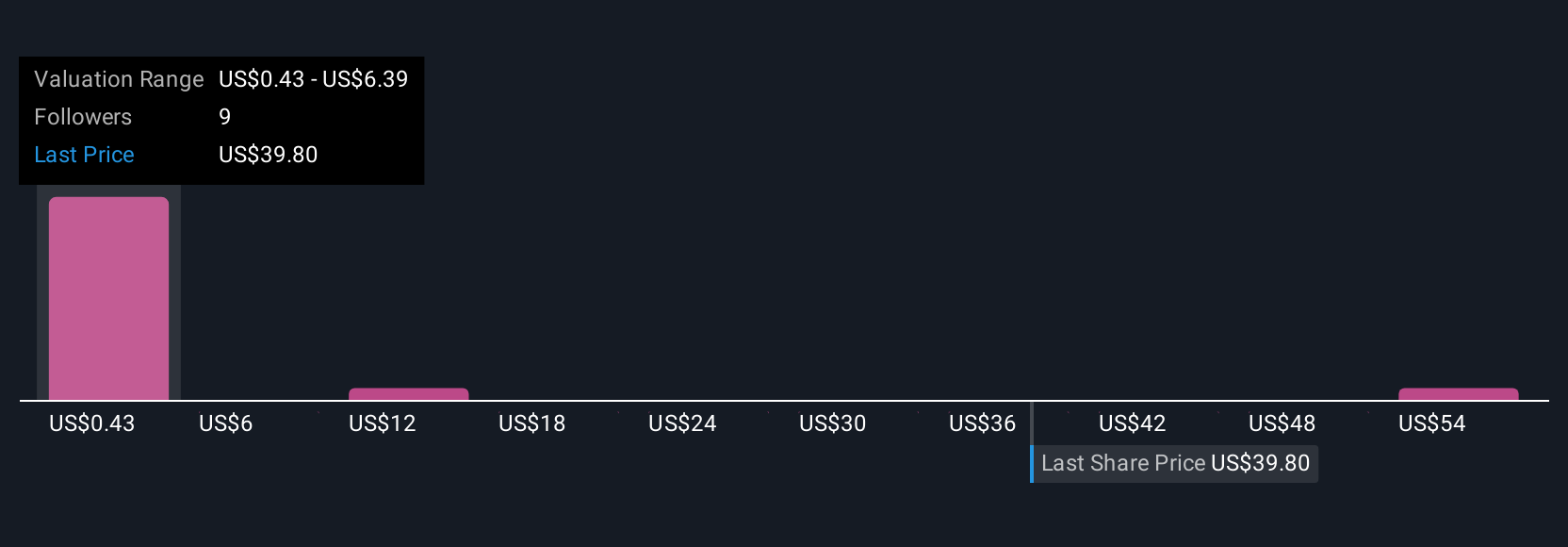

However, there is one financing-related risk here that investors really should not ignore. The valuation report we've compiled suggests that Bitmine Immersion Technologies' current price could be inflated.Exploring Other Perspectives

Twenty five members of the Simply Wall St Community currently peg Bitmine’s fair value anywhere from about US$0.35 to US$130 per share, showing just how far apart expectations can be. That spread sits against a business whose near term fortunes still hinge on Ethereum price moves and Bitmine’s ability to convert its large treasury into recurring income, so it is worth exploring several viewpoints before deciding where you stand.

Explore 25 other fair value estimates on Bitmine Immersion Technologies - why the stock might be worth less than half the current price!

Build Your Own Bitmine Immersion Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Bitmine Immersion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitmine Immersion Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報