Rumor has it that senior Japanese government officials “gave the green light” to the December rate hike. Will the global market storm be repeated under the impact of the butterfly effect?

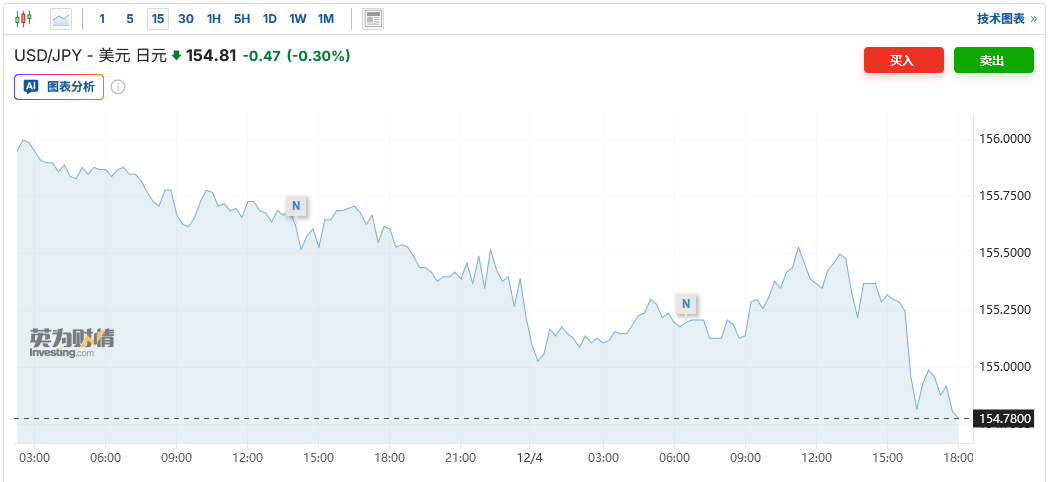

The Zhitong Finance App learned that, according to people familiar with the matter, if the Bank of Japan decides to raise interest rates in December, key officials in the Takaichi Sanae government will not try to stop it, even though some senior officials oppose the timing of this rate hike. At a time when market expectations that the Bank of Japan will raise interest rates by 25 basis points at the December 19 policy meeting are heating up, the Japanese government's position increases the possibility that the country's central bank will raise interest rates this month. As of press time, the exchange rate of the US dollar against the yen fell to 154.81 yen per dollar. The yield on Japan's two-year treasury bonds rose to 1.022%.

Bank of Japan's December rate hike is “in the arrow”

On Thursday, the media quoted three Japanese government sources as reporting that the Bank of Japan is likely to raise interest rates this month and that the Japanese government will tolerate this move. Although the Bank of Japan is independent of the government, under a 2013 joint agreement, the two sides agreed to strengthen policy coordination to overcome deflation and achieve sustainable economic growth. After Takaichi Sanae was elected Prime Minister of Japan, her support for monetary easing prompted market speculation that she might try to influence the Bank of Japan to raise interest rates at a slower pace.

However, analysts have previously pointed out that the political pressure on the Bank of Japan to keep interest rates low seems to have abated. Kazuo Monma, the former head of monetary policy at the Bank of Japan, predicts that since one of Takaichi Sanae's key priorities is to help Japanese households cope with high inflation, the prime minister known for advocating monetary easing will allow the Bank of Japan to push forward with interest rate hikes.

It is worth mentioning that Bank of Japan Governor Kazuo Ueda sent a clear hawkish signal earlier this week. Speaking to local business leaders in Nagoya on Monday, Kazuo Ueda said that the Bank of Japan “will weigh the pros and cons of raising policy interest rates and make timely decisions based on domestic and foreign economic, inflation, and financial market conditions.” He added that any rate hike is only an adjustment to the degree of easing, and the current overall environment is still relaxed. This statement suggests that the Bank of Japan is likely to take action this month.

By referring to a specific policy meeting, Kazuo Ueda is likely implying that the possibility of interest rate action at that time is rising. Looking back at the end of December last year, the governor of the Bank of Japan made it clear that he would carefully evaluate the economic situation at the next meeting — and it was at that meeting that the Bank of Japan finally decided to raise interest rates.

Prior to Kazuo Ueda's speech on Monday, several Bank of Japan officials had already made statements suggesting that the Bank of Japan might be about to raise interest rates. Masuda Kazuyuki, who recently joined the Bank of Japan Policy Committee, said that the time to raise interest rates is approaching. Another committee member, Junko Koeda, also said that the Bank of Japan should push for policy normalization, even though she did not say whether the next steps should be taken in December. Even Dove member Noguchi Asahi pointed out last week that the risk of policy adjustments being made too late is rising.

Some of the latest economic data also supported the market's expectations for the Bank of Japan's interest rate hike. According to data released by Japan's Ministry of Internal Affairs and Communications on Friday, consumer prices excluding fresh food in Tokyo rose 2.8% year on year in November, slightly higher than economists' median estimate of 2.7%, in line with last month's results; the core CPI index after further excluding energy also rose 2.8%, the same as last month. Meanwhile, the Ministry of Economy, Trade and Industry reported that industrial output increased 1.4% month-on-month in October, far exceeding the 0.6% decline estimated by the market. These economic data may strengthen the Bank of Japan's confidence that its economic outlook is gradually being realized, and push the central bank to further normalize monetary policy.

Furthermore, early signs of Japan's 2026 salary negotiations suggest that wages will once again achieve steady growth, which provides a basis for the Bank of Japan to raise interest rates further. Rengo, Japan's largest trade union organization with 7 million members, plans to seek a salary increase of 5% or more in 2026 labor negotiations. This is the same as what the organization asked for in 2025, and eventually reached its biggest salary increase in 34 years this year.

Will the butterfly effect of interest rate hikes impact the global market once again?

The hawkish signal released by Kazuo Ueda on Monday pushed the yield on Japan's two-year treasury bonds, which are sensitive to monetary policy, to break through 1% on Monday, for the first time in 17 years. The rise in expectations of the Bank of Japan's interest rate hike has had a ripple effect in the global fixed income market — government bonds, including US bonds, European bonds, and New Zealand treasury bonds, all fell on Monday. Matt Miskin, co-chief investment strategist at Manulife John Hancock Investments, said, “After the Bank of Japan released hawkish signals of interest rate hikes in December, the global bond market is feeling the butterfly effect.”

The market's key concern is that as Japanese domestic bond yields rise, Japanese investors may withdraw their capital to the country, reducing demand for foreign government bonds. Michael Metcalfe, head of macro strategy at State Street Markets, warned: “The more obvious the signs of interest rate normalization in Japan, the more likely Japanese investors are to withdraw from the foreign bond market or at least reduce the purchase of foreign bonds. This will weaken a key source of international financing at a time when sovereign bond issuance surges.”

Withdrawing capital from foreign bonds, including US bonds, from within Japan may push up 10-year US bond yields, and this “anchor of global asset pricing” has a key influence on global risk assets.

Furthermore, since the Bank of Japan has been implementing ultra-low interest rates for a long time, global financial institutions have become accustomed to borrowing yen and then buying other high-yield assets. The size of this arbitrage deal is as high as $5 trillion. The market is worried that rising interest rates in Japan may cause arbitrage trading to close again, leading to a resurgence of market turmoil in August last year. At the time, the closing of the Japanese yen arbitrage trade triggered sharp fluctuations in the global market, and the Nikkei 225 Index plummeted 12% in one day. Similar to the current environment, the market was also met with interest rate hikes by the Bank of Japan and interest rate cuts by the Federal Reserve at that time.

Some analysts believe that although the market storm of August last year will not be replicated, there may be similarities. The yen is still an important global financing currency. Once interest spreads narrow and the yen strengthens rapidly, highly leveraged arbitrage packages will be forced to close positions. Emerging market assets and highly valued growth stocks are often the first to be injured. Other analysts point out that the huge market shock in August last year is unlikely to be repeated, but there is also a possibility that the subsequent strengthening of the yen and the increase in Japanese bond yields will continue, triggering another tightening of global liquidity, which in turn will lead to an increase in global risk-free returns and a drop in the price of liquidity-sensitive assets.

Nasdaq

Nasdaq 華爾街日報

華爾街日報