How Criteo’s Strong Q3 and Retail Media Momentum May Shape Criteo (CRTO) Investors

- Criteo recently reported stronger-than-expected third quarter 2025 results, delivering robust earnings despite challenging market conditions and ongoing shifts in digital advertising.

- Analysts highlighted Criteo’s exposure to fast-growing areas such as Retail Media and agentic commerce, suggesting its commerce-focused ad infrastructure is gaining relevance with advertisers and partners.

- We’ll examine how this stronger-than-expected quarterly performance, especially in Retail Media, could influence Criteo’s existing investment narrative and risk profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Criteo Investment Narrative Recap

To own Criteo, you need to believe that its commerce-focused ad stack, especially Retail Media and agentic commerce, can offset pressures from larger platforms and client concentration. The stronger than expected Q3 2025 results help the short term catalyst of execution in Retail Media, but do not remove the longer term uncertainty around monetizing AI driven, agent based advertising models.

Among recent updates, I see the ongoing share buybacks as particularly relevant here. Criteo has now repurchased over 21.2 million shares for about US$687.5 million, which amplifies the impact of any earnings progress from Retail Media and AI products, but also raises the bar for sustaining cash generation if growth in newer channels or large client spend stalls.

Yet behind the strong quarter, investors should still be aware of...

Read the full narrative on Criteo (it's free!)

Criteo's narrative projects $1.0 billion revenue and $147.8 million earnings by 2028. This implies revenues will decrease by 19.2% per year and earnings will rise by about $11.3 million from $136.5 million today.

Uncover how Criteo's forecasts yield a $35.92 fair value, a 82% upside to its current price.

Exploring Other Perspectives

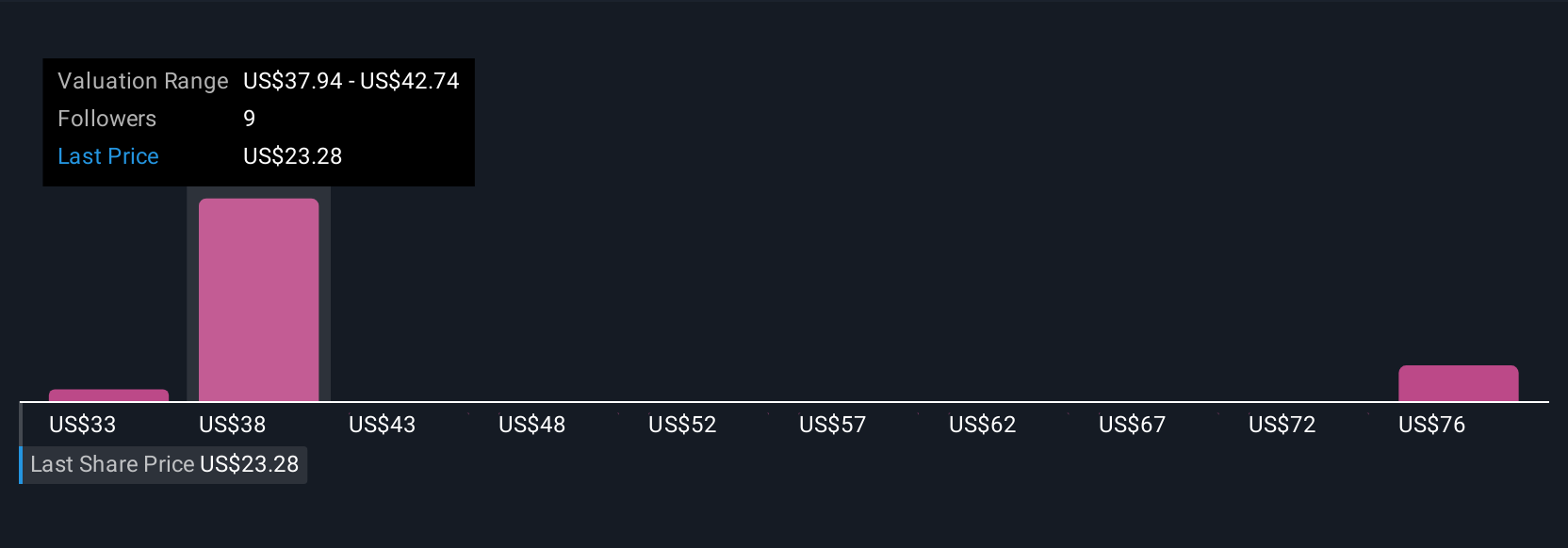

Four members of the Simply Wall St Community currently estimate Criteo’s fair value between about US$33 and US$127, showing how far apart individual views can be. Against that backdrop, Criteo’s stronger than expected Q3 and growing Retail Media exposure sit alongside unresolved questions about long term AI monetization, so it can be useful to compare several of these perspectives before forming a view.

Explore 4 other fair value estimates on Criteo - why the stock might be worth over 6x more than the current price!

Build Your Own Criteo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Criteo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Criteo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Criteo's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報