Can Rapport Therapeutics’ (RAPP) RAP-219 Data Details Reframe Its Neurology Pipeline Valuation?

- Rapport Therapeutics announced that it will present detailed Phase 2a data for its lead candidate RAP-219 in focal onset seizures, including efficacy and safety outcomes, at the American Epilepsy Society Annual Meeting in Atlanta on December 5–9, 2025.

- A particularly interesting angle for investors is the planned disclosure of how RAP-219’s efficacy varies over the first month of treatment and across different baseline disease severities, offering a deeper look at its potential clinical profile.

- Next, we will examine how this upcoming RAP-219 Phase 2a data release, especially the baseline severity analyses, shapes Rapport Therapeutics’ investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Rapport Therapeutics' Investment Narrative?

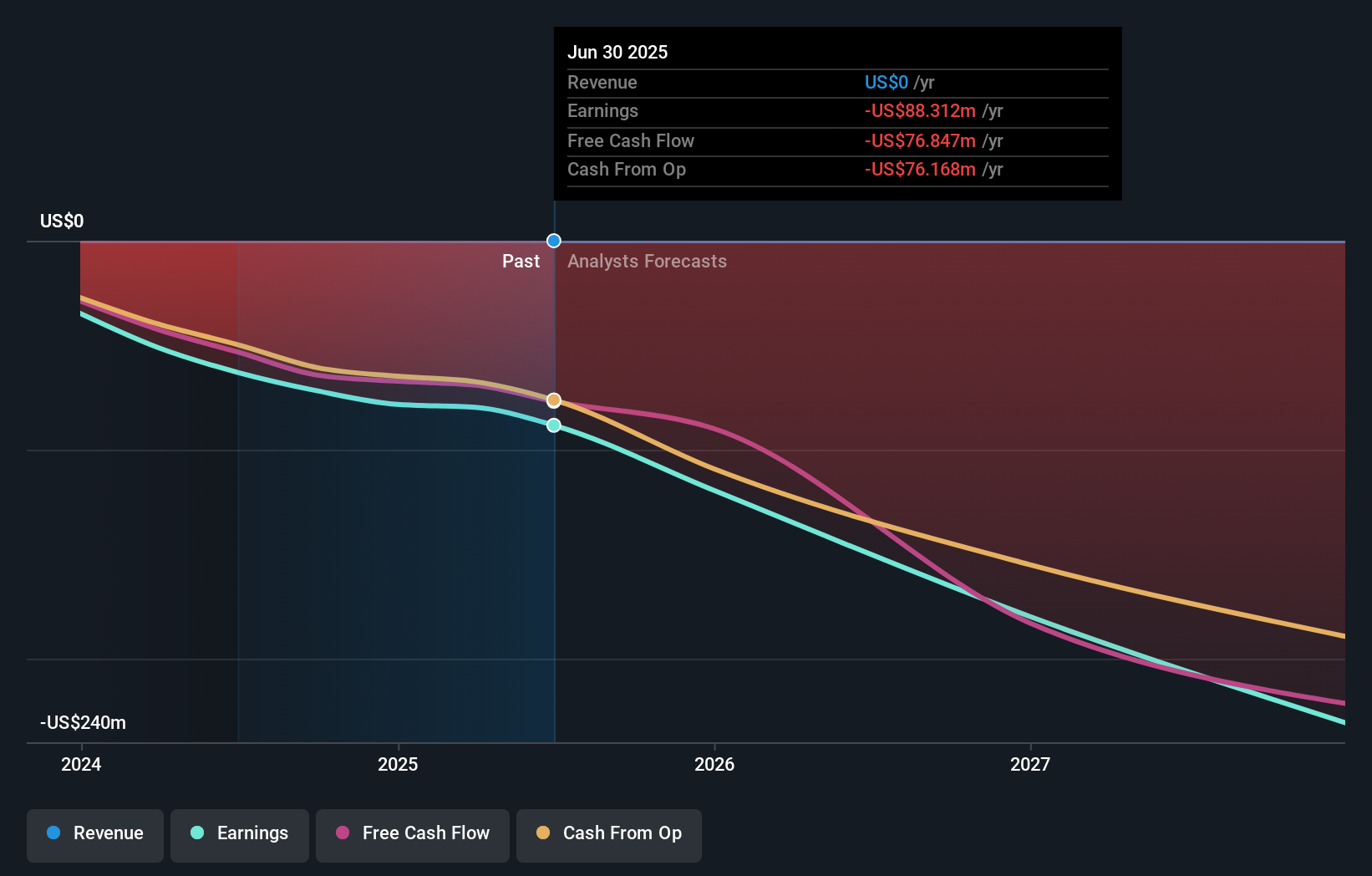

To own Rapport Therapeutics, you have to believe that RAP-219 can convert its early clinical promise in focal onset seizures into a differentiated epilepsy franchise, despite the company’s zero revenue, widening losses and reliance on external capital. The upcoming detailed Phase 2a readout at AES is now the key near term catalyst, because it goes beyond topline numbers and starts to address durability of effect and performance in patients with different baseline severities, both of which matter for how regulators, physicians and partners might view the asset. Given the very strong share price run this year and ongoing volatility, fresh data that refine RAP-219’s efficacy and safety story could either reinforce the current narrative or sharpen concerns around trial design, execution risk and future fundraising needs.

However, there is a funding and dilution risk here that investors should not ignore. The valuation report we've compiled suggests that Rapport Therapeutics' current price could be inflated.Exploring Other Perspectives

Explore another fair value estimate on Rapport Therapeutics - why the stock might be worth just $51.50!

Build Your Own Rapport Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rapport Therapeutics research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Rapport Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rapport Therapeutics' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報