Undiscovered Gems In Asia And 2 Other Promising Small Cap Stocks

Amidst global market fluctuations driven by trade policy uncertainties and inflation concerns, Asia's small-cap stocks present intriguing opportunities for investors seeking growth. In this environment, identifying promising stocks often involves looking for companies with strong fundamentals and the potential to thrive despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tibet Weixinkang Medicine | NA | 14.86% | 35.28% | ★★★★★★ |

| VICOM | NA | 3.60% | -2.15% | ★★★★★★ |

| Triocean Industrial Corporation | 7.23% | 47.26% | 57.96% | ★★★★★★ |

| AIC | 23.80% | 25.41% | 61.47% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.38% | -11.74% | -29.32% | ★★★★★★ |

| Xuelong GroupLtd | NA | -3.81% | -16.81% | ★★★★★★ |

| Hokkan Holdings | 56.86% | -6.83% | 14.66% | ★★★★★☆ |

| Daewon Cable | 24.09% | 8.60% | 57.94% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

| Kuo Yang Construction | 83.40% | -32.54% | -39.68% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

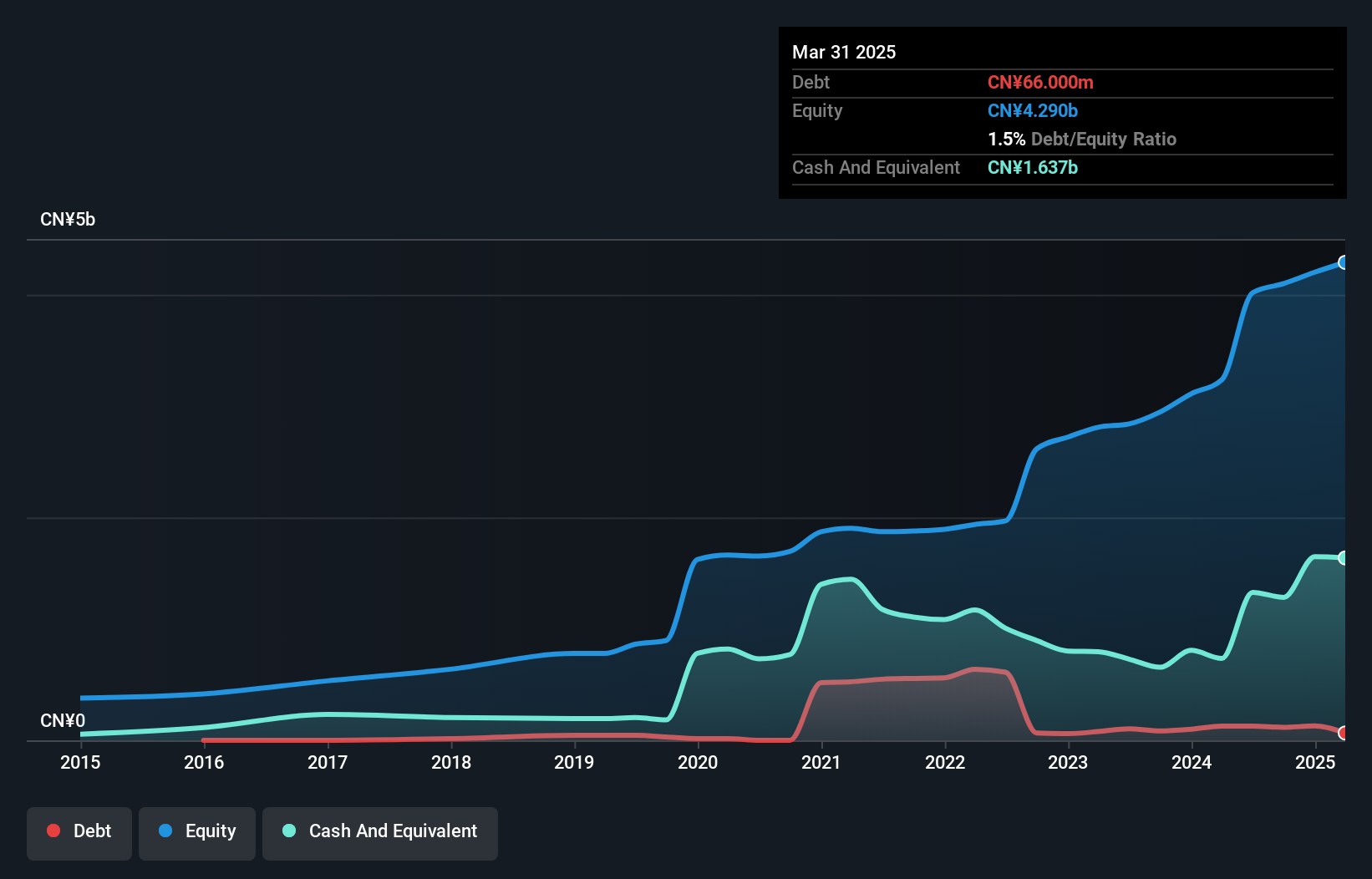

Lucky Harvest (SZSE:002965)

Simply Wall St Value Rating: ★★★★★★

Overview: Lucky Harvest Co., Ltd. focuses on the research, development, production, and sale of precision stamping dies and structural metal parts in China with a market capitalization of CN¥11.69 billion.

Operations: Lucky Harvest derives its revenue primarily from the sale of precision stamping dies and structural metal parts. The company's market capitalization is CN¥11.69 billion, indicating its significant presence in the industry.

Lucky Harvest, a smaller player in the machinery sector, has shown robust financial health with its interest payments covered 87 times by EBIT, indicating strong earnings quality. The company boasts more cash than total debt and has successfully reduced its debt-to-equity ratio from 3.3 to 2.8 over five years. Despite a volatile share price recently, earnings grew by 8.9% last year, outpacing the industry average of -0.03%. With a price-to-earnings ratio of 29x below the market's 39x, it seems well-positioned for future growth as earnings are projected to rise by over 21% annually.

- Click here to discover the nuances of Lucky Harvest with our detailed analytical health report.

Gain insights into Lucky Harvest's past trends and performance with our Past report.

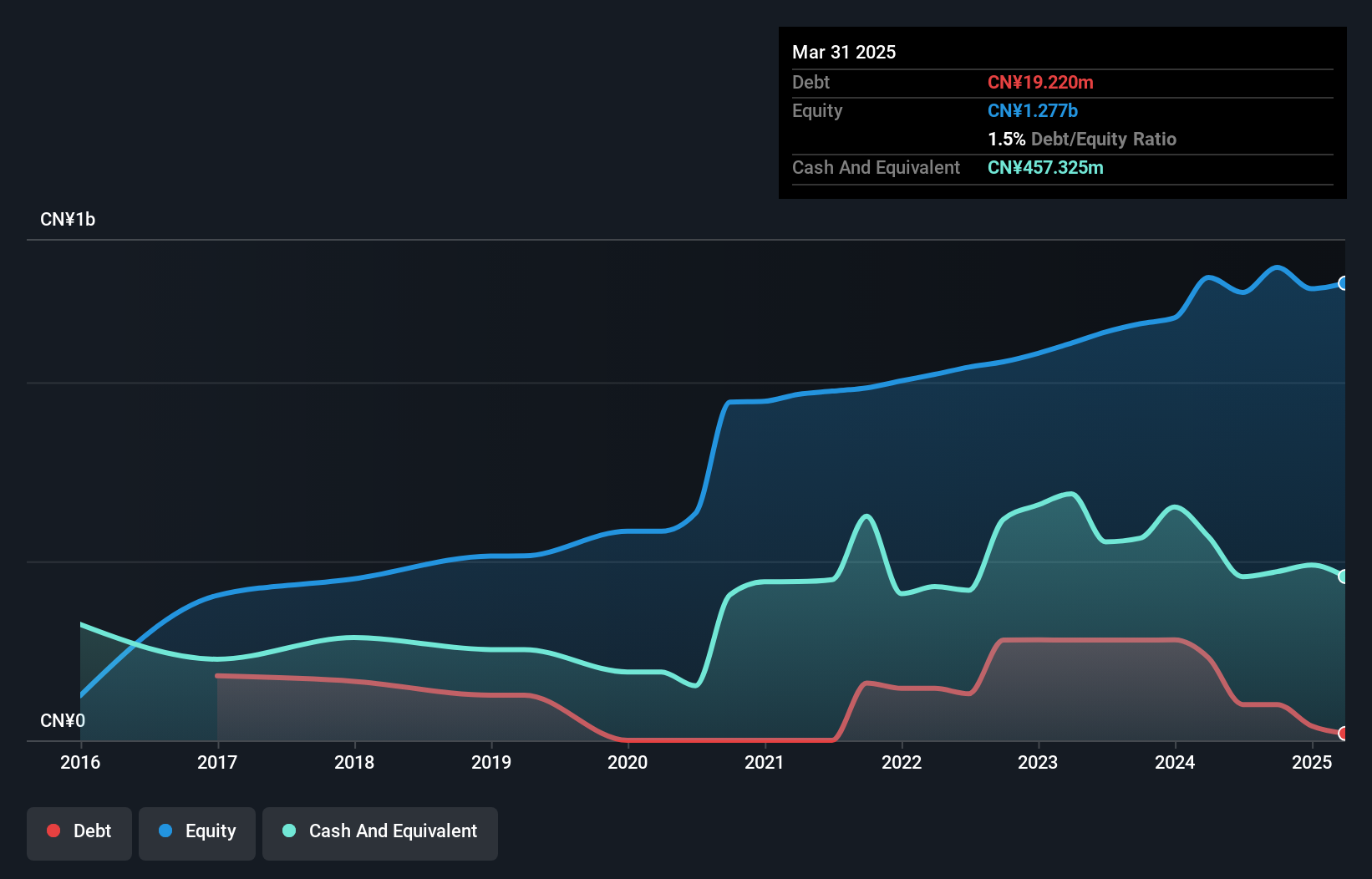

Qingdao KutesmartLtd (SZSE:300840)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qingdao Kutesmart Co., Ltd. is engaged in the manufacturing and sale of men's, women's, and children's apparel both within China and internationally, with a market capitalization of CN¥6.84 billion.

Operations: Kutesmart generates revenue through the sale of men's, women's, and children's apparel domestically and internationally. The company's financial performance is highlighted by a net profit margin of 12.5%, reflecting its profitability in the competitive apparel market.

Kutesmart, a smaller player in the luxury sector, has shown impressive earnings growth of 46% over the past year, outpacing the industry average of 2%. This growth is supported by high-quality earnings and positive free cash flow. The company’s debt to equity ratio saw a slight increase from 7.5 to 7.6 over five years, indicating stable financial management despite this uptick. Additionally, Kutesmart holds more cash than its total debt, suggesting a robust balance sheet capable of supporting future endeavors without immediate liquidity concerns.

- Click to explore a detailed breakdown of our findings in Qingdao KutesmartLtd's health report.

Explore historical data to track Qingdao KutesmartLtd's performance over time in our Past section.

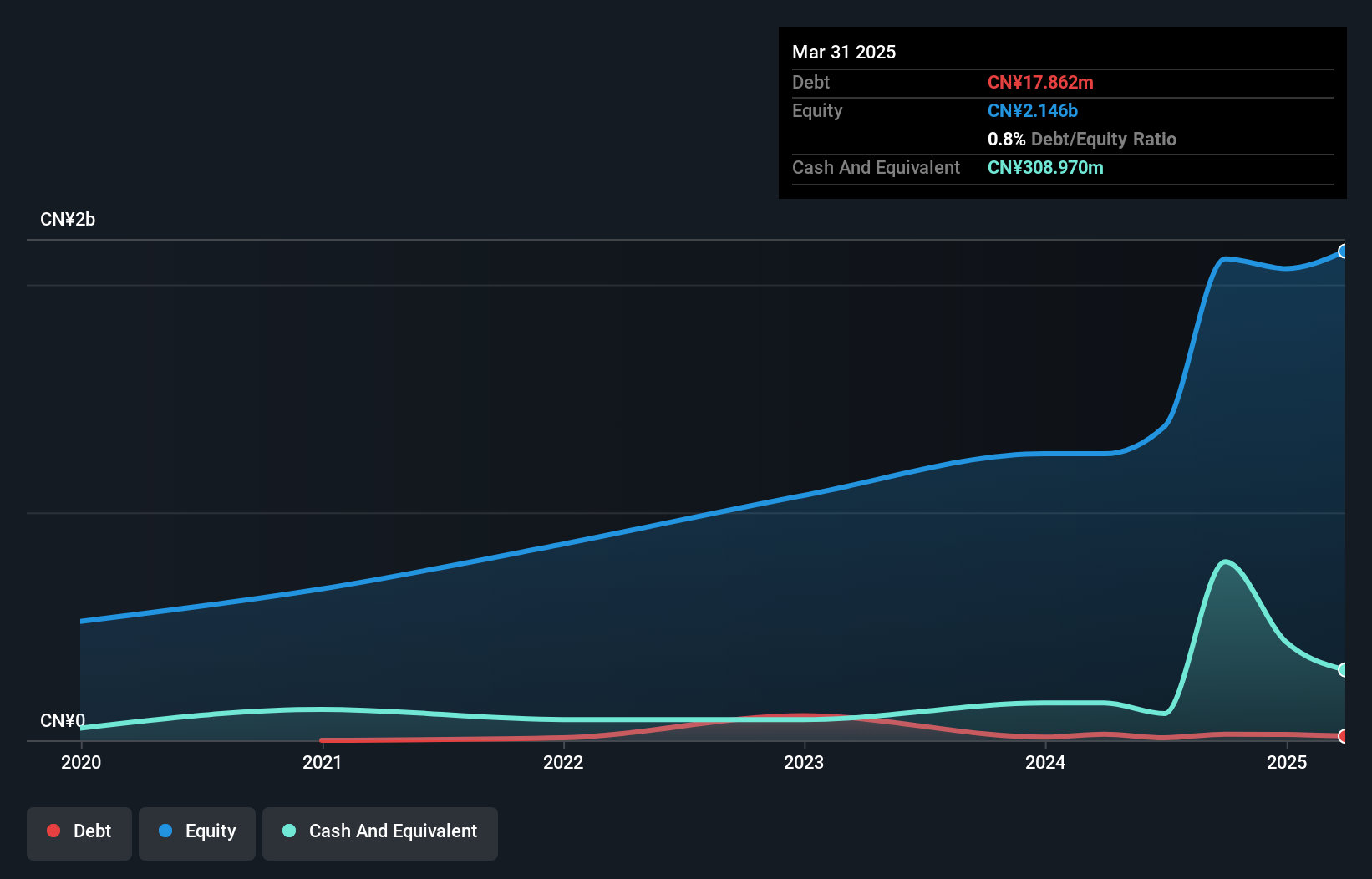

JirFine Intelligent Equipment (SZSE:301603)

Simply Wall St Value Rating: ★★★★☆☆

Overview: JirFine Intelligent Equipment Co., Ltd. focuses on the research, development, production, and sale of CNC machine tools and has a market cap of CN¥6.91 billion.

Operations: JirFine generates revenue primarily from the sale of CNC machine tools. The company has a market cap of CN¥6.91 billion, reflecting its significant presence in the industry.

JirFine Intelligent Equipment, a smaller player in the machinery sector, has been making waves with its impressive earnings growth of 14% over the past year, outpacing the industry's -0.03%. The company enjoys a strong position with more cash than total debt and boasts high-quality non-cash earnings. Its price-to-earnings ratio of 34.7x is attractive compared to the CN market's 38.6x. Recently added to the S&P Global BMI Index, JirFine seems poised for further recognition as it continues to demonstrate robust financial health and promising growth prospects in its niche market segment.

Turning Ideas Into Actions

- Explore the 2580 names from our Asian Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

華爾街日報

華爾街日報