Undervalued Small Caps With Insider Action To Watch In March 2025

Over the last 7 days, the United States market has experienced a 4.6% decline, yet it remains up by 8.8% over the past year with earnings forecasted to grow by 14% annually. In this context, identifying small-cap stocks that may be undervalued and have insider activity can offer potential opportunities for investors seeking to capitalize on these dynamic market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First Mid Bancshares | 10.7x | 2.6x | 40.82% | ★★★★★★ |

| Eagle Financial Services | 7.4x | 1.6x | 39.86% | ★★★★★☆ |

| Shore Bancshares | 10.2x | 2.3x | 10.14% | ★★★★★☆ |

| PCB Bancorp | 10.6x | 2.8x | 35.53% | ★★★★★☆ |

| Arrow Financial | 14.5x | 3.2x | 42.01% | ★★★★☆☆ |

| S&T Bancorp | 10.9x | 3.7x | 41.90% | ★★★★☆☆ |

| Citizens & Northern | 12.0x | 2.9x | 45.18% | ★★★☆☆☆ |

| West Bancorporation | 14.2x | 4.3x | 43.00% | ★★★☆☆☆ |

| Alpha Metallurgical Resources | 9.5x | 0.6x | -340.54% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -151.98% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Materialise (NasdaqGS:MTLS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Materialise is a company that specializes in 3D printing solutions across medical, software, and manufacturing sectors with a market capitalization of approximately $0.89 billion.

Operations: Materialise generates revenue through its three segments: Medical, Software, and Manufacturing. The company has experienced fluctuations in its net income margin over the years, with recent data showing a positive trend reaching 5.04% as of December 2024. Gross profit margin has shown variation but was recorded at 56.54% for the same period. Operating expenses are primarily driven by sales & marketing and R&D costs, which have consistently been significant components of the company's expenditure structure.

PE: 19.9x

Materialise, a company in the 3D printing sector, shows promising growth potential with projected earnings increasing by 15.32% annually. Insider confidence is evident as Wilfried Vancraen purchased 15,000 shares for US$80,250 recently. Despite a volatile share price and reliance on external borrowing for funding, Materialise reported an impressive net income rise to EUR 13.44 million in 2024 from EUR 6.72 million the previous year. The firm anticipates revenue between EUR 270 million and EUR 285 million for 2025, indicating continued expansion prospects.

- Get an in-depth perspective on Materialise's performance by reading our valuation report here.

Gain insights into Materialise's historical performance by reviewing our past performance report.

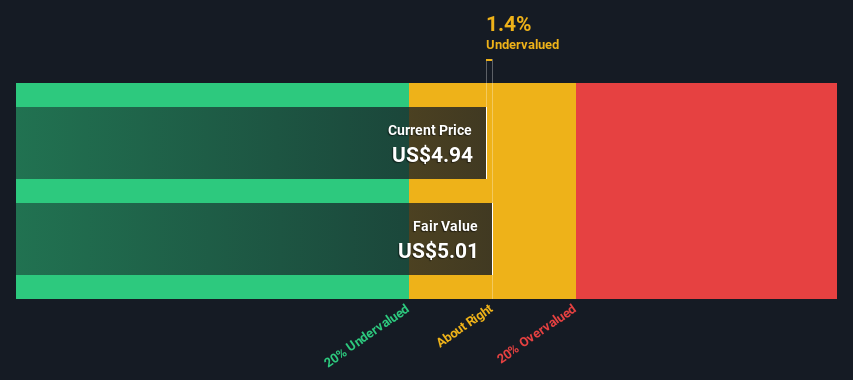

PCB Bancorp (NasdaqGS:PCB)

Simply Wall St Value Rating: ★★★★★☆

Overview: PCB Bancorp operates as a bank holding company providing a range of banking products and services primarily to small and medium-sized businesses, with a market capitalization of approximately $0.18 billion.

Operations: PCB Bancorp generates revenue primarily from the banking industry, with recent figures showing $96.31 million in revenue. The company consistently achieves a gross profit margin of 100%, indicating no cost of goods sold is reported. Operating expenses, including general and administrative costs, represent a significant portion of expenditures, most recently totaling $60.02 million. Net income margin has varied over time, with the latest figure at 25.93%.

PE: 10.6x

PCB Bancorp, a compact player in the financial sector, shows promising signs of being undervalued. For the fourth quarter ending December 2024, they reported an increase in net interest income to US$23.16 million and net income rising to US$7.03 million compared to the previous year. Insider confidence is evident as Sang Lee purchased 17,427 shares valued at approximately US$320,657. With earnings projected to grow annually by 14.72%, PCB's future appears optimistic amidst recent dividend increases and stable performance metrics.

- Click to explore a detailed breakdown of our findings in PCB Bancorp's valuation report.

Assess PCB Bancorp's past performance with our detailed historical performance reports.

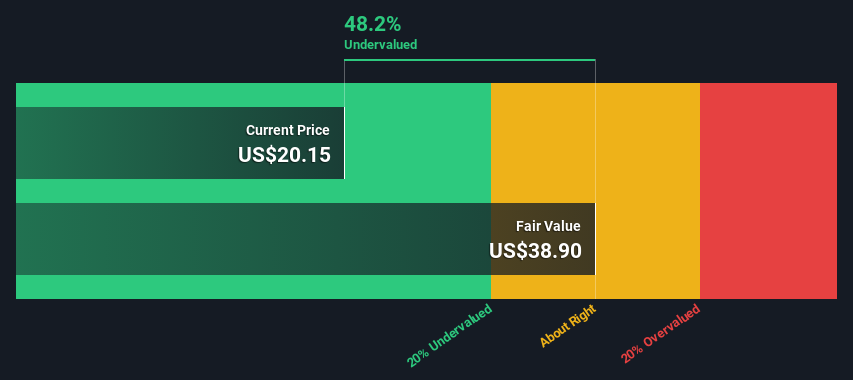

Alpha Metallurgical Resources (NYSE:AMR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Alpha Metallurgical Resources is a mining company focused on the production and sale of metallurgical coal, with a market capitalization of approximately $2.50 billion.

Operations: The company generates revenue primarily through its operations, with a significant portion of costs attributed to COGS. The net income margin has shown variability, reaching as high as 36.14% in September 2022 and dropping to 6.34% by December 2024. Operating expenses have been consistent over recent periods, impacting overall profitability alongside non-operating expenses and D&A costs.

PE: 9.5x

Alpha Metallurgical Resources, a smaller company in the U.S. market, has seen its profit margins drop significantly from 20.8% to 6.3% over the past year, with earnings per share also declining sharply. Despite these challenges, insider confidence is evident as an independent director recently acquired over 10,000 shares for US$2.4 million between October and February, reflecting potential optimism about future growth prospects or perceived value at current prices. The company completed a significant buyback earlier but hasn't repurchased any shares recently.

- Delve into the full analysis valuation report here for a deeper understanding of Alpha Metallurgical Resources.

Gain insights into Alpha Metallurgical Resources' past trends and performance with our Past report.

Make It Happen

- Gain an insight into the universe of 67 Undervalued US Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

華爾街日報

華爾街日報