HEICO (NYSE:HEI) Sees Q1 Sales Rise To US$1 Billion Net Income Up US$53 Million Year-Over-Year

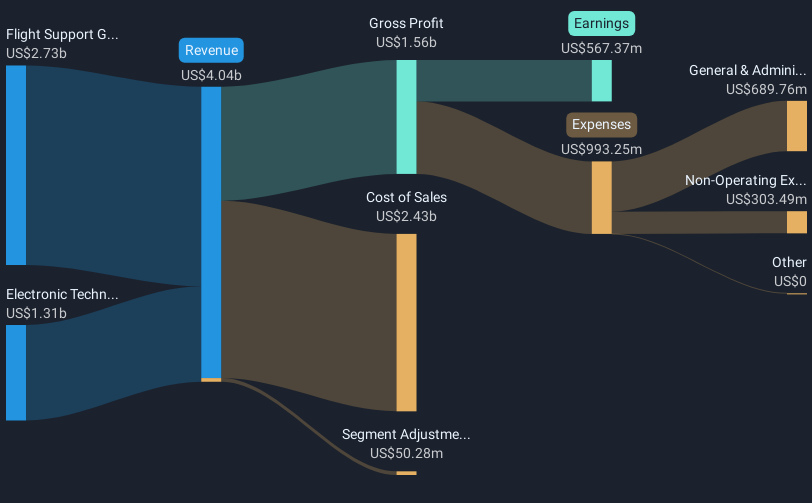

HEICO (NYSE:HEI) reported strong financial results for the first quarter of FY2025, with sales increasing to USD 1,030 million and net income rising to USD 168 million, compared to the previous year. This robust earnings announcement likely influenced the company's 2% price increase over the past week, underscoring investor confidence in HEICO's operational strategies and growth initiatives. In contrast, the broader market experienced a 4% downturn during the same period, amidst turmoil from fluctuating tech stocks like Nvidia and concerns over new tariffs. These mixed market conditions may have further emphasized the relative strength of HEICO's performance, as the company seemingly outshone broader market uncertainties. Notably, despite the chip sector decline and tariff news impacting investor sentiment, HEICO's gains were likely sustained by its significant earnings growth, signaling a positive reception from the market.

Get an in-depth perspective on HEICO's performance by reading our analysis here.

Over the past five years, HEICO's total shareholder return was an impressive 92.35%, reflecting the company's strong market position and operational success. This performance outpaced the broader US market's one-year return of 16.7%, highlighting HEICO's resilience in a challenging market environment. A key factor contributing to this long-term growth has been the company's consistent earnings expansion, with profits growing by an average of 8.8% annually. Furthermore, HEICO's earnings growth of 27.4% last year outperformed the Aerospace & Defense industry, which saw growth of 23%.

HEICO's commitment to rewarding shareholders has been evident through regular dividend payments, such as the December 2024 announcement of a US$0.11 per share dividend. The company has also maintained a robust acquisition strategy, actively pursuing opportunities in the Flight Support and ETG sectors. Despite high valuations compared to industry averages, these strategic moves have evidently fostered strong shareholder returns over the extended period.

- Get the full picture of HEICO's valuation metrics and investment prospects—click to explore.

- Gain insight into the risks facing HEICO and how they might influence its performance—click here to read more.

- Is HEICO part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

華爾街日報

華爾街日報