Assessing Sonic Healthcare (ASX:SHL) Valuation After 2025 Share Price Weakness And Steady Fundamentals

Sonic Healthcare (ASX:SHL) has drawn attention after a share price fall of nearly 20% since early 2025, even as revenue, net income and a balance sheet with more equity than debt suggest resilient underlying operations.

See our latest analysis for Sonic Healthcare.

Over the past year Sonic Healthcare’s share price return has softened, with a 1-year total shareholder return decline of 16.9% and a 5-year total shareholder return decline of 22%. The recent 90-day share price return of 3.5% suggests any positive momentum is still tentative when set against the longer term pullback from earlier in 2025.

If Sonic’s recent weakness has you reassessing your watchlist, it could be a good moment to compare it with other healthcare stocks that might better fit your thesis.

With Sonic Healthcare’s shares sitting below some valuation estimates despite recent revenue and net income growth, the key question is whether current pricing is conservative or whether the market already views future growth as fully reflected.

Most Popular Narrative Narrative: 20.6% Undervalued

With Sonic Healthcare last closing at A$22.33 against a narrative fair value of A$28.11, the valuation hinges on how future earnings and margins play out over the next few years.

The acceleration of personalized medicine and preventative healthcare, including demand for genetic and high-value specialty tests, is enabling Sonic to expand higher-margin service offerings (e.g., specialty genetics labs in both Australia and the US), with the potential to boost both revenue and net margins in coming years.

Want to see what sits behind that optimism on earnings and margins? The narrative leans on steady top line growth, a richer test mix, and a future profit multiple that rivals higher growth sectors. Curious which specific revenue and margin assumptions support that A$28.11 fair value on a 6.48% discount rate and how that compares with today’s price?

Result: Fair Value of A$28.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real watchpoints, including acquisition integration risk and possible regulatory or reimbursement changes that could pressure margins and challenge this earnings narrative.

Find out about the key risks to this Sonic Healthcare narrative.

Another View: What Do The Current Ratios Say?

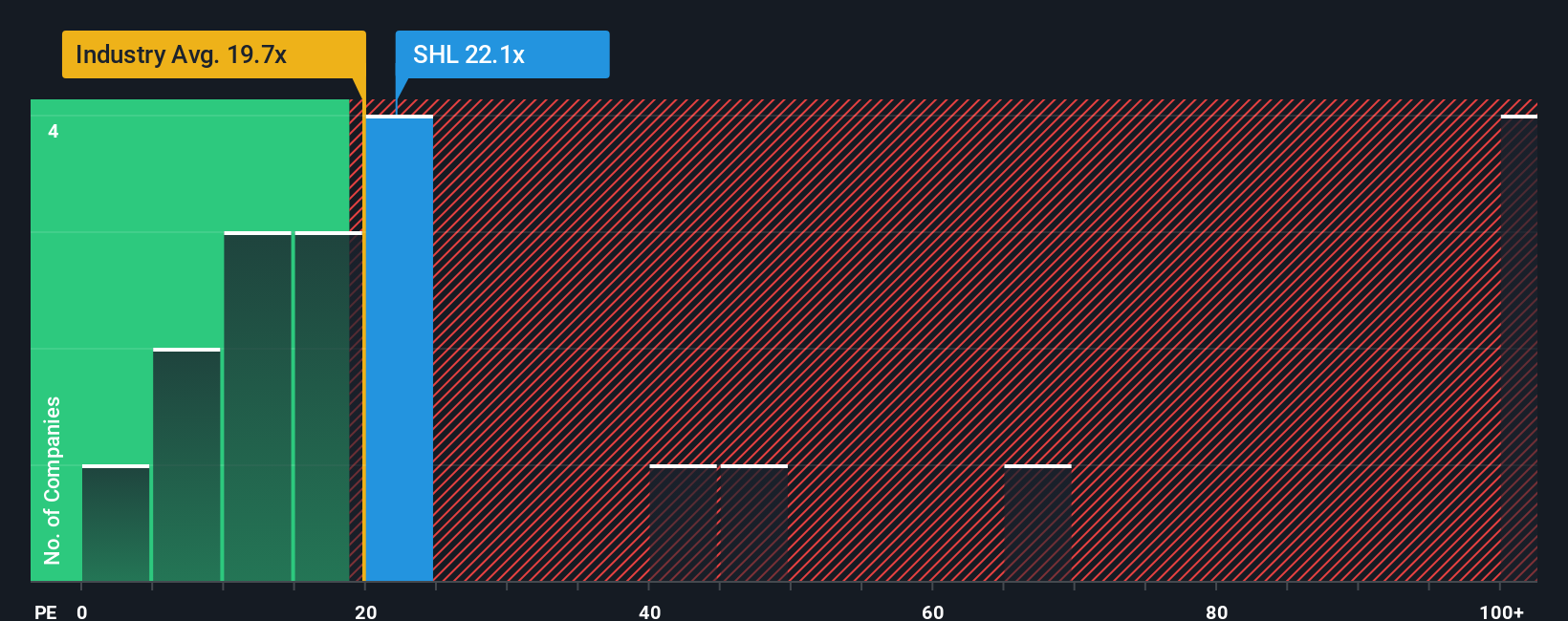

Our DCF work and the analyst narrative lean toward Sonic Healthcare looking undervalued, but the current P/E of 21.5x tells a more cautious story. It sits above the Global Healthcare industry average of 19.9x, even though our fair ratio estimate is a much higher 40.9x.

In practice, that means the share price is not obviously cheap when you line it up against global peers, yet it screens as good value against the fair ratio that the market could move towards. Is that a margin of safety you are comfortable with, or a sign to question the growth assumptions baked into that higher fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sonic Healthcare Narrative

If you see the data differently or simply prefer to test your own assumptions, you can build a complete Sonic Healthcare narrative in minutes with Do it your way.

A great starting point for your Sonic Healthcare research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Sonic Healthcare is only one piece of your watchlist, now is the time to widen your search and pressure test your thesis against fresh opportunities.

- Spot potential bargain opportunities early by scanning these 881 undervalued stocks based on cash flows that appear cheap relative to their cash flows and could merit a closer look.

- Ride powerful technology trends by checking out these 28 AI penny stocks that are tied to artificial intelligence themes across different parts of the market.

- Strengthen your income focus by reviewing these 11 dividend stocks with yields > 3% that combine dividend yields above 3% with share market exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报