A Look At Bank Of Nova Scotia (TSX:BNS) Valuation As Major Restructuring And 2026 Growth Aims Take Shape

Bank of Nova Scotia (TSX:BNS) is in the middle of a major reset as it exits underperforming markets, cuts at least 3,000 roles, and targets higher earnings in 2026 after topping recent profit expectations.

See our latest analysis for Bank of Nova Scotia.

Recent restructuring news and the upcoming April 2026 shareholders’ meeting have arrived alongside a 13.78% 90 day share price return and a very strong 1 year total shareholder return of 42.87%, which suggests improving momentum after a softer year to date share price return.

If this reset at Bank of Nova Scotia has you thinking about where else capital might work harder, it could be worth scanning fast growing stocks with high insider ownership as a way to spot other potential ideas.

With Bank of Nova Scotia posting higher recent profits, trading close to analyst targets, and sitting on a reported 36% intrinsic discount, the key question is simple: is there still an opportunity for investors here, or has the market already priced in the reset and any potential future growth?

Most Popular Narrative Narrative: 1% Overvalued

With Bank of Nova Scotia last closing at CA$101.08 and the most followed narrative pointing to fair value around CA$100.27, the gap is tight and the story hinges on execution.

The analysts have a consensus price target of CA$87.071 for Bank of Nova Scotia based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$94.0, and the most bearish reporting a price target of just CA$78.0.

Want to understand why modest revenue growth assumptions, firmer margins, and a lower future P/E still support that fair value? The narrative leans on detailed projections for earnings and share count that could shift the whole picture if they play out differently. Curious which of those moving parts really does the heavy lifting in this valuation story?

Result: Fair Value of $100.27 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on Latin American exposure and heavy Canadian mortgage ties not turning into higher credit losses or slower loan growth that undermines the reset story.

Find out about the key risks to this Bank of Nova Scotia narrative.

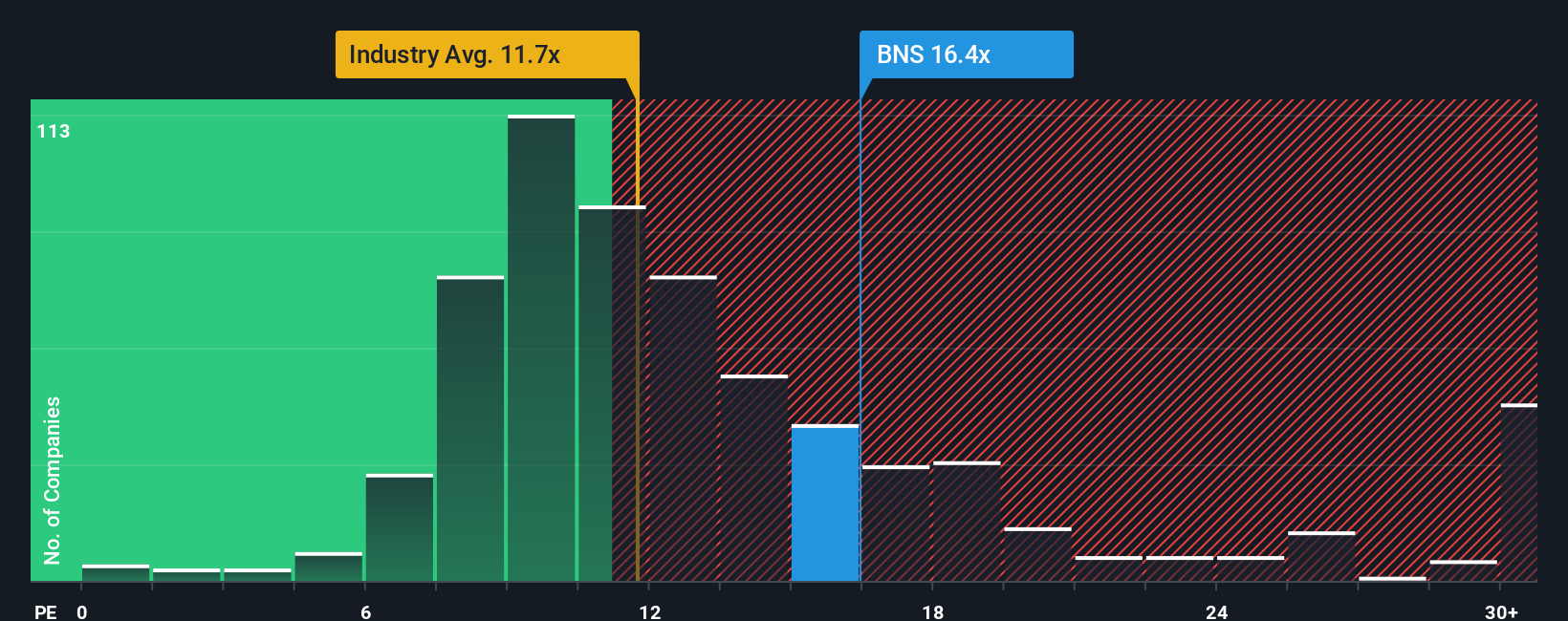

Another Angle: P/E Ratios Point To A Richer Price

While one narrative calls Bank of Nova Scotia roughly fairly valued around CA$100, the current P/E of 17.2x sits above both its fair ratio of 16.1x and the North American banks average of 11.9x, as well as a 14.8x peer average. That richer multiple could mean less room for error if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Nova Scotia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Nova Scotia Narrative

If you look at the numbers and reach a different conclusion, or simply want to test your own assumptions in detail, you can build a custom view of the story in just a few minutes and Do it your way

A great starting point for your Bank of Nova Scotia research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you risk missing other opportunities that might suit your goals even better, so give yourself a broader watchlist to work with.

- Spot potential value gaps by checking out these 879 undervalued stocks based on cash flows that the market may be pricing differently to their underlying cash flows.

- Ride powerful technology themes by scanning these 27 AI penny stocks shaping how automation, data and software play into future business models.

- Boost your income focus by reviewing these 12 dividend stocks with yields > 3% that pair yield above 3% with stock market exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报