Assessing Enel (BIT:ENEL) Valuation After €2b Hybrid Note Offerings And Recent Share Price Strength

Enel (BIT:ENEL) has drawn fresh attention after completing two fixed to floating rate subordinated perpetual hybrid note offerings on 7 January 2026, raising roughly €2b in callable, variable rate capital.

See our latest analysis for Enel.

These hybrid note issues come after a period of firm share price momentum, with Enel’s 90 day share price return of 11.35% and 1 year total shareholder return of 40.43% suggesting investors have recently been more comfortable with its risk and income profile.

If this kind of financing activity has you thinking about where else returns could come from, it might be worth scanning fast growing stocks with high insider ownership as a way to spot other potential opportunities.

With Enel’s share price up 40.43% over the past year and trading slightly above the €9.12 price target, investors may need to consider whether the remaining upside is limited or whether the market is underestimating future growth potential.

Most Popular Narrative Narrative: 2.8% Overvalued

With Enel closing at €9.27 against a narrative fair value of about €9.02, the story hinges on whether its execution can justify a small premium.

The analysts have a consensus price target of €8.491 for Enel based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €10.0, and the most bearish reporting a price target of just €7.6.

Curious what keeps this valuation so tightly bound to future earnings and margins, even as revenue growth assumptions ease only slightly and discount rates barely move?

Result: Fair Value of $9.02 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still a couple of pressure points that could flip this story, including tighter regulation in Italy or Spain and ongoing FX hits from Latin America.

Find out about the key risks to this Enel narrative.

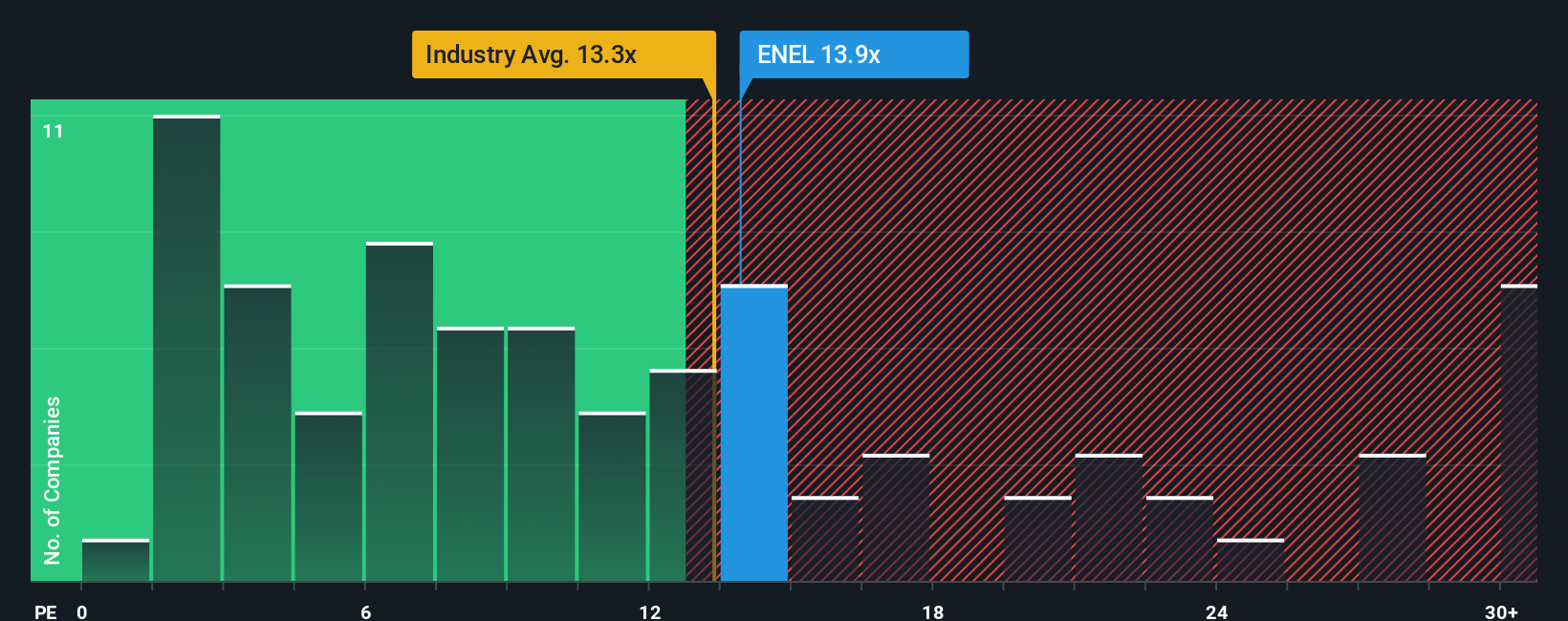

Another Take: Market Ratio Sends a Different Signal

Our DCF work may flag Enel as overvalued at €9.27 versus a fair value of €6.76, but the P/E picture is less one sided. The current 15.2x sits below the Italian market at 17x and the fair ratio of 18.9x, yet slightly above the European utilities average of 14.7x. The question is whether the risk is that the price drifts toward the DCF line, or that the market multiple and fair ratio pull it higher instead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enel Narrative

If you see the numbers differently or prefer to run your own checks, you can build a custom Enel story in minutes by using Do it your way.

A great starting point for your Enel research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Enel has sharpened your thinking, do not stop here. Broaden your watchlist with a few focused screens that could surface ideas you have not considered yet.

- Spot potential value by scanning these 881 undervalued stocks based on cash flows that might be pricing in more caution than their cash flows suggest.

- Target income potential by checking out these 12 dividend stocks with yields > 3% offering yields above 3% that could support a steadier return profile.

- Lean into long term themes by reviewing these 79 cryptocurrency and blockchain stocks tied to blockchain and digital asset adoption around the world.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报