Three Undiscovered Gems in Asia with Promising Potential

As Asian markets navigate a landscape marked by modest improvements in manufacturing and strategic government approaches to economic stimulus, investors are increasingly seeking opportunities that may not yet be on the radar. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can offer a promising avenue for those looking to capitalize on emerging trends.

Top 5 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Maezawa Kasei Industries | 0.77% | 3.52% | 20.55% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Machvision | NA | -5.24% | -7.71% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.06% | -13.76% | -28.84% | ★★★★★★ |

| Center International GroupLtd | 13.20% | -0.33% | -19.78% | ★★★★★★ |

| HannStar Board | 75.58% | -3.17% | -4.85% | ★★★★★☆ |

| Suzhou Xingye Materials TechnologyLtd | 0.14% | -3.11% | -19.10% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| YuanShengTai Dairy Farm | 15.09% | 11.64% | -31.87% | ★★★★★☆ |

| Yunnan Jinxun Resources | 36.66% | 75.25% | 111.88% | ★★★★★☆ |

| Poly Culture Group | 156.58% | -6.52% | -53.93% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Sichuan Haite High-techLtd (SZSE:002023)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Haite High-tech Co., Ltd focuses on providing aircraft airborne equipment maintenance services in China, with a market cap of CN¥11.14 billion.

Operations: The company generates revenue primarily from aircraft airborne equipment maintenance services. It has a market capitalization of CN¥11.14 billion, reflecting its significant presence in the industry.

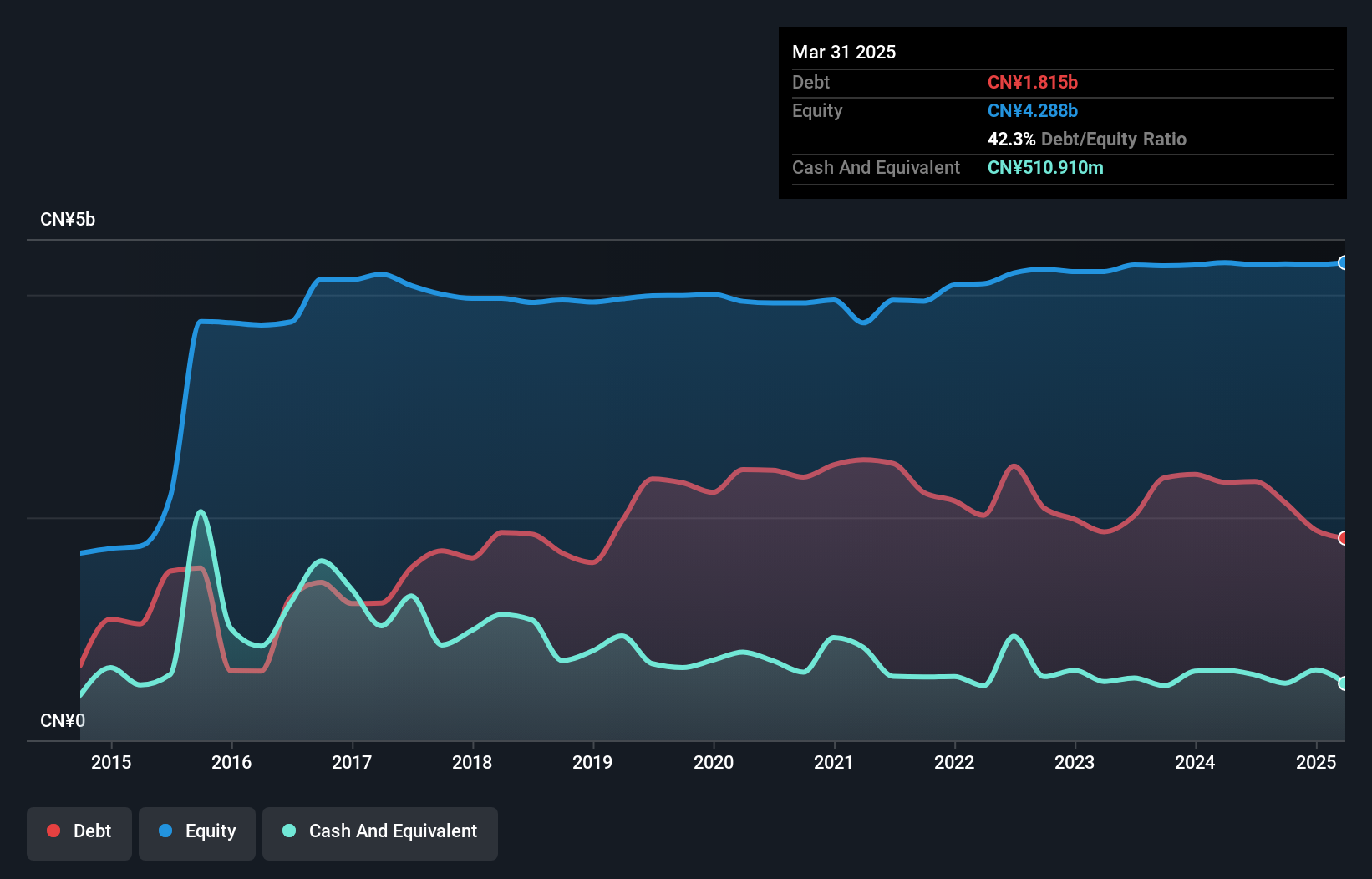

Sichuan Haite High-tech, a small player in the tech landscape, has shown impressive earnings growth of 69.7% over the past year, outperforming its industry peers. With sales reaching CNY 1.09 billion for the nine months ending September 2025 and net income climbing to CNY 119 million from CNY 61.9 million a year earlier, it demonstrates solid performance. The company maintains a satisfactory net debt to equity ratio at 13.8%, and its interest payments are well covered by EBIT at 3.1 times coverage, indicating strong financial health despite previous declines in earnings over five years by an average of 37%.

Hiconics Eco-energy Technology (SZSE:300048)

Simply Wall St Value Rating: ★★★★★★

Overview: Hiconics Eco-energy Technology Co., Ltd. operates in the industrial control, residential energy storage, and distributed PV EPC sectors both in China and internationally, with a market capitalization of CN¥7.90 billion.

Operations: Hiconics Eco-energy Technology generates revenue primarily from its industrial control, residential energy storage, and distributed PV EPC sectors. The company has a market capitalization of CN¥7.90 billion.

Hiconics Eco-energy Technology has turned profitable recently, showcasing impressive growth with earnings forecasted to rise 82% annually. The company reported a significant jump in sales for the nine months ending September 2025, reaching CNY 6.18 billion from CNY 3.11 billion the previous year, while net income soared to CNY 74 million from just CNY 10.81 million a year ago. With no debt on its books and high-quality earnings, Hiconics seems well-positioned in its industry despite being a smaller player, offering potential upside as it continues to capitalize on its financial health and market opportunities.

TOA (TSE:1885)

Simply Wall St Value Rating: ★★★★★★

Overview: TOA Corporation, with a market cap of ¥243.48 billion, offers construction and engineering services primarily in Japan.

Operations: The company's revenue is primarily driven by its Domestic Civil Engineering Business, generating ¥145.07 billion, followed by the Domestic Building Construction Business at ¥107.54 billion. The Overseas business contributes an additional ¥80.44 billion to the revenue stream.

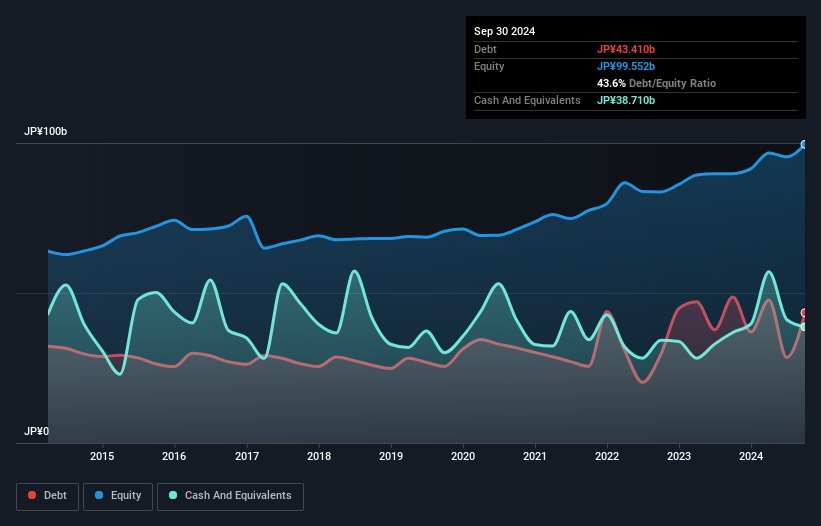

TOA has shown robust financial health, with a satisfactory net debt to equity ratio of 1.8% and well-covered interest payments at 173 times EBIT. Over the past five years, earnings have grown at an impressive rate of 22.7%, although recent growth of 25.4% slightly lags behind the construction industry's average of 35.2%. The company projects increased net sales by JPY 7 billion due to progress in overseas construction, with revised guidance indicating higher operating profits and EPS for fiscal year ending March 2026. Recent dividend announcements reflect a slight decrease from last year's figures but still signal strong shareholder returns.

- Dive into the specifics of TOA here with our thorough health report.

Gain insights into TOA's past trends and performance with our Past report.

Turning Ideas Into Actions

- Embark on your investment journey to our 2488 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报