Assessing Affirm Holdings (AFRM) Valuation As Bullish Sentiment Meets Consumer Credit Concerns

Why Affirm is suddenly in the spotlight

Affirm Holdings (AFRM) is back in focus as investors weigh upbeat commentary from TV personality Jim Cramer and bullish options trades against fresh warnings about consumer credit stress and rising default risks.

See our latest analysis for Affirm Holdings.

At a share price of $83.05, Affirm’s recent moves have been tied to this tug-of-war between upbeat commentary, bullish long-dated call options, and concerns about consumer credit health, with a 30-day share price return of 21.94% and a 1-year total shareholder return of 41.55% suggesting momentum has been building despite the debate.

If Affirm’s sharp swings have your attention, it could be a good moment to widen your search and check out fast growing stocks with high insider ownership.

With Affirm shares at $83.05, a 30-day return of 21.94% and a 1-year total return of 41.55% already on the board, the key question is whether there is still a buying opportunity here or if markets are simply pricing in future growth.

Most Popular Narrative: 10.4% Undervalued

With Affirm’s last close at $83.05 versus a narrative fair value of $92.71, the gap rests on confident assumptions about future growth and profitability.

Analysts are assuming Affirm Holdings's revenue will grow by 22.9% annually over the next 3 years.

Analysts assume that profit margins will increase from 1.6% today to 12.6% in 3 years time.

Curious what earnings power and margin profile could justify that kind of uplift, and what future P/E this narrative leans on, without seeing every assumption upfront?

Result: Fair Value of $92.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could shift quickly if a large enterprise partner walks away, as expected, or if competition in buy now, pay later squeezes pricing power.

Find out about the key risks to this Affirm Holdings narrative.

Another View: Multiples Paint a Very Different Picture

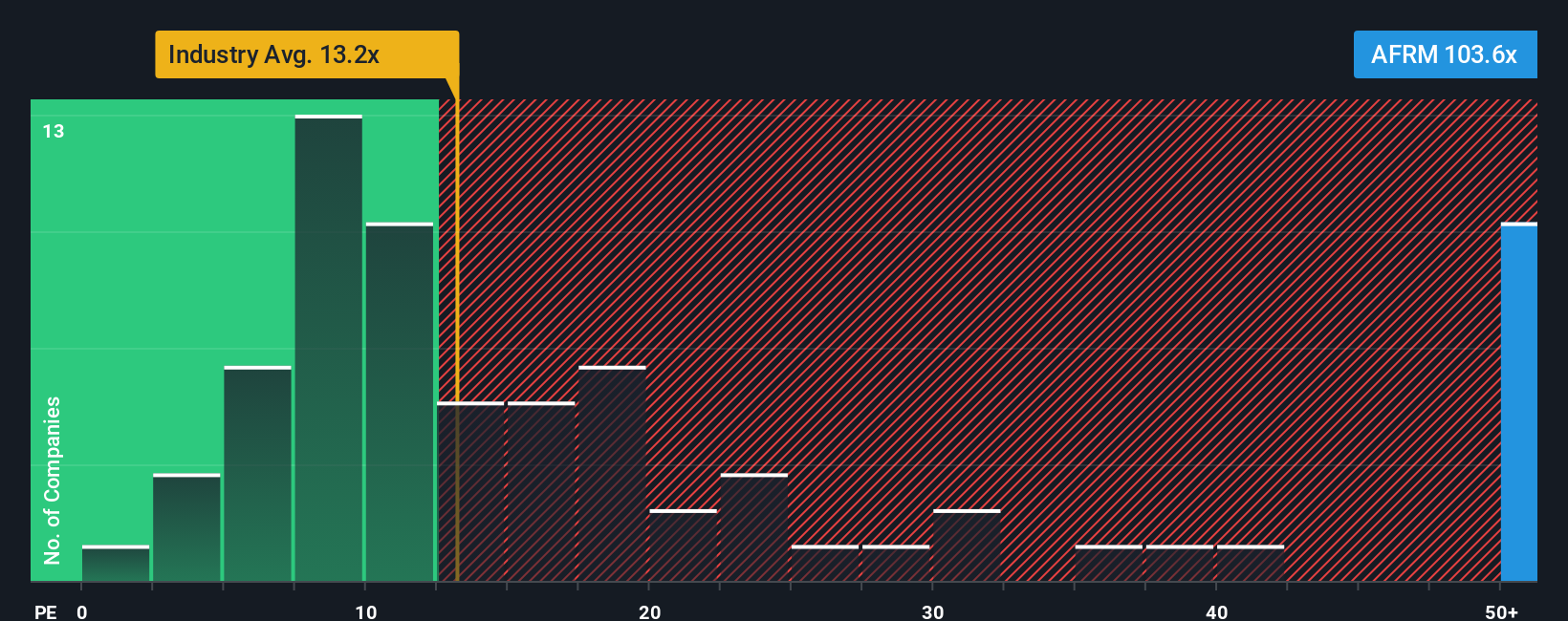

The narrative model suggests Affirm is about 10.4% undervalued, yet its P/E of 117.6x is far above the US Diversified Financial industry at 14.2x and peers at 31.3x. It also sits well above a 29.3x fair ratio that the market could drift toward, which would mean a lot of valuation risk if sentiment cools. Which signal do you trust more: the optimistic growth story or the rich earnings multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Affirm Holdings Narrative

If you do not buy into this view, or simply like to work from the raw numbers yourself, you can rebuild the story in minutes with Do it your way.

A great starting point for your Affirm Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Affirm has you thinking more broadly about opportunities, do not stop at one stock. This is your cue to scan the market and spot what others might miss.

- Spot potential mispricings by checking out these 883 undervalued stocks based on cash flows where prices may not fully reflect underlying cash flows.

- Tap into powerful themes by running your eye over these 27 AI penny stocks at the intersection of artificial intelligence and long term growth stories.

- Add more punch to your income watchlist by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报