Assessing Alcoa (AA) Valuation After A Sharp Three Year High Rally Driven By Aluminum Market Tailwinds

Alcoa (AA) has grabbed investor attention after a sharp rally to three year highs, powered by stronger aluminum prices, tight supply conditions, and heavier trading interest in both shares and options.

See our latest analysis for Alcoa.

That surge in interest is showing up clearly in the numbers, with a 30 day share price return of 41.12% and a 90 day share price return of 69.57%. The 1 year total shareholder return of 76.51% points to strong upward momentum rather than a short lived spike.

If Alcoa’s move has you thinking about where capital could work hardest next, it might be worth scanning fast growing stocks with high insider ownership as a starting list of other fast moving ideas with aligned insiders.

With Alcoa now at three year highs and trading around $62.74, yet still showing an intrinsic discount flag of 69.04%, the key question is whether the stock is genuinely undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 38.1% Overvalued

With Alcoa closing at $62.74 against a fair value estimate of $45.42 in the most followed narrative, the gap hinges on how future profits evolve.

Alcoa's successful development and commercialization of its EcoLum low-carbon aluminum products and the ELYSIS zero-carbon smelting process position the company to capture premium pricing and greater market share as customers and regulators increasingly prioritize sustainability, which could sustain or expand profit margins over time.

Curious what kind of earnings reset justifies a market price well above this fair value line, even with modest revenue assumptions and thinner future margins? The narrative leans on specific profit forecasts, a tighter margin profile, and a very particular P/E multiple a few years out. If you want to see exactly how those building blocks stack up against today’s price, the full narrative lays out every step.

Result: Fair Value of $45.42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear swing factors here, including stronger long term aluminum demand linked to decarbonization and the wider adoption of EcoLum and ELYSIS products, that could challenge this cautious view.

Find out about the key risks to this Alcoa narrative.

Another View: Market Multiple Signals

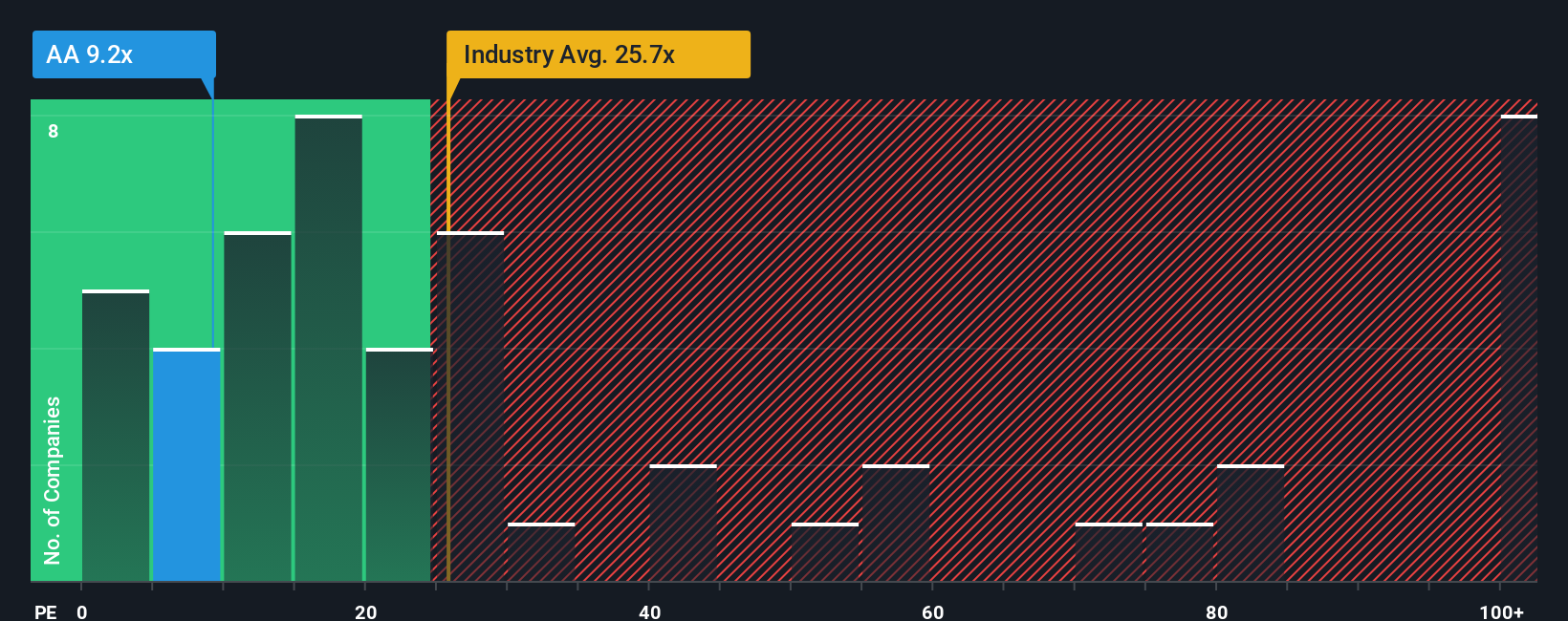

While the most followed narrative sees Alcoa as 38.1% overvalued at $62.74, our P/E based work paints a different picture. At 14.5x earnings, the shares sit well below both peers at 29.6x and a fair ratio of 16.9x. This suggests the market is still pricing in some caution rather than exuberance. The question is whether that discount reflects real earnings risk or a potential mispricing.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alcoa Narrative

If you see the numbers differently or prefer to test your own assumptions against the data, you can build a custom Alcoa view in minutes: Do it your way.

A great starting point for your Alcoa research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Alcoa has sharpened your focus, do not stop here. Broaden your watchlist now so you are not the one hearing about the next big idea after it runs.

- Spot potential value early by checking out these 3543 penny stocks with strong financials that pair lower share prices with stronger financial foundations than many expect.

- Ride powerful technology shifts by reviewing these 27 AI penny stocks that sit at the crossroads of artificial intelligence and rapid business adoption.

- Focus on price and cash flow discipline with these 882 undervalued stocks based on cash flows that screen for companies trading below what their cash flows might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报