Assessing IPG Photonics (IPGP) Valuation After Mixed Share Performance And An 18.4% Undervaluation Narrative

IPG Photonics stock snapshot and recent performance

IPG Photonics (IPGP) has drawn investor attention after a period of mixed share performance, with the stock down about 3.5% over the past day and 11.5% over the past 3 months, while remaining modestly positive year to date.

See our latest analysis for IPG Photonics.

The recent 7 day share price return of 7.08% contrasts with a weaker 90 day share price return of 11.54% and a 5 year total shareholder return decline of 68.12%. This suggests momentum has been fading despite a modestly positive year to date move.

If IPG Photonics has you thinking about what else is moving in tech and laser related hardware, it could be a good time to check out high growth tech and AI stocks.

With IPG Photonics posting mixed long term returns but reporting recent annual revenue and net income growth, the key question is whether the current share price still reflects a discount or whether the market already prices in future growth.

Most Popular Narrative: 18.4% Undervalued

With IPG Photonics last closing at US$76.67 against a narrative fair value of US$94, the key question is what assumptions bridge that gap.

The company's flexibility to shift manufacturing across regions to mitigate tariffs, combined with operational improvements and cost reduction actions, should drive margin expansion and eventually boost both net income and free cash flow as revenues ramp.

Want to see what is behind that confidence in higher margins and earnings? The narrative leans hard on specific revenue, profitability, and valuation assumptions that could materially reshape the long term earnings profile and the share price maths. Curious how those moving parts fit together into that US$94 figure?

Result: Fair Value of $94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real pressure points to watch, including ongoing tariff and geopolitical risks, as well as the possibility that higher investment in new segments weighs on margins if adoption disappoints.

Find out about the key risks to this IPG Photonics narrative.

Another angle on IPG Photonics' valuation

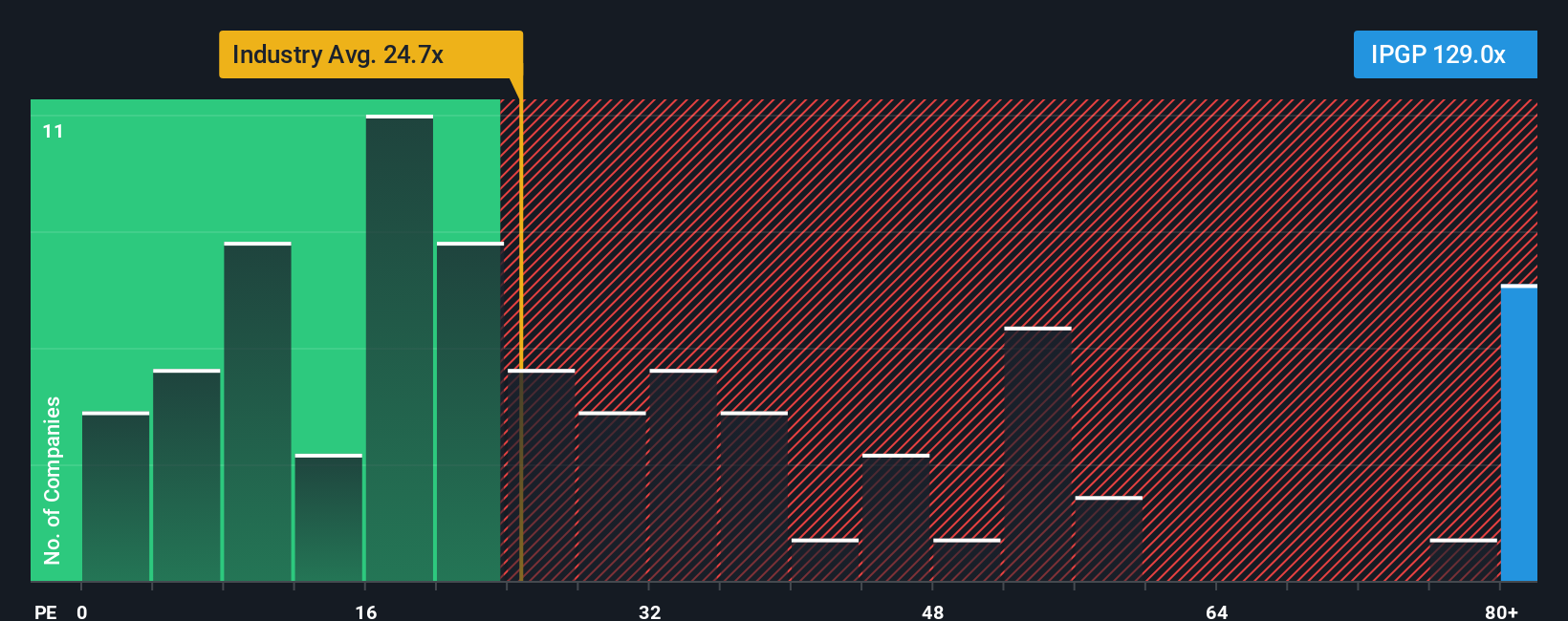

The popular narrative points to an 18.4% discount to fair value, yet the current P/E of 126x tells a very different story. That compares with 30.7x for peers, 25.7x for the US Electronic industry, and a fair ratio of 37.3x that the market could move towards. How would you interpret that in terms of potential upside or valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IPG Photonics Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a full IPG Photonics view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding IPG Photonics.

Looking for more investment ideas?

If you are weighing IPG Photonics, it is a good moment to broaden your watchlist and compare your thinking with other types of opportunities.

- Spot potential high risk, high reward setups by scanning these 3545 penny stocks with strong financials that already clear basic financial strength checks.

- Explore AI-related themes by filtering for these 26 AI penny stocks that connect artificial intelligence themes to listed companies you can analyze.

- Look for pricing gaps by focusing on these 884 undervalued stocks based on cash flows where current market prices differ from cash flow based estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报