Assessing CarGurus (CARG) Valuation As Shares Trade On A Higher P/E Than Industry Peers

Why CarGurus (CARG) is on investors’ radar today

CarGurus (CARG) is drawing attention after recent share price moves, with the stock closing at US$37.97 and posting mixed short term returns alongside stronger gains over the past 3 months and year.

See our latest analysis for CarGurus.

While the 1 day and 7 day share price returns have been slightly negative, the 30 day and 90 day share price returns of 7.23% and 11.71% suggest momentum has been building, alongside a 3 year total shareholder return of around 14x.

If CarGurus has you looking closer at online auto platforms, it could be a good moment to scan other auto opportunities through auto manufacturers.

So with revenue at about US$926.4m, net income above US$150m and the shares trading near US$38, is CarGurus still trading at a discount, or is the market already pricing in its future growth potential?

Most Popular Narrative Narrative: 6.3% Undervalued

With CarGurus last closing at US$37.97 against a narrative fair value of about US$40.54, the current pricing sits slightly below that framework.

The analysts have a consensus price target of $38.667 for CarGurus based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $44.0, and the most bearish reporting a price target of just $33.0.

Want to see what is driving that valuation gap? Earnings, margins, and future multiples sit at the core of this narrative. The mix may surprise you.

Result: Fair Value of $40.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh rising digital competition, including Amazon Autos, as well as the risk that scaling beyond North America proves tougher than analysts currently expect.

Find out about the key risks to this CarGurus narrative.

Another View: Higher P/E Tells A Different Story

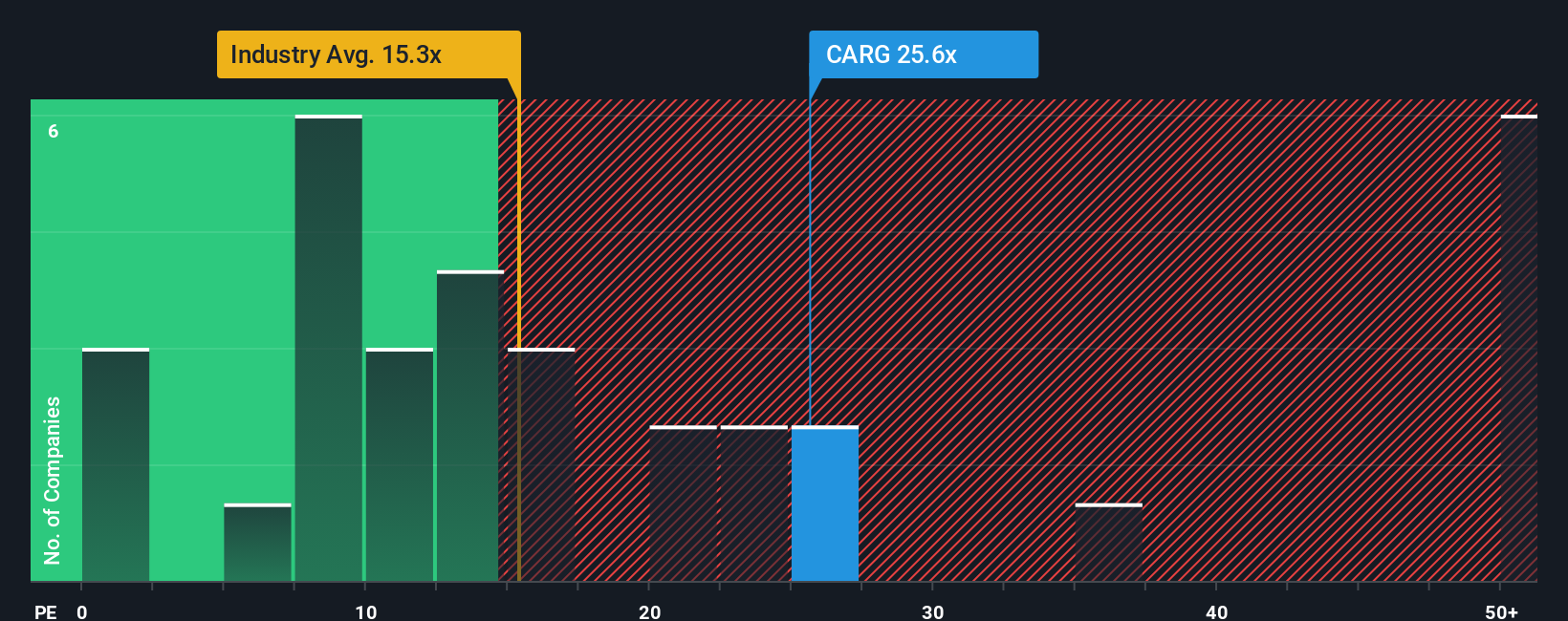

The narrative fair value suggests CarGurus is about 6.3% undervalued, but the share price of US$37.97 sits on a P/E of 23.8x. That is higher than the US Interactive Media and Services industry at 15.4x, the peer average at 12.8x, and even our fair ratio of 22.6x.

In plain terms, the market is already paying a richer price for each dollar of earnings than both peers and the fair ratio imply, which can limit upside if expectations slip. The question for you is whether CarGurus can keep justifying that premium over time.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CarGurus Narrative

If you look at this and reach a different conclusion, or simply prefer to test your own assumptions against the numbers, you can build a complete narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding CarGurus.

Looking for more investment ideas?

Before you move on, give yourself the best chance of spotting opportunities by using the Simply Wall St Screener to surface ideas that fit your style.

- Target potential high growth stories early by checking out these 3545 penny stocks with strong financials that also show stronger balance sheets and fundamentals than you might expect at this size.

- Ride the AI trend with focus by scanning these 26 AI penny stocks that connect artificial intelligence to real revenues rather than just headlines.

- Hunt for value with discipline by reviewing these 884 undervalued stocks based on cash flows that could offer more attractive prices relative to their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报