Applied Materials (AMAT) Valuation Check After AI Driven Share Price Momentum And Sector Rebound

Recent gains in Applied Materials (AMAT) have been closely tied to strong interest in artificial intelligence related chip spending, as investors focus on data center growth, memory and logic demand, and upcoming earnings guidance.

See our latest analysis for Applied Materials.

The latest rally has come after a series of strong daily moves tied to AI themed chip equipment enthusiasm and expectations for the 12 February earnings update, with a 90 day share price return of 32.64% and a 1 year total shareholder return of 66.75%. This suggests momentum has been building rather than cooling.

If AI hardware is on your radar, this is a good time to see what else is moving and compare Applied Materials with high growth tech and AI stocks.

With AMAT now around US$292 and trading above the average analyst price target of US$261.19, the key question is whether AI excitement has already done the heavy lifting or if markets are still underpricing future growth and a true buying opportunity remains.

Most Popular Narrative Narrative: 18% Overvalued

Compared with the most followed fair value estimate of US$248.44, Applied Materials at US$292.20 is priced well above that reference point, setting up a clear gap for investors to assess.

The Fair Value Estimate has risen slightly to $248.44 from $241.69, incorporating modestly stronger long term assumptions.

The Future P/E has risen modestly to 27.6x from 27.0x, indicating a small expansion in the valuation multiple applied to forward earnings.

Curious what sort of revenue growth, margin profile, and earnings multiple have to line up to support that higher fair value line? The narrative leans on steady top line expansion, firmer profitability, and a richer future P/E that still sits below some high growth peers. If you want to see exactly how those moving parts add up to that number, the full narrative breaks the math out step by step.

Result: Fair Value of $248.44 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the picture can change quickly if export rules on China tighten again or a few key chip customers pull back on wafer fab equipment orders.

Find out about the key risks to this Applied Materials narrative.

Another View: Earnings Multiple Sends A Different Signal

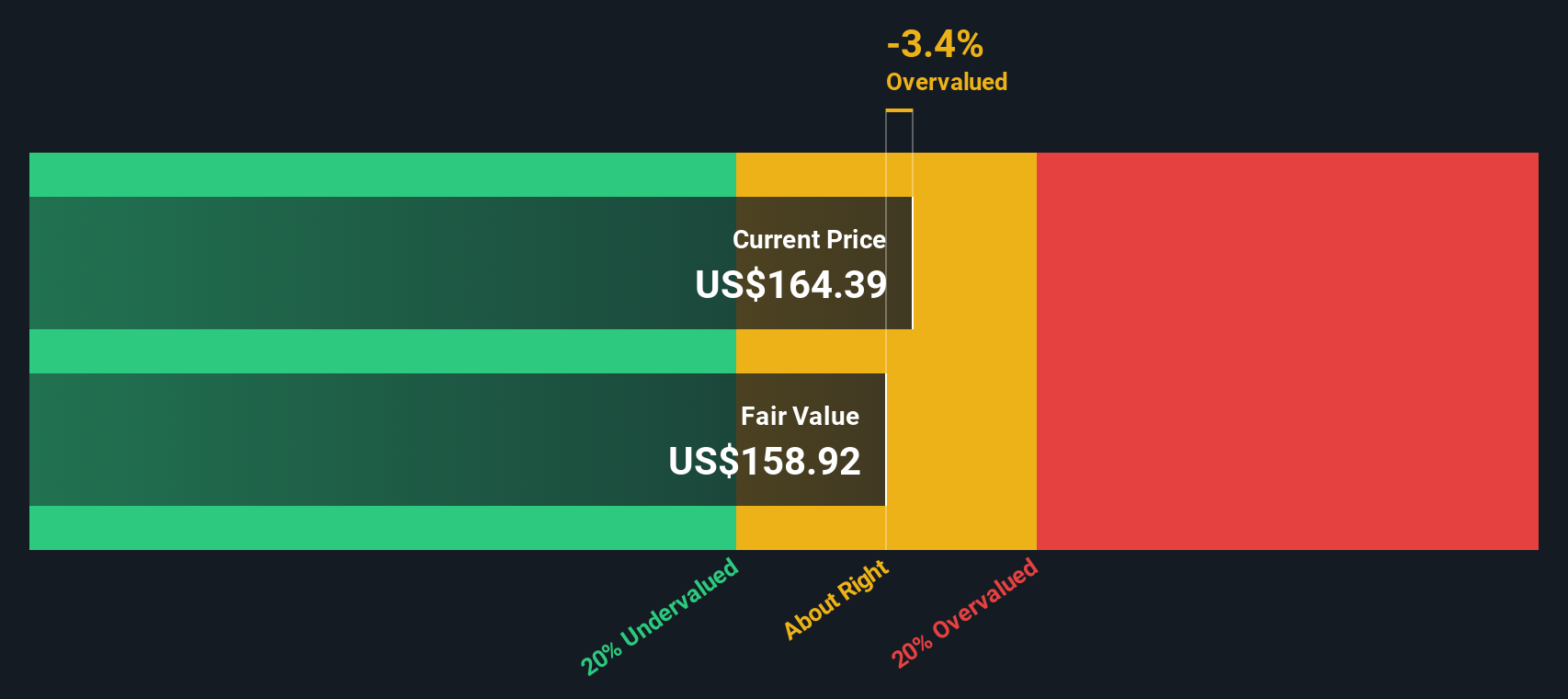

Our DCF model flags Applied Materials as expensive, with the current US$292.20 share price sitting well above an estimated fair value of US$139.39. That is a wide gap, and it sits uncomfortably next to the AI optimism and strong share price momentum you have just seen. So is the market already paying tomorrow’s price today?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Applied Materials Narrative

If you see the numbers differently or you simply prefer to test your own assumptions, you can build a custom view of AMAT in minutes: Do it your way.

A great starting point for your Applied Materials research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking For More Investment Ideas?

If you are serious about sharpening your watchlist, do not stop at one stock. Use the screener to spot clear ideas before everyone else catches on.

- Target dependable income potential by scanning these 12 dividend stocks with yields > 3% that may offer more consistent cash returns than a single AI themed name.

- Zero in on potential mispricings by filtering for these 884 undervalued stocks based on cash flows where cash flow expectations and share prices appear out of sync.

- Tap into the next wave of computing by reviewing these 29 quantum computing stocks that are building hardware and software around quantum technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报