A Look At Helmerich & Payne (HP) Valuation After Recent Share Price Swings

Helmerich & Payne (HP) is back on investors’ radar after recent share price moves, with the stock showing mixed short term returns that contrast with its performance over the past 3 years.

See our latest analysis for Helmerich & Payne.

The share price has been choppy recently, with a 1-day share price return of 2.19% decline, but the 90-day share price return of 30.78% suggests momentum has been building even as the 3-year total shareholder return of 28.36% decline shows a tougher longer term picture.

If HP’s swings have you rethinking your energy exposure, it could be a good moment to widen the search and look at fast growing stocks with high insider ownership as potential next ideas.

So with HP trading close to analyst targets but still showing a large modelled intrinsic discount and a mixed return profile, is this a reset that opens up value, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 0% Overvalued

Helmerich & Payne’s most followed narrative sees fair value at about US$30.27 per share, very close to the recent US$30.38 close. This frames an almost fully reflected valuation in the current price.

The company's growing international footprint, highlighted by the successful KCA integration and new tender opportunities in Saudi Arabia and Argentina, positions H&P to capture incremental market share and expand EBITDA as geopolitical instability and supply concerns reinforce demand for high-spec rigs.

Curious what underpins that near one to one match between model and market? Revenue, margins and a richer future earnings multiple all carry weight here.

Result: Fair Value of $30.27 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh risks like potential rig overcapacity and H&P’s heavy North American exposure, which could pressure utilization, day rates, and cash generation.

Find out about the key risks to this Helmerich & Payne narrative.

Another View: Multiples Still Point To Value

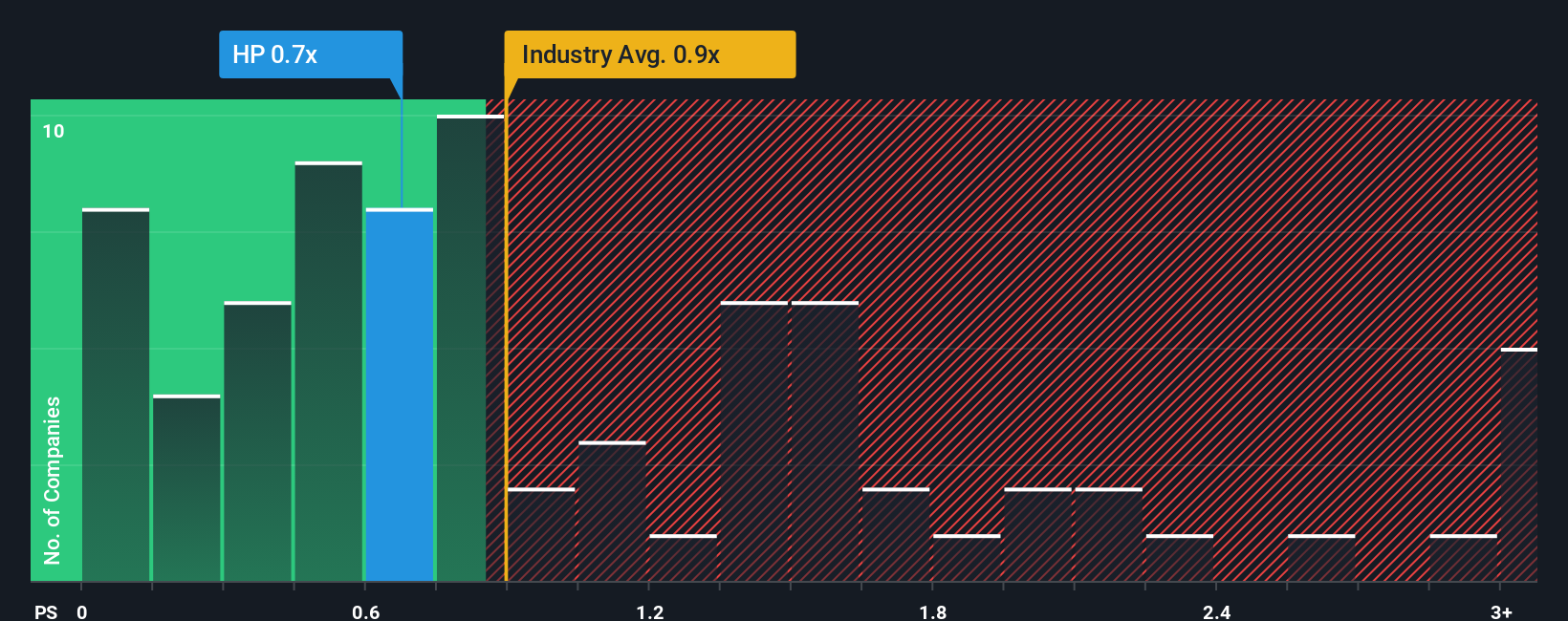

While the popular narrative pegs Helmerich & Payne as roughly fairly priced, the pricing based on sales tells a different story. The current P/S ratio of 0.8x sits below both the fair ratio of 0.9x and the peer and industry averages of 1.2x and 1.1x. That gap suggests the market is assigning a discount that could either indicate caution or potential mispricing. Which side do you think it is?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Helmerich & Payne Narrative

If you are not fully on board with these views or simply prefer to test the numbers yourself, you can build and tweak a version that fits your thesis in just a few minutes, then Do it your way.

A great starting point for your Helmerich & Payne research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are weighing what to do next after reviewing Helmerich & Payne, this is the moment to scan the wider market and spot opportunities before others move.

- Target companies with low share prices but solid fundamentals by reviewing these 3545 penny stocks with strong financials that pass strict financial quality filters.

- Spot potential growth stories at the intersection of software and machine learning through these 26 AI penny stocks focused on this theme.

- Zero in on companies priced below their estimated cash flow value using these 884 undervalued stocks based on cash flows to see where the numbers already look compelling.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报