What Geely Automobile Holdings (SEHK:175)'s AI Push And Sales Beat Means For Shareholders

- In early January 2026, Geely Automobile Holdings reported that it exceeded its 2025 annual sales target with over 3.02 million vehicles delivered and set a higher 2026 volume goal alongside ambitious new energy vehicle targets.

- Around the same time, Geely used CES 2026 to showcase its Full-Domain AI 2.0 architecture and G-ASD intelligent driving system, underscoring how AI-enabled features are becoming central to its smart vehicle offering.

- We’ll now explore how Geely’s launch of Full-Domain AI 2.0 at CES 2026 may influence the company’s existing investment narrative.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Geely Automobile Holdings Investment Narrative Recap

To own Geely Automobile Holdings, you need to believe it can scale volume in China and overseas while shifting successfully toward smart, AI-enabled NEVs without eroding profitability. The latest sales beat and higher 2026 volume and NEV targets reinforce the near term growth catalyst around model launches and exports, but they do not remove the key risk that intense competition, especially in NEVs, could pressure pricing and margins.

The most relevant update here is Geely’s 2026 guidance for 3.45 million units in sales and a 2.22 million NEV target, since this frames how impactful Full-Domain AI 2.0 and G-ASD could be to its smart-car positioning. These targets sit alongside ongoing efforts to integrate brands like Zeekr and Lynk & Co, which many investors are watching as a potential driver of scale benefits and cost efficiencies.

Yet behind the strong sales headlines, investors should be aware that rising NEV competition and pricing pressure could...

Read the full narrative on Geely Automobile Holdings (it's free!)

Geely Automobile Holdings' narrative projects CN¥463.1 billion revenue and CN¥22.5 billion earnings by 2028. This requires 19.5% yearly revenue growth and about CN¥7.4 billion earnings increase from CN¥15.1 billion today.

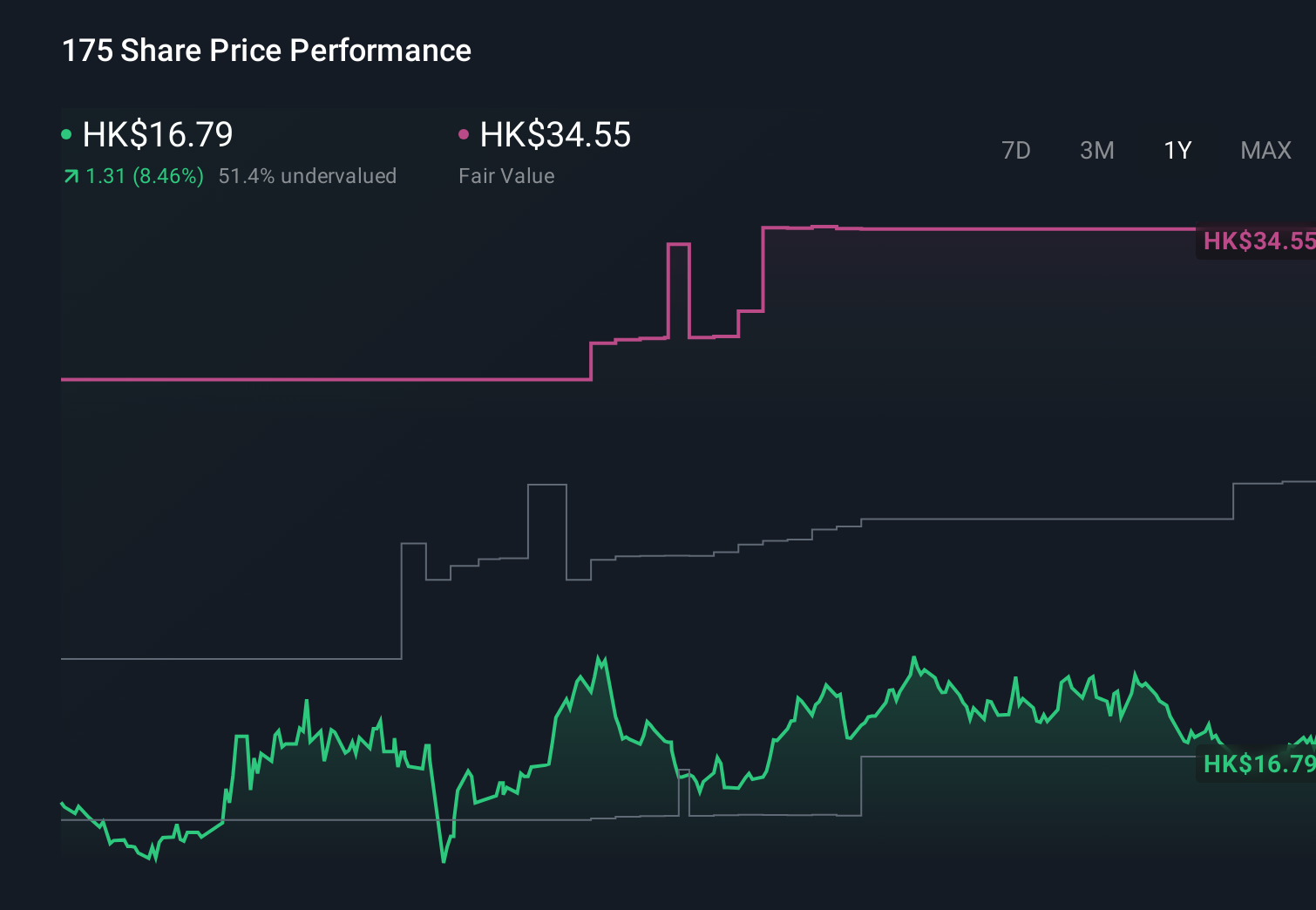

Uncover how Geely Automobile Holdings' forecasts yield a HK$26.38 fair value, a 52% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly HK$22.70 to HK$44.70 per share, highlighting a wide spread of individual expectations. Against this backdrop, Geely’s push into AI-enabled NEVs and higher 2026 volume targets puts even more focus on whether it can defend margins in an increasingly crowded market, so it is worth weighing several different viewpoints before forming a view.

Explore 5 other fair value estimates on Geely Automobile Holdings - why the stock might be worth just HK$22.70!

Build Your Own Geely Automobile Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Geely Automobile Holdings research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Geely Automobile Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Geely Automobile Holdings' overall financial health at a glance.

No Opportunity In Geely Automobile Holdings?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报