Assessing Ally Financial (ALLY) Valuation After Analyst Upgrades And A US$2b Share Buyback Announcement

Analyst upgrades and buyback set the stage

Ally Financial (ALLY) is in focus after several major banks raised their views on the stock and the company authorized a $2b share repurchase program with no set expiration.

These moves, combined with new board appointments and ongoing business tweaks, give investors fresh information to assess how the auto-focused lender’s capital return plans and risk profile line up with their own objectives.

See our latest analysis for Ally Financial.

Ally Financial’s recent 52 week high and 90 day share price return of 18.78% come on top of a 12 month total shareholder return of 35.03%. This suggests momentum has been building as buyback plans, analyst upgrades, and new hires land.

If Ally’s move has you thinking about auto lenders more broadly, it could be a useful moment to scan auto manufacturers for other car focused names tied to vehicle demand trends.

With Ally shares around $46.55, an 8.78% intrinsic discount and roughly 10% gap to the average analyst target, the key question is whether that gap signals a genuine opening or if the market already reflects future growth.

Most Popular Narrative Narrative: 9.1% Undervalued

Against Ally Financial’s last close of US$46.55, the most followed narrative pins fair value closer to US$51, framing the current gap as meaningful.

Ongoing balance sheet remixing into higher-yielding auto and corporate finance loans, as well as optimized deposit pricing, are increasing net interest margin beyond recent headwinds (e.g., card sale, mortgage runoff). This points to a path for above-peer NIM and sustained earnings improvement.

Curious what kind of revenue climb, margin reset, and earnings step up are baked into that valuation gap? The full narrative spells out the assumptions driving that fair value call.

Result: Fair Value of $51.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh the chance that auto credit conditions worsen or regulatory costs climb. These factors could pressure earnings and challenge that undervalued story.

Find out about the key risks to this Ally Financial narrative.

Another View: Multiples Paint A Tougher Picture

Our DCF model suggests Ally Financial is trading about 8.8% below an estimated fair value of roughly US$51, which lines up with the 9.1% discount implied by the consensus narrative. On that math, the stock screens as undervalued.

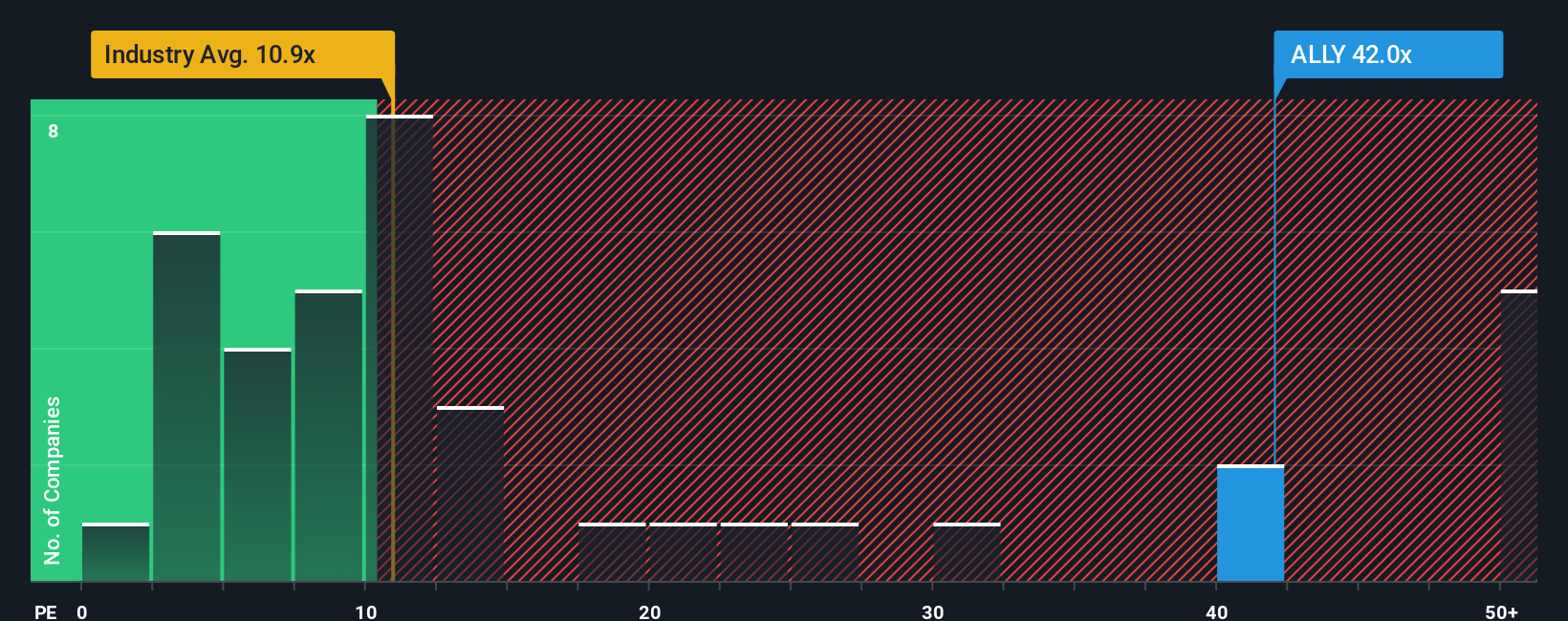

But the P/E ratio tells a different story. At 27.4x, Ally trades well above the US Consumer Finance industry at 9.6x and above a fair ratio of 20.5x that the market could move towards. That gap signals downside risk if expectations cool, so which signal do you trust more for your own time horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ally Financial Narrative

If you read this and think the assumptions miss something important, or you simply prefer your own work, you can build a custom view in minutes, starting with Do it your way.

A great starting point for your Ally Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Ally has sharpened your thinking, do not stop here. Use the screener to spot other angles before the next round of opportunities races past you.

- Target income potential with these 12 dividend stocks with yields > 3% that highlight companies sharing more of their cash flows with investors through higher yields.

- Spot early tech shifts by scanning these 26 AI penny stocks tied to artificial intelligence themes before they hit the mainstream.

- Zero in on value by reviewing these 886 undervalued stocks based on cash flows that the market currently prices cheaply relative to their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报