StoneX Group (SNEX) Leans Into MiCA License: Is Its Digital-Asset Bridge Strategy Gaining Traction?

- StoneX Group’s subsidiary StoneX Digital recently obtained a Crypto-Asset Service Provider license under the EU’s Markets in Crypto-Assets Regulation from the Central Bank of Ireland, allowing it to offer regulated execution and custody services across the bloc.

- This move effectively plugs StoneX’s traditional brokerage and clearing infrastructure into the EU’s emerging digital-asset rulebook, potentially strengthening its role as a bridge between conventional and crypto finance for institutional clients.

- We’ll now examine how this new EU-wide MiCA license could influence StoneX Group’s investment narrative and future digital-asset positioning.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is StoneX Group's Investment Narrative?

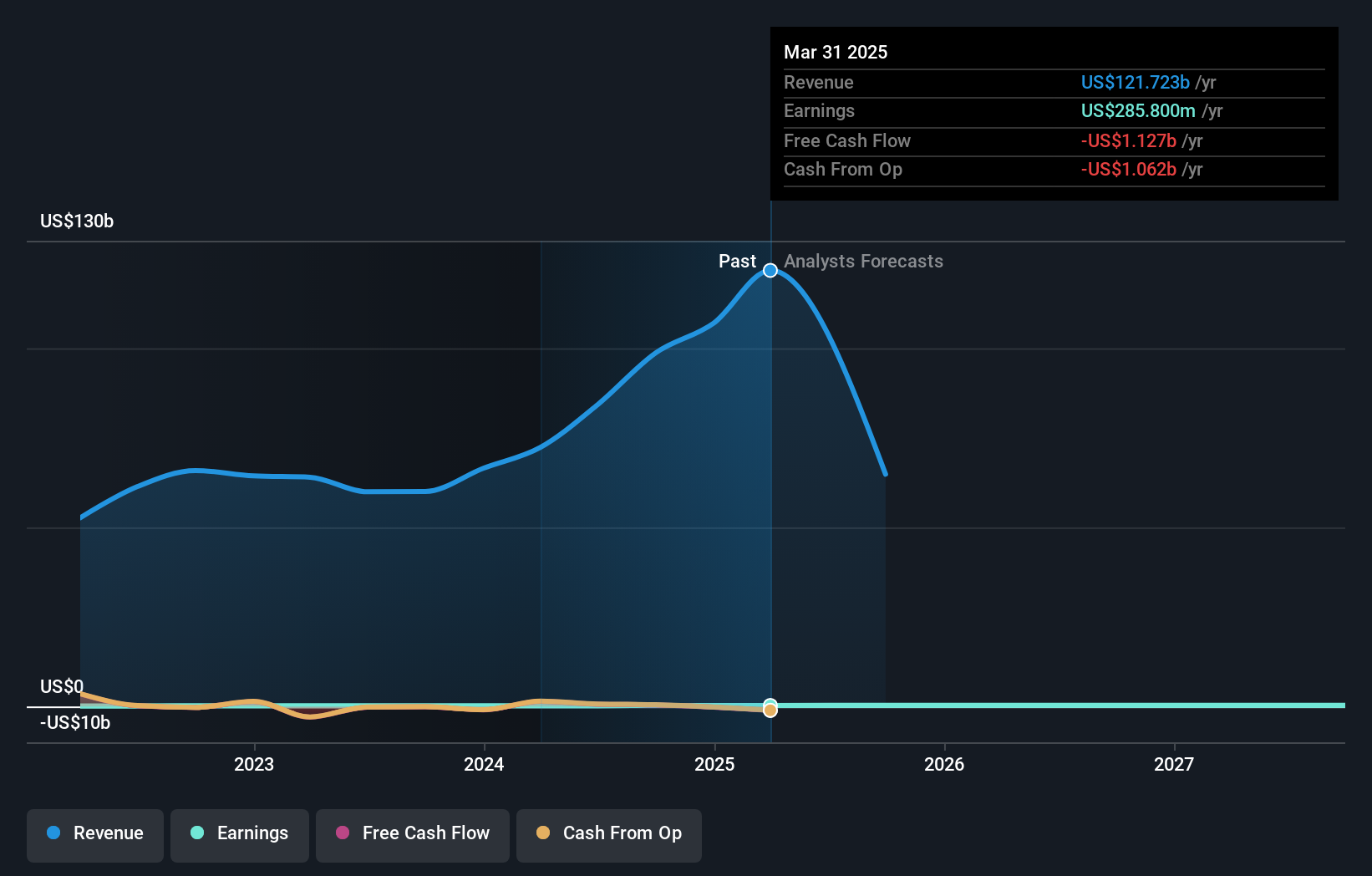

To own StoneX Group, you have to believe in a global brokerage and payments business that can keep compounding modest earnings while carefully layering on new fee streams. Recent results show steady earnings growth and high‑volume revenues, but also thin margins and low double‑digit return on equity, so small changes in volumes or costs matter. In the near term, key catalysts remain integration of R.J. O’Brien, execution of the buyback, and how well StoneX monetizes its payments and prime brokerage franchises. The new EU MiCA license for StoneX Digital fits into that story as an enabler rather than a game‑changer: it broadens the digital‑asset addressable market and strengthens relationships with clients like Caliber, but is unlikely to move overall group earnings quickly given the size of the core business. The bigger risk is that crypto expansion adds regulatory and compliance complexity on top of already tight margins.

However, there is a regulatory and balance sheet risk here that investors should really understand. StoneX Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community range from about US$48 to a very large number, showing just how far apart individual expectations sit. Set that against the more measured earnings growth outlook and thin profit margins discussed above, and it is clear you are weighing very different views on how much StoneX’s expanding digital and payments platforms can contribute over time.

Explore 6 other fair value estimates on StoneX Group - why the stock might be worth less than half the current price!

Build Your Own StoneX Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StoneX Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free StoneX Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StoneX Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报