Is It Too Late To Reassess Intel (INTC) After Its 114% One Year Rally?

- If you are wondering whether Intel is still good value after its recent run, this article will walk through what the current price might be asking you to believe about the company.

- Intel shares last closed at US$42.63, with returns of 15.5% over 7 days, 5.3% over 30 days, 8.3% year to date, 114.4% over 1 year and 46.0% over 3 years, while the 5 year return sits at a 20.4% decline.

- Recent headlines around Intel have focused on its role in the broader semiconductor sector and the market's interest in chipmakers linked to AI and data center demand, which have kept attention firmly on the stock. At the same time, ongoing updates about its manufacturing roadmap and foundry ambitions have given investors more information to weigh against those share price moves.

- Simply Wall St currently gives Intel a valuation score of 3 out of 6. Next, we will look at how different valuation approaches arrive at that view, and then finish with a way to put all those methods into a clearer big picture.

Approach 1: Intel Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes the cash Intel is expected to generate in the future, then discounts those cash flows back to today to estimate what the business might be worth right now.

For Intel, the model used is a 2 Stage Free Cash Flow to Equity approach built on cash flow projections in US$. The latest twelve month free cash flow is a loss of about $13.7b. Analyst-style projections and extrapolations used by Simply Wall St see free cash flow moving toward about $10.95b by 2035, with interim years ranging from roughly $1.94b of outflow in 2026 to $4.32b in 2029 and then rising through the following years.

When all those projected cash flows are discounted back to today, the estimated intrinsic value comes out at about $14.39 per share, compared with the recent share price of $42.63. On this basis, the DCF output suggests Intel is very materially overvalued, with an implied premium of 196.2% over the model’s estimate.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intel may be overvalued by 196.2%. Discover 884 undervalued stocks or create your own screener to find better value opportunities.

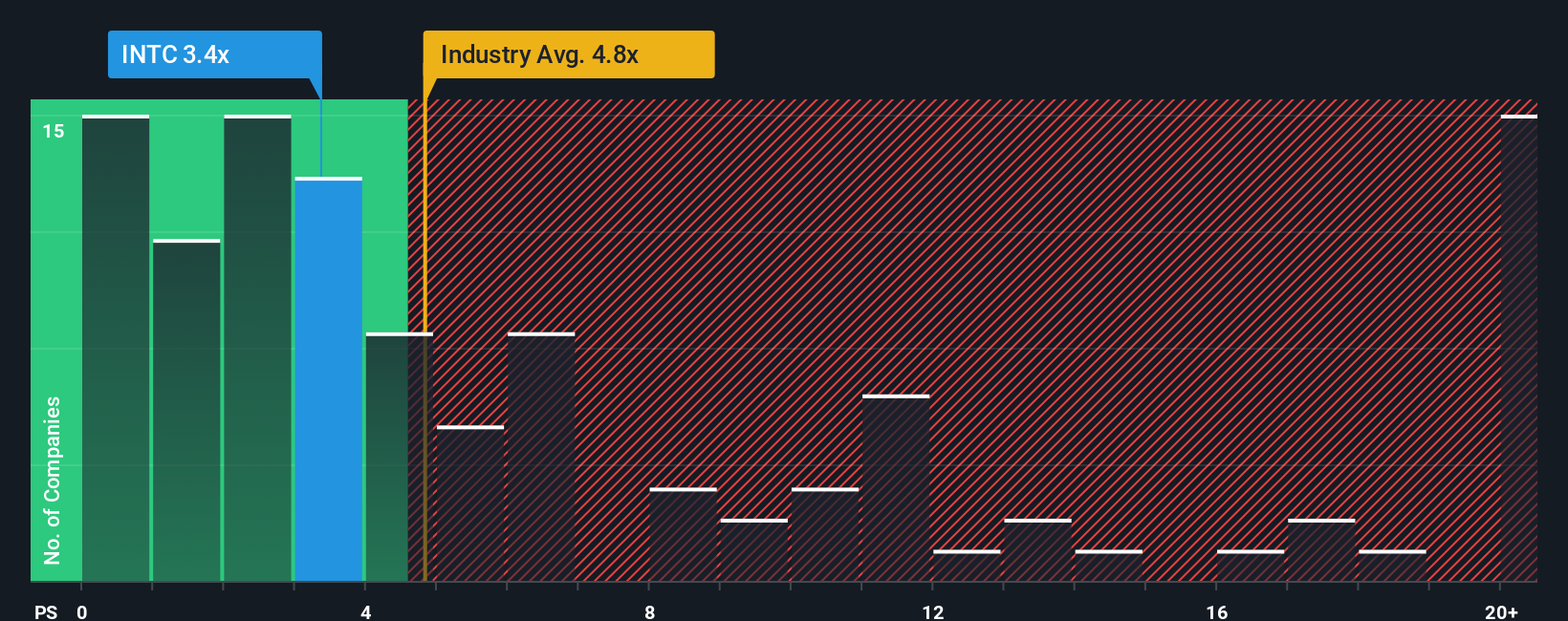

Approach 2: Intel Price vs Sales

For companies that are still rebuilding profitability or have very small earnings, price based on sales is often more useful than P/E, because revenue tends to be more stable and less affected by short term swings in margins.

In general, higher expected growth and lower risk can justify a higher “normal” valuation multiple, while slower expected growth or higher risk can point to a lower one. That same idea applies to P/S, not just P/E.

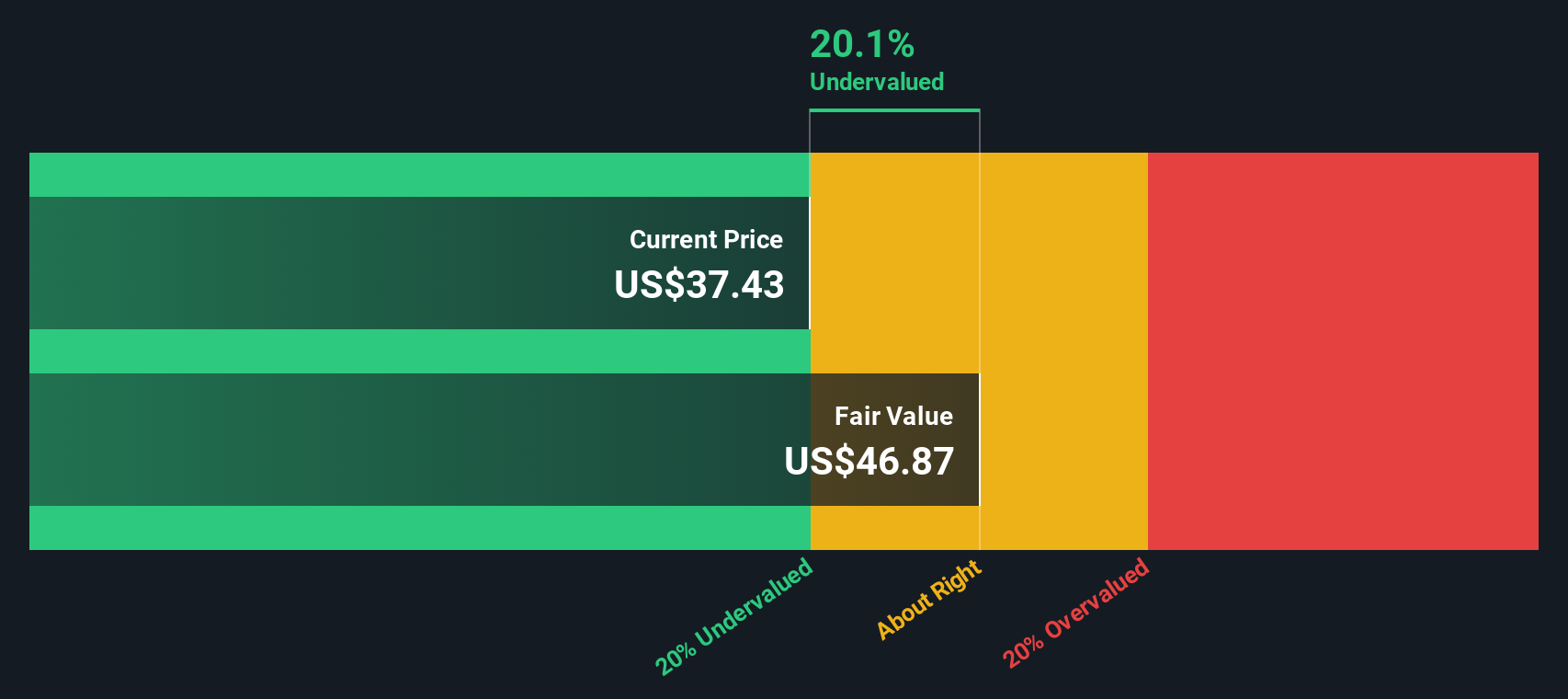

Intel currently trades on a P/S ratio of 3.98x. The wider Semiconductor industry average is 5.16x, while Simply Wall St’s peer group average for Intel sits higher at 13.73x. To go a step further, Simply Wall St also calculates a proprietary “Fair Ratio” of 5.68x. This is an estimate of what Intel’s P/S might be based on its earnings growth profile, industry, profit margins, market cap and company specific risks.

The Fair Ratio can be more informative than a simple peer or industry comparison because it adjusts for Intel’s own characteristics instead of assuming that all chipmakers deserve the same multiple.

With Intel’s current P/S of 3.98x below the Fair Ratio of 5.68x, this approach points to the shares being undervalued on a sales basis.

Result: UNDERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intel Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simply the story you believe about a company, linked directly to a financial forecast and a fair value. On Simply Wall St’s Community page you can see this in action for Intel. One investor might anchor on a fair value of about US$16.15 because they focus on organizational complexity and slower revenue. Another might lean toward about US$52.00 because they expect stronger AI and foundry progress. The platform will keep updating those Narratives as news or earnings arrive, so you can easily compare each Fair Value to the current price and decide what that means for your own timing.

For Intel, however, we will make it really easy for you with previews of two leading Intel Narratives:

Fair value in this bullish Narrative: US$52.00 per share

At the recent price of US$42.63, this Narrative implies the shares are about 18.0% below its fair value estimate.

Revenue growth assumption in this Narrative: 5.72% per year

- Views Intel’s push into AI focused products and advanced manufacturing nodes as a way to rebuild revenue, margins, and confidence in a turnaround.

- Assumes meaningful improvement in profitability, with analysts in this camp expecting higher earnings and a P/E of 37.2x on future earnings to support a fair value of about US$52.

- Highlights both execution upside around foundry and AI, and risks from process delays, high investment needs, and changing customer preferences that could challenge this optimistic view.

Fair value in this more cautious Narrative: about US$38.14 per share

At the recent price of US$42.63, this Narrative implies the shares are about 11.8% above its fair value estimate.

Revenue growth assumption in this Narrative: 5.60% per year

- Treats Intel’s AI and foundry ambitions as promising but still unproven, with execution risk and a rich P/E multiple seen as key constraints on upside.

- Builds in moderate revenue growth and margin recovery, but concludes that recent price moves already reflect much of that improvement, leading to a fair value of roughly US$38.

- Flags organizational complexity, the long path for foundry returns, and macro and industry risks as reasons the current price could be ahead of what the underlying numbers support.

If you want to keep going, you can read each Narrative in full, stress test the assumptions against your own expectations for Intel’s AI and foundry plans, and decide which story, if either, feels closer to how you see the company.

Curious how numbers become stories that shape markets? Explore Community Narratives

Do you think there's more to the story for Intel? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报