A Look At Equifax (EFX) Valuation As Regulatory Scrutiny Over Pricing Practices Intensifies

Equifax (EFX) is back in focus after Federal Housing Finance Agency Director Bill Pulte questioned credit reporting pricing practices, echoing concerns from the Mortgage Bankers Association and putting regulatory attention on how bureaus charge mortgage lenders.

See our latest analysis for Equifax.

Despite the recent regulatory headlines, Equifax’s 1-day share price return of 0.59% and 30-day share price return of 1.53% sit against a weaker 1-year total shareholder return of a 13.27% decline. This suggests that recent momentum has not yet reversed longer-term underperformance.

If scrutiny of credit bureaus has you reassessing your watchlist, this could be a useful moment to look at fast growing stocks with high insider ownership as potential fresh ideas beyond the big names.

With the shares around US$213.50, an implied intrinsic discount of about 50% and a sizeable gap to the US$264.75 analyst target, the key question is simple: is Equifax mispriced today, or is the market already baking in future growth?

Most Popular Narrative Narrative: 20% Undervalued

Compared with Equifax’s last close of US$213.50, the most followed narrative implies a higher fair value, built on specific growth and margin expectations.

Global cloud migration and investments in proprietary technology platforms are now largely complete. This is enabling margin expansion through operating leverage, efficiency gains, and scalable innovation, which is expected to increase EBITDA and net margins over time. International expansion, especially in underpenetrated markets like Latin America and through the integration of new platforms (Ignite, InterConnect, Data Fabric), is diversifying Equifax's revenue streams and providing additional runway for earnings growth and margin improvement.

Curious what earnings profile, margin step up, and future P/E multiple are built into that valuation gap? The full narrative lays out those financial bets in detail.

Result: Fair Value of $266.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to keep an eye on rising litigation and regulatory costs, as well as competitive pressure from alternative scoring models that could squeeze margins and mortgage revenues.

Find out about the key risks to this Equifax narrative.

Another Angle: Earnings Multiple Sends A Different Signal

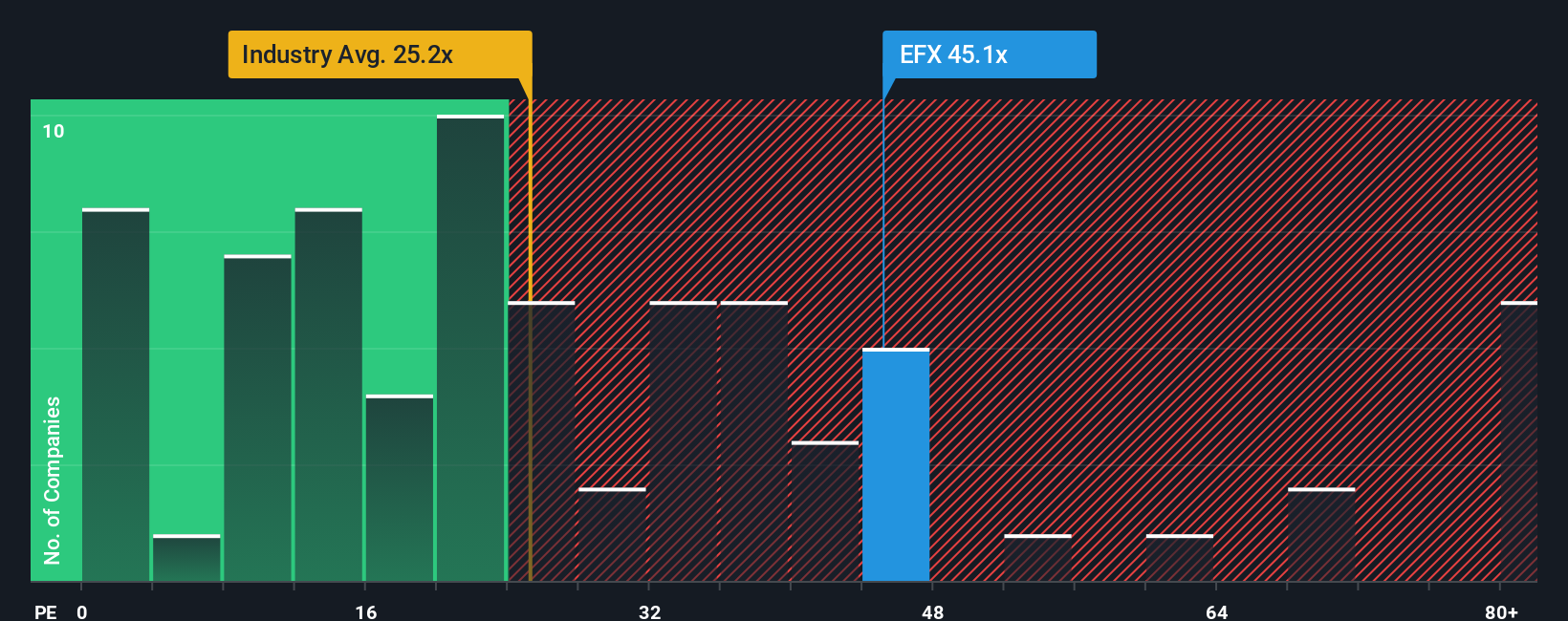

While the narrative fair value points to Equifax as undervalued, the earnings multiple tells a tighter story. The shares trade on a P/E of 39.7x, compared with a fair ratio of 32.9x, the US Professional Services industry at 25x, and peers at 35.8x, which suggests investors are already paying up for growth that still needs to be delivered.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equifax Narrative

If you see the numbers differently or want to stress test the assumptions yourself, it only takes a few minutes to build a personalised view. Do it your way.

A great starting point for your Equifax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Equifax has sharpened your thinking, do not stop here. Broaden your opportunity set with targeted stock ideas that could reshape how you build your portfolio.

- Spot potential turnaround names by scanning these 3549 penny stocks with strong financials that already show stronger financial footing than many investors might expect at this size.

- Position yourself closer to potential growth stories in automation and data science by reviewing these 26 AI penny stocks that sit at the intersection of software and machine learning.

- Zero in on value driven opportunities by focusing on these 884 undervalued stocks based on cash flows where current prices do not fully reflect estimates based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报