Henry Schein (HSIC) Valuation Check As CEO Retirement Delay Puts Succession Planning In Focus

CEO retirement delay puts succession planning in focus

Henry Schein (HSIC) is back in the spotlight after long-serving CEO Stanley Bergman delayed his retirement, as the company continues its search for a successor and lays out its leadership transition timeline.

See our latest analysis for Henry Schein.

The leadership uncertainty comes at a time when momentum has been improving, with the share price at $78.14 after a 21.02% 90 day share price return and a 9.96% 1 year total shareholder return, even though the 3 year total shareholder return is slightly negative.

If you are looking beyond Henry Schein and want more ideas in the same space, it could be worth scanning healthcare stocks for other healthcare names catching investors' attention.

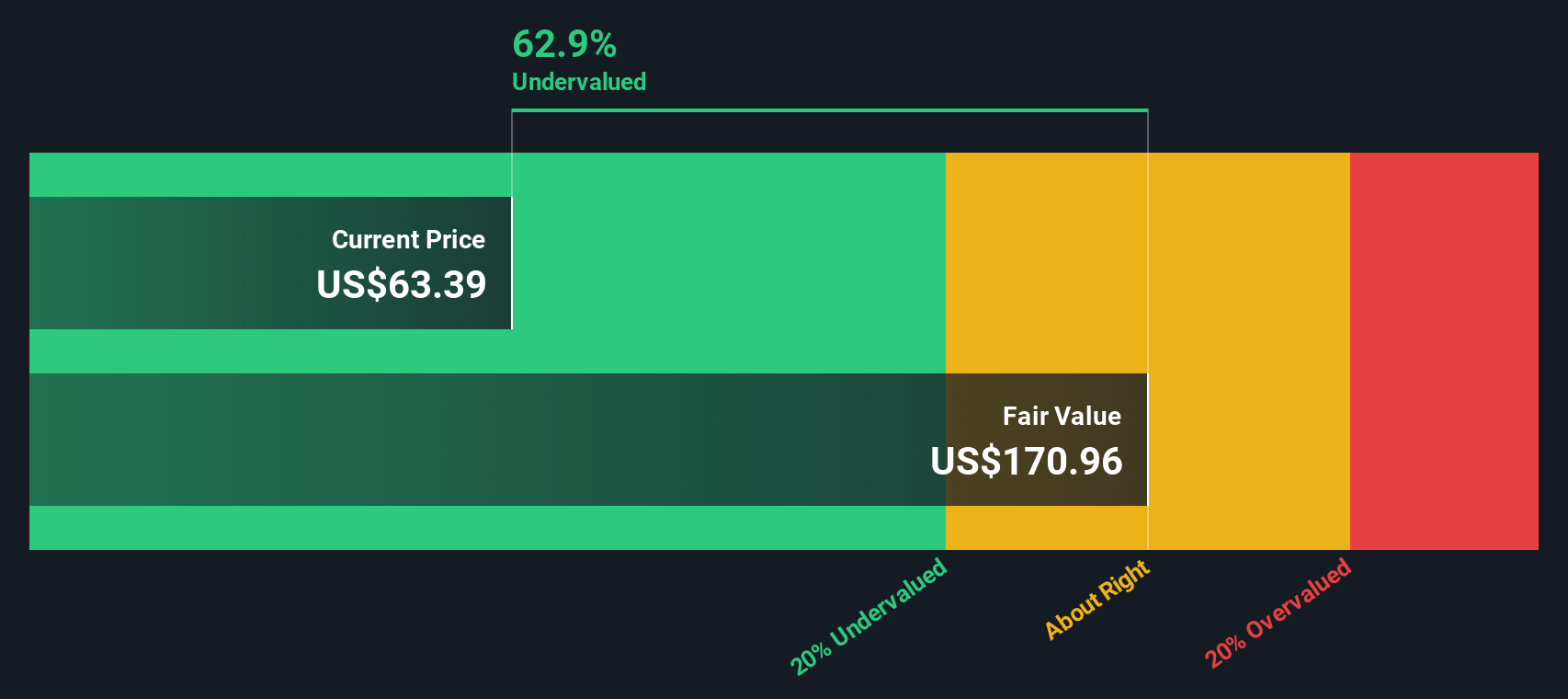

With the shares at $78.14, a 21.02% 90 day gain and a reported intrinsic discount of 55.12% pointing in different directions, is Henry Schein still trading below its worth, or has the market already priced in future growth?

Most Popular Narrative: 0.6% Overvalued

With Henry Schein last closing at $78.14 against a narrative fair value of about $77.64, the valuation gap is narrow, and the story turns on earnings quality and the future mix of higher margin businesses.

The analysts have a consensus price target of $73.231 for Henry Schein based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $83.0, and the most bearish reporting a price target of just $55.0.

Curious what kind of revenue mix, margin lift, and earnings trajectory are included in that tight fair value band? The underlying forecasts refer to higher margin segments, recurring software revenue, and a lower future earnings multiple than today. Want to see exactly how those moving parts add up to this valuation assessment?

Result: Fair Value of $77.64 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stiff pricing pressure in categories like gloves, along with flat dental patient traffic and ongoing staffing shortages, could easily knock this earnings story off course.

Find out about the key risks to this Henry Schein narrative.

Another View: Earnings Multiple Sends A Different Signal

The SWS DCF model suggests Henry Schein at $78.14 is trading about 55% below an estimated fair value of $174.11. This contrasts sharply with the tight 0.6% overvaluation from the narrative fair value of $77.64. Two models present two very different messages, so which one feels more reasonable to you?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Henry Schein Narrative

If you are not sold on these assumptions or simply prefer to test the numbers yourself, you can review the data and build a fresh view in just a few minutes, starting with Do it your way.

A great starting point for your Henry Schein research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more stock ideas?

If Henry Schein is on your radar, do not stop here. Put a few more ideas on your watchlist so you are not relying on a single story.

- Target income potential with these 12 dividend stocks with yields > 3% that could add more consistent cash returns to your portfolio mix.

- Hunt for opportunities using these 884 undervalued stocks based on cash flows that might be trading cheaply based on their cash flows.

- Tap into future-facing themes with these 79 cryptocurrency and blockchain stocks before the next wave of attention arrives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报