Assessing IAMGOLD’s Valuation As S&P Composite Index Inclusion Draws New Investor Attention

Index inclusion puts IAMGOLD in focus

IAMGOLD (TSX:IMG) has been drawing fresh attention after its inclusion in the S&P Composite Index, an event that can reshape how the stock trades by influencing liquidity, visibility, and demand from index-linked investors.

See our latest analysis for IAMGOLD.

The index inclusion arrives after a strong run, with a 30-day share price return of 14.39% and 90-day share price return of 33.16%, alongside a very large 1-year total shareholder return and multi year total shareholder returns that remain elevated. This suggests momentum has been building rather than fading.

If this kind of renewed attention on IAMGOLD has you thinking about what else is moving, it could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With IAMGOLD now in the S&P Composite Index, a CA$23.53 share price, an intrinsic value estimate implying a 62.61% discount, and only a small gap to the average analyst target, is there still upside here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 4.7% Undervalued

The most followed narrative puts IAMGOLD’s fair value at about CA$24.69 per share, slightly above the last close at CA$23.53, and builds a detailed case around growth, margins, and risk.

The successful ramp-up and ahead-of-schedule capacity achievement at the Côté Gold mine, coupled with consistent production and ongoing cost optimization, set the stage for a material near-term increase in gold output, which should significantly boost future revenues and cash flow as temporary ramp-up costs subside.

Curious what kind of revenue path, margin reset, and future earnings multiple are needed to support that valuation? The narrative leans on ambitious growth math and a specific profit profile a few years out. The full story walks through how those moving parts are discounted back at a 7.40% rate to land on that fair value.

Result: Fair Value of $24.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on controlling rising operating and capital costs and avoiding disruptions at Côté Gold or Essakane, which could quickly change the earnings picture.

Find out about the key risks to this IAMGOLD narrative.

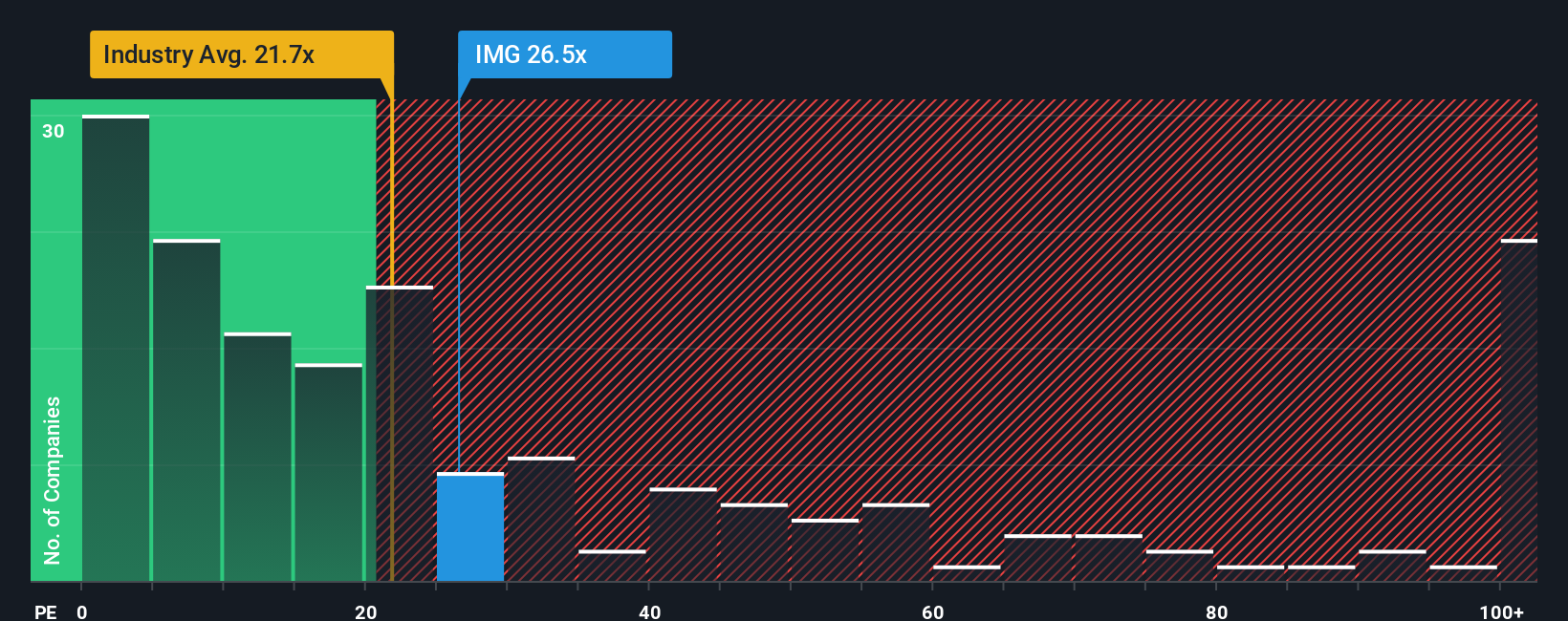

Another View: What The P/E Ratio Is Saying

That fair value narrative leans on discounted cash flows and detailed forecasts. The P/E snapshot tells a more mixed story. IAMGOLD trades at 28.4x earnings, above the Canadian Metals and Mining industry at 23.4x, yet below its own fair ratio of 44.4x and the 66.1x peer average. So is the current price a margin of safety, or is it a sign that expectations are already running hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IAMGOLD Narrative

If you look at the numbers and come to a different conclusion, or just want to test your own thesis, you can build a custom view in a few minutes, starting with Do it your way.

A great starting point for your IAMGOLD research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If IAMGOLD has sharpened your interest, do not stop here. Widen your watchlist now so you do not miss other opportunities that match your style.

- Target potential mispricing by scanning these 884 undervalued stocks based on cash flows that line up strong cash flows with prices that may not fully reflect them.

- Tap into fast moving themes across artificial intelligence by shortlisting these 26 AI penny stocks that link real business traction with this technology trend.

- Capture income ideas by reviewing these 12 dividend stocks with yields > 3% that combine higher yields with the backing of listed businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报