Can Barclays’ ACA Margin Upgrade Reframe Centene’s Core Government Health Strategy Narrative (CNC)?

- Recently, Barclays upgraded Centene’s rating after reviewing its positioning in the Affordable Care Act marketplace, highlighting the company’s ability to improve margins through premium increases while maintaining competitive offerings for members.

- This upgrade follows a period of guidance withdrawal and cost pressures in Medicaid and ACA plans, making the renewed focus on margin improvement in Centene’s core government-backed health businesses particularly important for investors assessing its resilience.

- Now we'll explore how Barclays’ view that Centene can enhance ACA margins without eroding competitiveness could reshape its overall investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Centene Investment Narrative Recap

To own Centene, you need to believe its government-backed health plans can earn acceptable margins despite policy and cost volatility. The key near term catalyst remains restoring Affordable Care Act profitability, while the biggest risk is policy and medical cost pressure in Medicaid and Marketplace products. Barclays’ upgrade reinforces confidence in ACA pricing and margin repair, but it does not remove the underlying uncertainty around subsidies, risk adjustment, and Medicaid rate adequacy.

The recent partnership between Centene’s Meridian Health Plan of Illinois and Cityblock Health to serve 10,000 Medicaid beneficiaries is especially relevant here. It underscores how Centene is trying to manage Medicaid cost trends and care coordination at the same time investors are focused on ACA margin improvement, tying the news flow back to both its main earnings engine and its most closely watched risk areas.

Yet behind the renewed optimism around ACA margins, investors should still be aware of...

Read the full narrative on Centene (it's free!)

Centene's narrative projects $195.6 billion revenue and $2.1 billion earnings by 2028.

Uncover how Centene's forecasts yield a $41.12 fair value, a 10% downside to its current price.

Exploring Other Perspectives

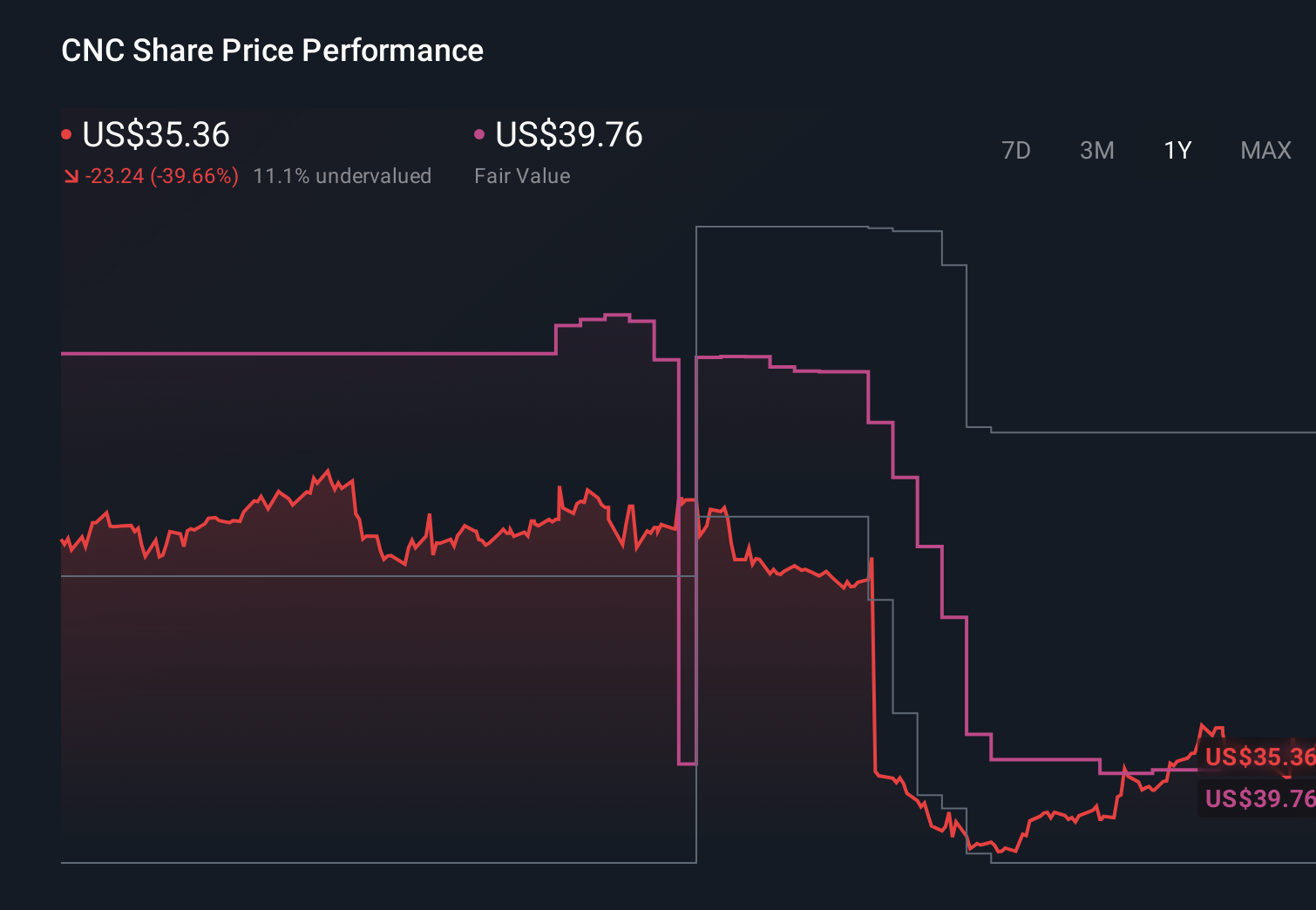

Sixteen members of the Simply Wall St Community place Centene’s fair value anywhere between US$32 and about US$211, showing just how far apart views can be. Against that backdrop, the recent focus on ACA margin recovery gives you one lens on performance, but broader risks around policy shifts and medical cost volatility mean it is worth weighing several different viewpoints before forming a view.

Explore 16 other fair value estimates on Centene - why the stock might be worth 30% less than the current price!

Build Your Own Centene Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centene research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Centene research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centene's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报