European Insider-Favored Growth Stocks To Watch In January 2026

As the European market continues to show resilience, with the STOXX Europe 600 Index reaching new highs and major stock indexes posting gains, investors are increasingly focusing on growth companies with substantial insider ownership. In this environment, stocks that combine robust growth potential with high levels of insider investment can be particularly appealing, as they may indicate confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 35% | 61.2% |

| Guard Therapeutics International (OM:GUARD) | 13.1% | 103.3% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Here's a peek at a few of the choices from the screener.

Mowi (OB:MOWI)

Simply Wall St Growth Rating: ★★★★☆☆

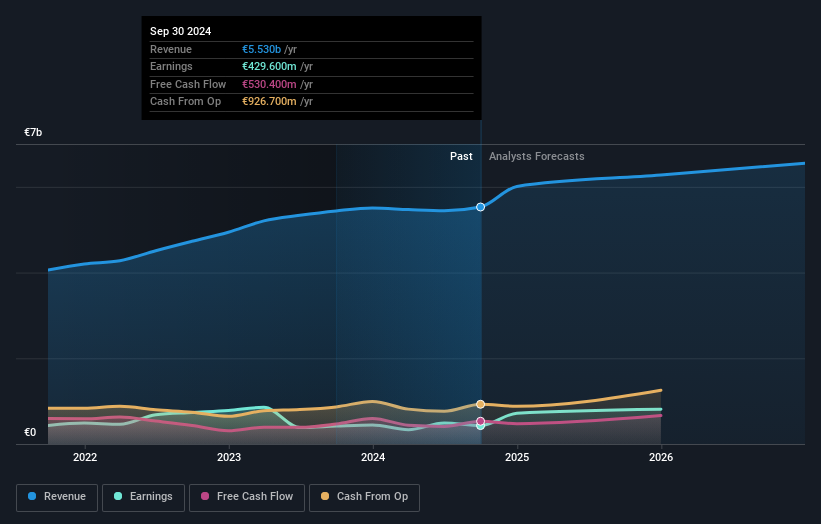

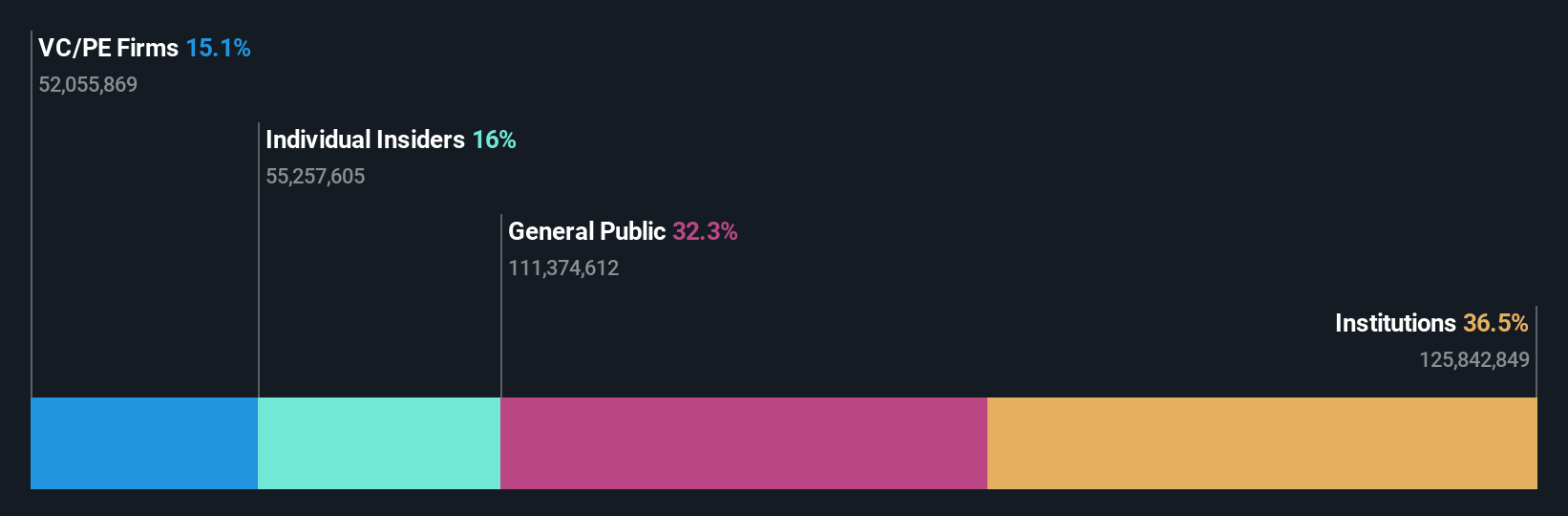

Overview: Mowi ASA is a seafood company that produces and sells Atlantic salmon products globally, with a market cap of NOK122.75 billion.

Operations: Mowi generates revenue from several segments, including Feed (€1.06 billion), Farming (€3.48 billion), Sales & Marketing - Markets (€4.05 billion), and Sales and Marketing - Consumer Products (€3.74 billion).

Insider Ownership: 15.3%

Mowi is experiencing significant earnings growth, forecasted at 43.8% annually, outpacing the Norwegian market's 15.5%. Despite high debt levels and slower revenue growth of 7.9%, a strategic partnership with Skretting/Nutreco aims to enhance profitability with expected annual net cost savings of EUR 55 million. Recent results show increased net income for Q3 2025 at EUR 110 million from EUR 48.9 million a year ago, indicating robust operational performance amidst evolving market dynamics.

- Navigate through the intricacies of Mowi with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Mowi's share price might be on the cheaper side.

Northern Ocean (OB:NOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Northern Ocean Ltd. offers offshore contract drilling services to the global oil and gas industry, with a market cap of NOK2.56 billion.

Operations: The company generates revenue from providing contract drilling services to the oil and gas sector, amounting to $223.47 million.

Insider Ownership: 15.5%

Northern Ocean is poised for growth with its revenue forecasted to increase at 11.5% annually, outpacing the Norwegian market. Despite a volatile share price and a cash runway of less than a year, the company is expected to become profitable within three years. Recent contract extensions with Rhino Resources and Equinor have expanded its backlog to US$394 million, indicating strong demand for its services despite ongoing net losses reported in recent earnings results.

- Unlock comprehensive insights into our analysis of Northern Ocean stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Northern Ocean shares in the market.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK6.03 billion.

Operations: The company's revenue primarily comes from its Communications Software segment, which generated SEK2.02 billion.

Insider Ownership: 16.3%

Truecaller is positioned for growth with earnings forecasted to grow 15.49% annually, surpassing the Swedish market's average. Despite high share price volatility, it trades at a significant discount to fair value and shows substantial insider buying recently. The launch of Family Protection aims to boost engagement and subscription revenues by enhancing user safety features, while partnerships like SmartBuy highlight its strategic focus on trust and communication solutions in Europe’s retail sector.

- Click to explore a detailed breakdown of our findings in Truecaller's earnings growth report.

- The valuation report we've compiled suggests that Truecaller's current price could be quite moderate.

Key Takeaways

- Click this link to deep-dive into the 207 companies within our Fast Growing European Companies With High Insider Ownership screener.

- Interested In Other Possibilities? This technology could replace computers: discover the 29 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报