Assessing Cybin’s Valuation As Helus Pharma Uplists To Nasdaq And Joins The Nasdaq Composite Index

Cybin (NasdaqGM:HELP) has entered the Nasdaq Composite Index following its rebrand to Helus Pharma and uplisting to Nasdaq. This development aligns with its late stage neuropsychiatry drug programs and commercialization plans.

See our latest analysis for Cybin.

The recent rebrand, uplisting and index inclusion come after a mixed run for investors, with a 23.18% 1 month share price return and a 16.11% 3 month share price return. This contrasts with a 23.85% 1 year total shareholder return decline and deeper multi year losses, suggesting momentum has picked up recently while long term holders remain significantly underwater.

If this kind of sector shift has your attention, it could be a good moment to scan other healthcare stocks that might fit your watchlist. You may uncover ideas at very different points in their journey.

With HELP trading at US$7.28 and sitting at a very large implied discount to its US$47.22 analyst target and intrinsic value estimate, you have to ask: is this a genuine opportunity, or is the market already pricing in future growth?

Price to Book of 2.6x: Is it justified?

On a simple P/B view, HELP at US$7.28 looks cheap against its peer group average of 6.3x, but slightly expensive versus the wider US pharmaceuticals sector at 2.5x.

P/B compares a company’s market value to its net assets, which can be a common yardstick for clinical stage drug developers that have limited or no revenue. For Cybin, the key question is whether investors are paying primarily for the balance sheet today or for the potential of its neuropsychiatry pipeline.

Our data flags HELP as good value relative to its peer set on this measure, yet a touch expensive compared with the broader industry. That mixed signal suggests the market is assigning a premium over the typical pharma name, while still pricing HELP below closer peers that may share similar risk and development profiles.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Preferred multiple of Price-to-Book 2.6x (UNDERVALUED)

However, you still need to weigh clinical trial setbacks or funding pressures, given zero reported revenue and a net loss of US$86.8m, against any perceived discount.

Find out about the key risks to this Cybin narrative.

Another View: Our DCF Signals A Much Deeper Discount

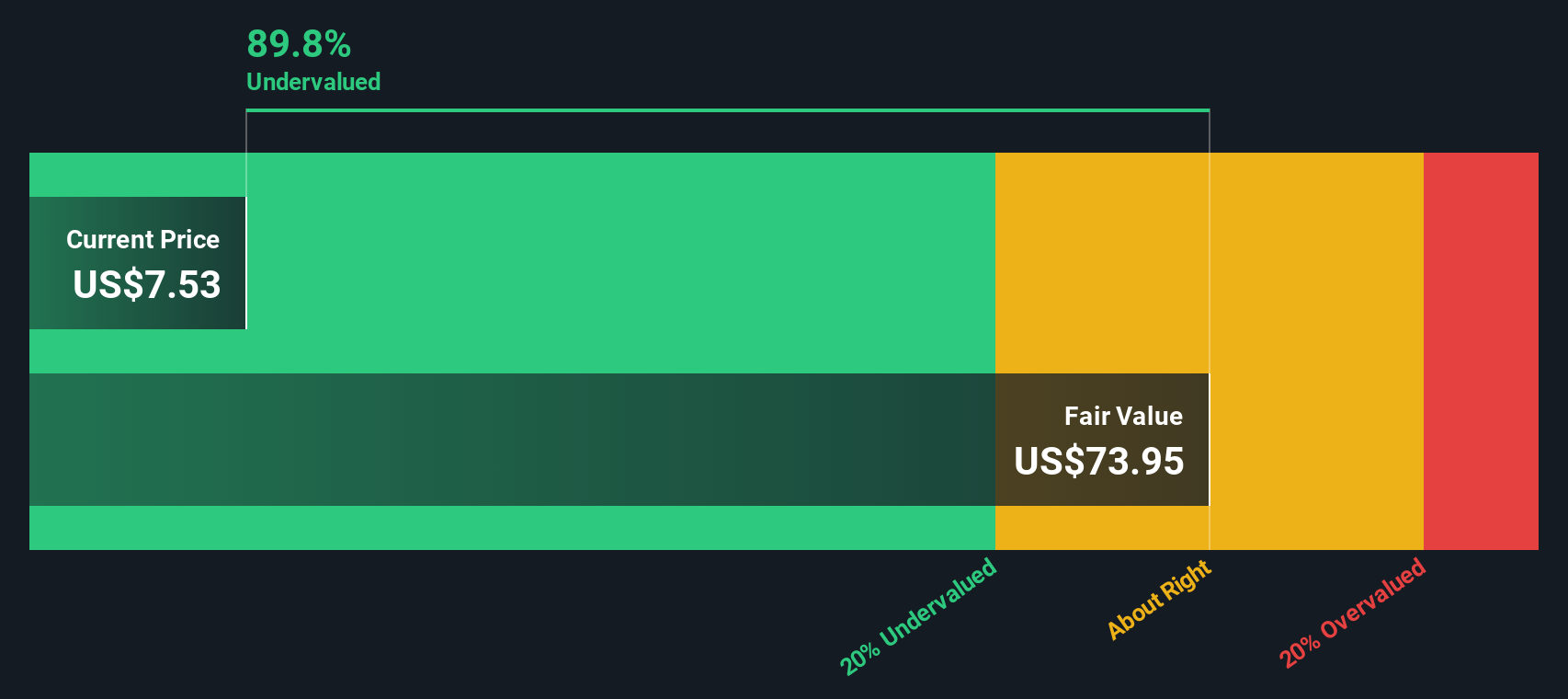

The P/B of 2.6x points to a modest discount versus peers, but our DCF model presents a much larger gap in valuation. With HELP at US$7.28 compared with an estimated fair value of US$73.95, it appears heavily undervalued. Is this a genuine pricing error, or is the market simply cautious about execution risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cybin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 887 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cybin Narrative

If you see the numbers differently or just prefer to test your own assumptions, you can build a full story for HELP in a few minutes: Do it your way.

A great starting point for your Cybin research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If HELP has sparked ideas, do not stop here. The wider market is full of opportunities that could fit your style and sharpen your portfolio watchlist.

- Target rapid upside potential with these 3552 penny stocks with strong financials, which pair smaller market caps with solid underlying financials.

- Ride the AI wave by scanning these 26 AI penny stocks that sit at the intersection of cutting edge technology and scalable business models.

- Focus on pricing power by filtering these 887 undervalued stocks based on cash flows, where current market prices sit below estimated cash flow driven value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报