Persimmon Plc (LON:PSN) Doing What It Can To Lift Shares

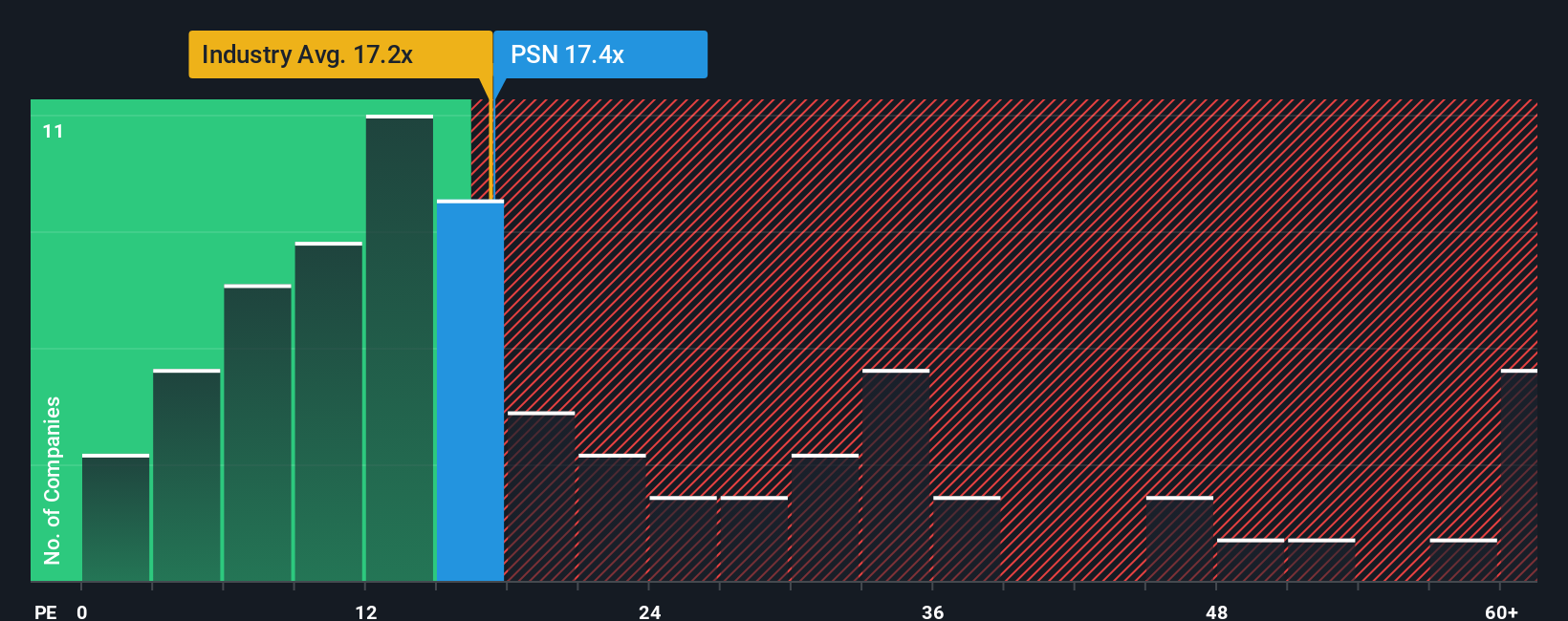

With a median price-to-earnings (or "P/E") ratio of close to 17x in the United Kingdom, you could be forgiven for feeling indifferent about Persimmon Plc's (LON:PSN) P/E ratio of 17.4x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, Persimmon's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Persimmon

What Are Growth Metrics Telling Us About The P/E?

Persimmon's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 65% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 21% per annum over the next three years. With the market only predicted to deliver 15% per annum, the company is positioned for a stronger earnings result.

In light of this, it's curious that Persimmon's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Persimmon's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Persimmon you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报