How Investors May Respond To Viking Holdings (VIK) Aggressive Multi‑Year Discount And Airfare Promotion

- Viking Holdings has launched The Viking Savings Event for North American travelers, offering up to 35 percent off all-inclusive voyages, free international airfare, and a US$25 deposit on select 2026–2028 river, ocean, and expedition itineraries, with the promotion running until January 31, 2026.

- The breadth of this promotion, including extra savings for returning guests, highlights how Viking is using aggressive incentives to stimulate forward bookings across its global fleet.

- We’ll now assess how this extensive discount-and-airfare package could influence Viking’s investment narrative around demand strength and profitability.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Viking Holdings Investment Narrative Recap

To own Viking Holdings, you need to believe that its premium, experience-focused cruises can stay in high demand while the company manages high debt and cost pressures. The Viking Savings Event looks material for near-term booking momentum, but the deep discounts and free airfare package could test how well Viking can protect profitability against already elevated fuel, operating, and marketing costs.

Among recent updates, Viking’s continued Nile and ocean fleet additions, including ships like Viking Vesta and Viking Mira, are particularly relevant here, as the company is layering aggressive promotions on top of a growing capacity base. How effectively these new vessels are filled, and at what net yield, will be central to whether current incentives support or strain the earnings trajectory investors are watching.

Yet beneath the appealing discounts and full ships, investors should be aware of how rising fuel and operating costs could...

Read the full narrative on Viking Holdings (it's free!)

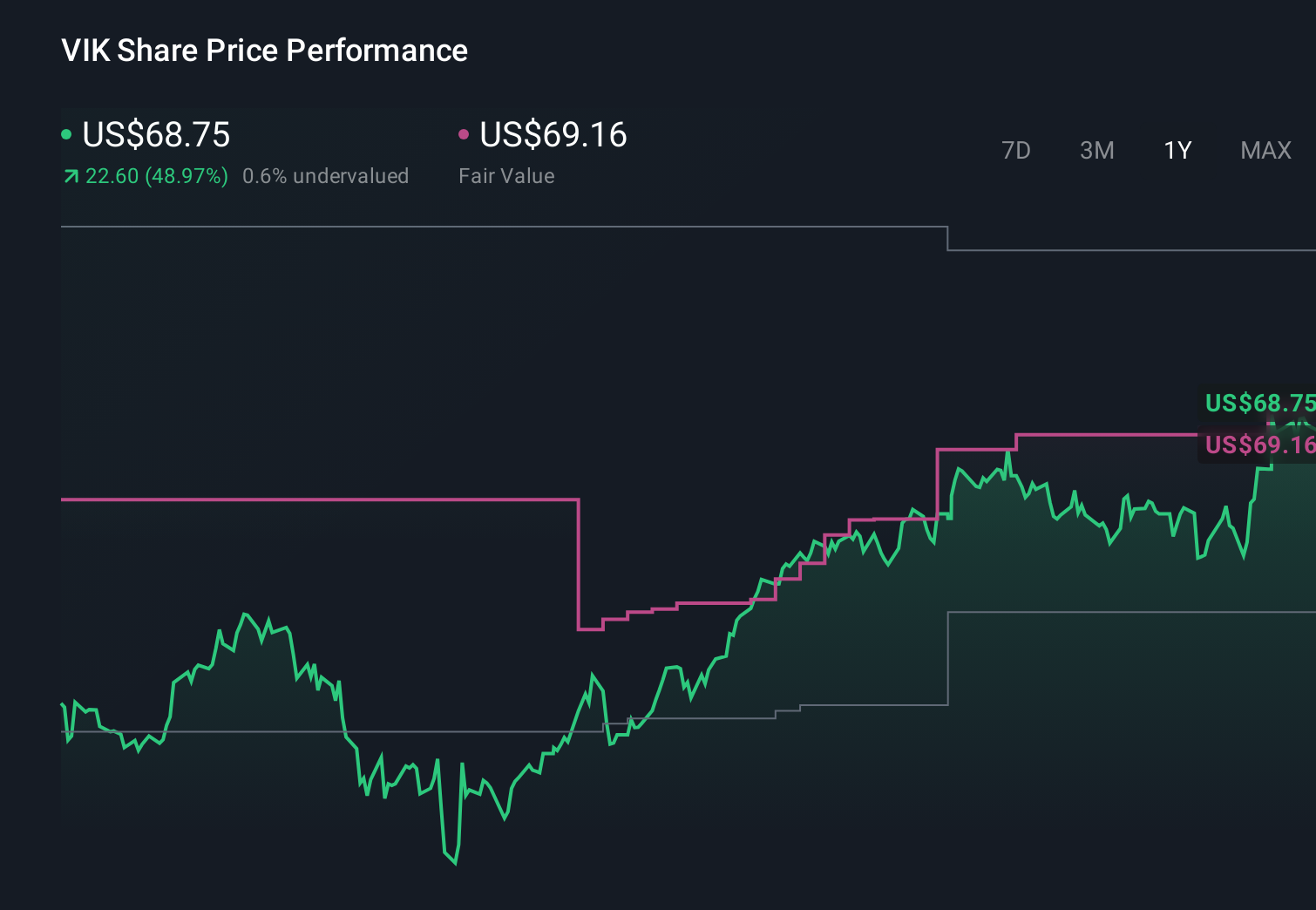

Viking Holdings' narrative projects $8.5 billion revenue and $2.0 billion earnings by 2028. This requires 13.6% yearly revenue growth and an earnings increase of about $1.3 billion from $694.2 million today.

Uncover how Viking Holdings' forecasts yield a $72.06 fair value, in line with its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$34 to US$94 per share, underscoring how far apart individual views can be. When you set those against Viking’s push for aggressive promotions to support bookings, it becomes even more important to compare different assumptions about margins and long term earnings power.

Explore 5 other fair value estimates on Viking Holdings - why the stock might be worth as much as 28% more than the current price!

Build Your Own Viking Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viking Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Viking Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viking Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报