Assessing Gecina (ENXTPA:GFC) Valuation After Recent Share Price Gains And Long Term Return Weakness

Gecina (ENXTPA:GFC) has attracted fresh attention after recent share moves, with the stock showing mixed returns over the past year and over a multi year period, prompting investors to reassess its valuation and income profile.

See our latest analysis for Gecina.

With the share price at €82.8 and a 1 day share price return of 4.22%, recent gains build on a positive year to date share price return of 3.24%. However, the 1 year total shareholder return of 1.16% decline and 5 year total shareholder return of 10.87% decline point to fading longer term momentum and a more mixed picture for investors assessing value and income today.

If Gecina has you rethinking your real estate exposure, it could be a good moment to widen the lens and check out fast growing stocks with high insider ownership for fresh ideas.

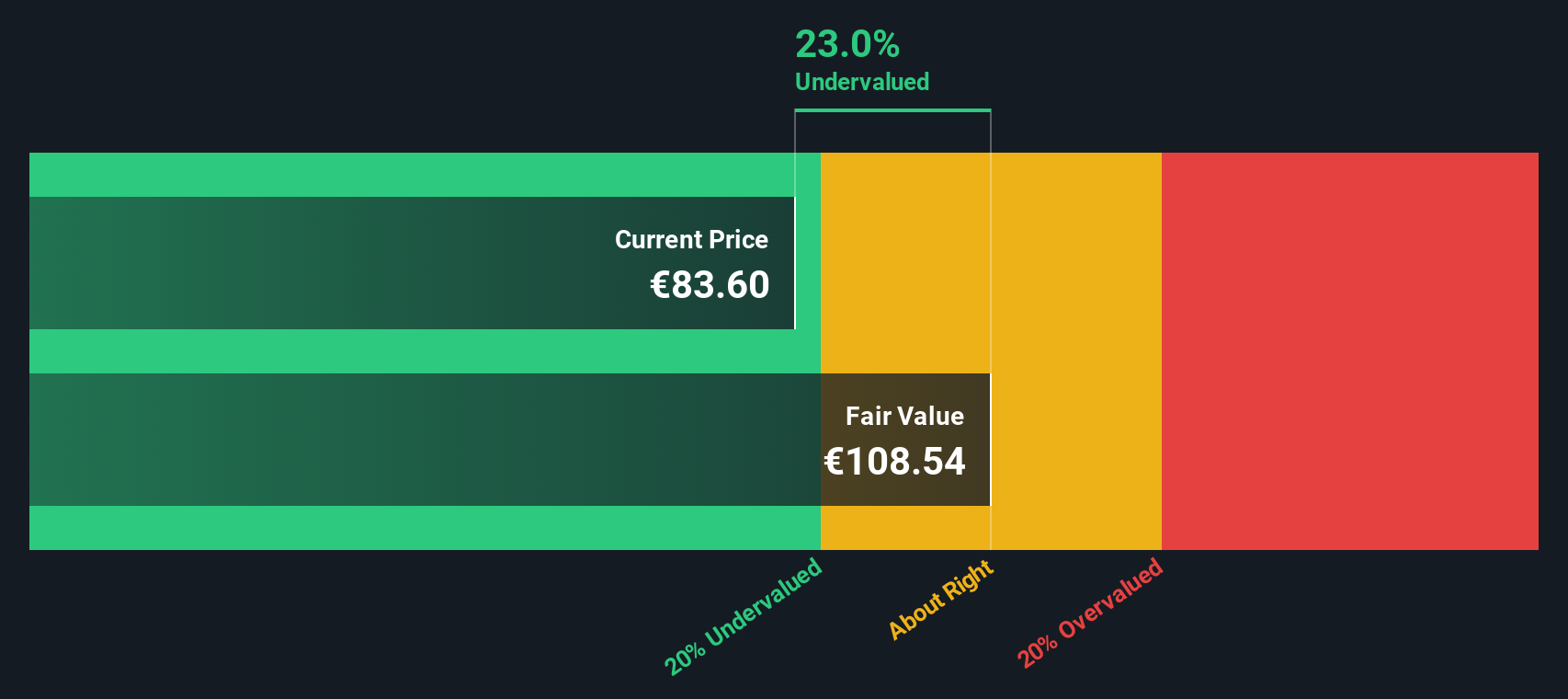

With Gecina trading at €82.8 against an analyst price target of €104.36 and an indicated intrinsic value discount of around 55%, you have to ask: is this a genuine value gap, or is the market already pricing in future growth?

Price to earnings of 12x: Is it justified?

On a P/E of 12x, Gecina looks inexpensive relative to several benchmarks, which stands out given the recent share price at €82.8.

The P/E multiple compares what investors are paying today for each unit of current earnings, which matters a lot for a mature, income focused office and residential REIT like Gecina. For this sector, earnings based valuations are a common reference point because cash generation and payout capacity sit at the core of most investment theses.

According to the statements, Gecina is described as good value on this yardstick, with a P/E of 12x versus a peer average of 72.9x and a global Office REITs industry average of 21.8x. Against the estimated fair P/E of 13.9x, the current level suggests the market is applying a clear discount that could narrow if earnings forecasts and dividend support remain intact.

Compared to peers, the gap is wide, and even against the fair ratio estimate the current P/E sits comfortably lower, pointing to a valuation level the market could move towards if sentiment improves. Explore the SWS fair ratio for Gecina

Result: Price-to-earnings of 12x (UNDERVALUED)

However, you also need to weigh risks such as revenue declining 3.35% annually and a 10.87% 5 year total return decline, which could be flagging structural headwinds.

Find out about the key risks to this Gecina narrative.

Another view using the SWS DCF model

The P/E of 12x suggests Gecina looks inexpensive, but our DCF model presents a different perspective. With an estimated fair value of €183.42 versus the current €82.8, the shares appear heavily undervalued. This raises the question of whether there is a genuine disconnect or whether the cash flow assumptions are too optimistic.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Gecina for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Gecina Narrative

If you see the numbers differently or prefer to work from your own assumptions, you can build a personalised view in just a few minutes, starting with Do it your way.

A great starting point for your Gecina research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You do not have to stop with one stock. Use this as a springboard, scan other opportunities, and make sure you are not leaving better ideas on the table.

- Spot potential turnaround plays by checking out these 3553 penny stocks with strong financials that already show solid financial strength instead of just hype.

- Get ahead of major tech shifts by reviewing these 26 AI penny stocks that are tied to real business models, not just buzzwords.

- Focus on valuation discipline by running through these 886 undervalued stocks based on cash flows that currently screen as cheap based on cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报