A Look At Hertz Global Holdings (HTZ) Valuation After Renewed Interest And Transformation Hopes

Hertz stock reacts to renewed interest

Hertz Global Holdings (HTZ) drew fresh attention after its shares rose 5% following a broker's higher price view, which was tied to the company’s focus on vehicle sales and digital channels during its ongoing business transformation.

See our latest analysis for Hertz Global Holdings.

That 5% jump in Hertz’s share price sits against a mixed backdrop, with a 7.47% year to date share price return and a 41.31% one year total shareholder return contrasting with a 66.55% total shareholder return decline over three years. This suggests renewed interest is only starting to rebuild momentum.

If this move has you looking beyond car rentals, it could be a good moment to scan other auto names through auto manufacturers and see how they compare.

Hertz is posting US$8.5b in revenue but still reporting a US$1.0b loss, and the shares now trade close to a broker price target. Is the recent excitement a genuine opportunity, or is future growth already baked in?

Most Popular Narrative: 11.6% Overvalued

With Hertz Global Holdings last closing at US$5.61 against a narrative fair value of US$5.03, the current price sits above that framework and raises questions about how much of the expected recovery is already in the share price.

The Fair Value estimate has risen moderately from approximately 4.39 dollars per share to about 5.03 dollars per share, reflecting a roughly 14 percent upward revision. The future P/E multiple has risen meaningfully from about 6.06x to roughly 6.93x, which suggests a higher valuation being placed on Hertz’s projected earnings.

Curious what justifies that higher earnings multiple on an unprofitable business today? The narrative leans heavily on a swing in margins and a different revenue path. Want to see which financial assumptions carry the whole valuation story?

Result: Fair Value of $5.03 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be challenged if Hertz’s younger fleet and vehicle sales continue to support margins, or if its digital partnerships lift utilization and pricing power faster than expected.

Find out about the key risks to this Hertz Global Holdings narrative.

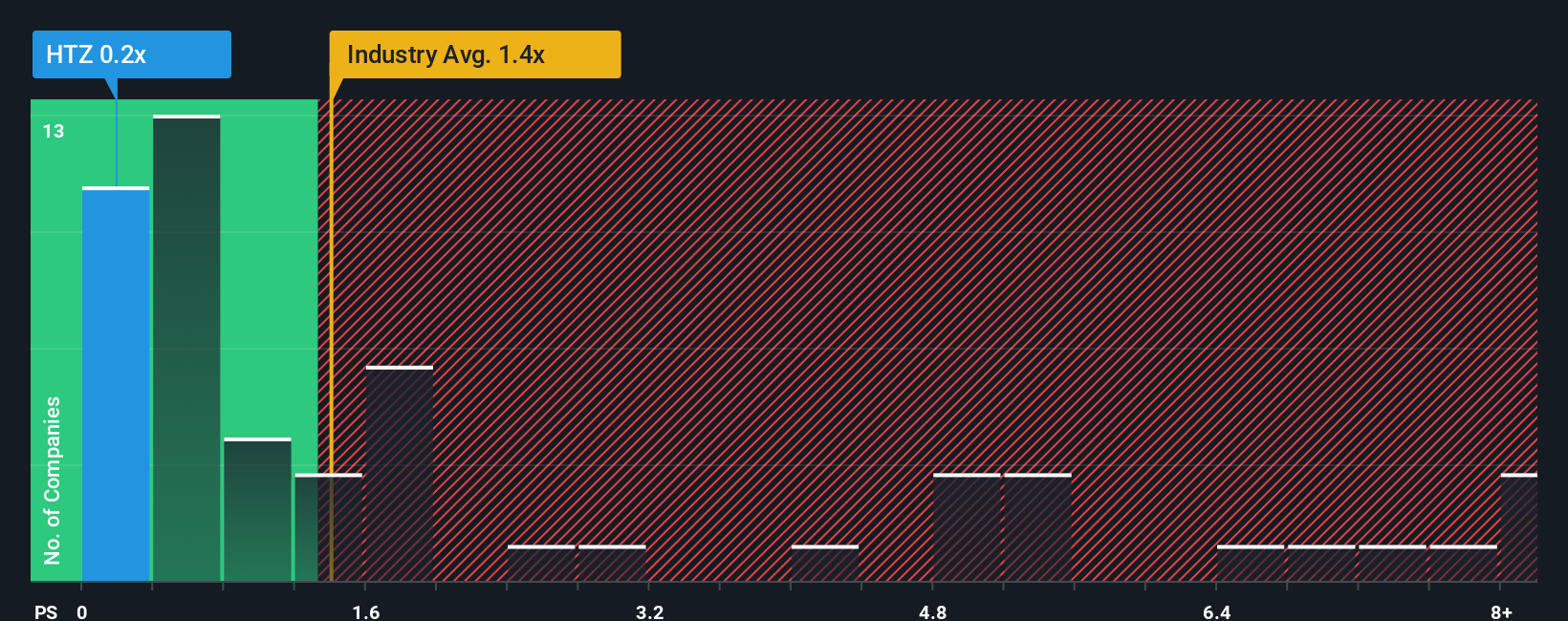

Another View: Cheap Sales Multiple Sends A Different Signal

While the narrative fair value of US$5.03 suggests Hertz Global Holdings is 11.6% overvalued at US$5.61, its P/S ratio of 0.2x tells a different story. That is well below both the US Transportation industry at 1.1x and a fair ratio of 0.4x, which points to a wide gap between price and sales that could either be a margin of safety or a warning that the market is still cautious about losses and balance sheet risk. Which explanation do you think fits better?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hertz Global Holdings Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to rely on your own research, you can build a complete view in just a few minutes, starting with Do it your way

A great starting point for your Hertz Global Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Hertz has you thinking differently about your portfolio, now is the time to widen your search and line up a few other candidates worth your attention.

- Spot potential turnarounds by scanning these 3553 penny stocks with strong financials that combine smaller market sizes with more resilient balance sheets and proven fundamentals.

- Target long term themes by reviewing these 26 AI penny stocks that are tied to practical AI use cases rather than just headlines.

- Hunt for pricing gaps by focusing on these 886 undervalued stocks based on cash flows that trade below what their cash flows might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报