3 UK Growth Stocks With Strong Insider Ownership

As the United Kingdom's FTSE 100 index grapples with declines influenced by weak trade data from China, investors are increasingly focused on identifying resilient opportunities amidst global economic uncertainties. In such a climate, growth stocks with strong insider ownership can be particularly appealing, as they often indicate confidence from those closely connected to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| Quantum Base Holdings (AIM:QUBE) | 33.9% | 93.2% |

| Plexus Holdings (AIM:POS) | 11.5% | 140% |

| Manolete Partners (AIM:MANO) | 34.9% | 38.1% |

| Kainos Group (LSE:KNOS) | 20.6% | 23% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Hochschild Mining (LSE:HOC) | 38.4% | 40.8% |

| B90 Holdings (AIM:B90) | 10.9% | 157.2% |

| Afentra (AIM:AET) | 37.7% | 38.7% |

| ActiveOps (AIM:AOM) | 21.9% | 102.9% |

We'll examine a selection from our screener results.

AO World (LSE:AO.)

Simply Wall St Growth Rating: ★★★★☆☆

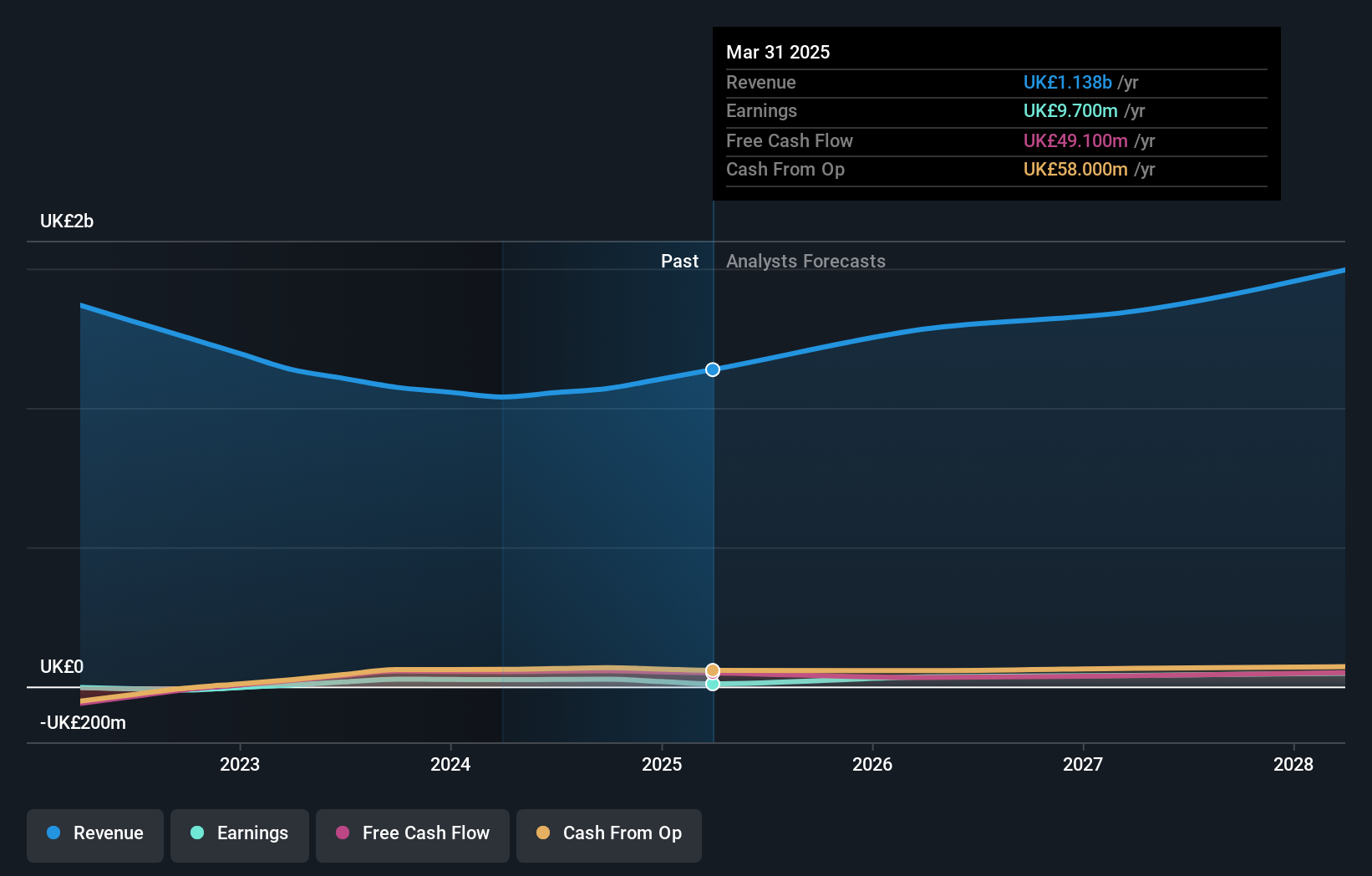

Overview: AO World plc, along with its subsidiaries, operates as an online retailer specializing in domestic appliances and ancillary services in the UK and Germany, with a market cap of £627.65 million.

Operations: The company's revenue is primarily derived from its online retailing segment, which focuses on domestic appliances and ancillary services, generating £1.21 billion.

Insider Ownership: 20.5%

AO World is poised for growth with forecasted annual earnings expansion of 37.6%, outpacing the UK market. Recent financials show improved sales at £585.6 million and net income of £12.6 million, though profit margins have declined to 0.9%. Despite substantial insider selling recently, the company benefits from high insider ownership which can align management's interests with shareholders', potentially supporting its strategic focus on revenue and earnings growth above market averages.

- Click here and access our complete growth analysis report to understand the dynamics of AO World.

- According our valuation report, there's an indication that AO World's share price might be on the expensive side.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★★☆

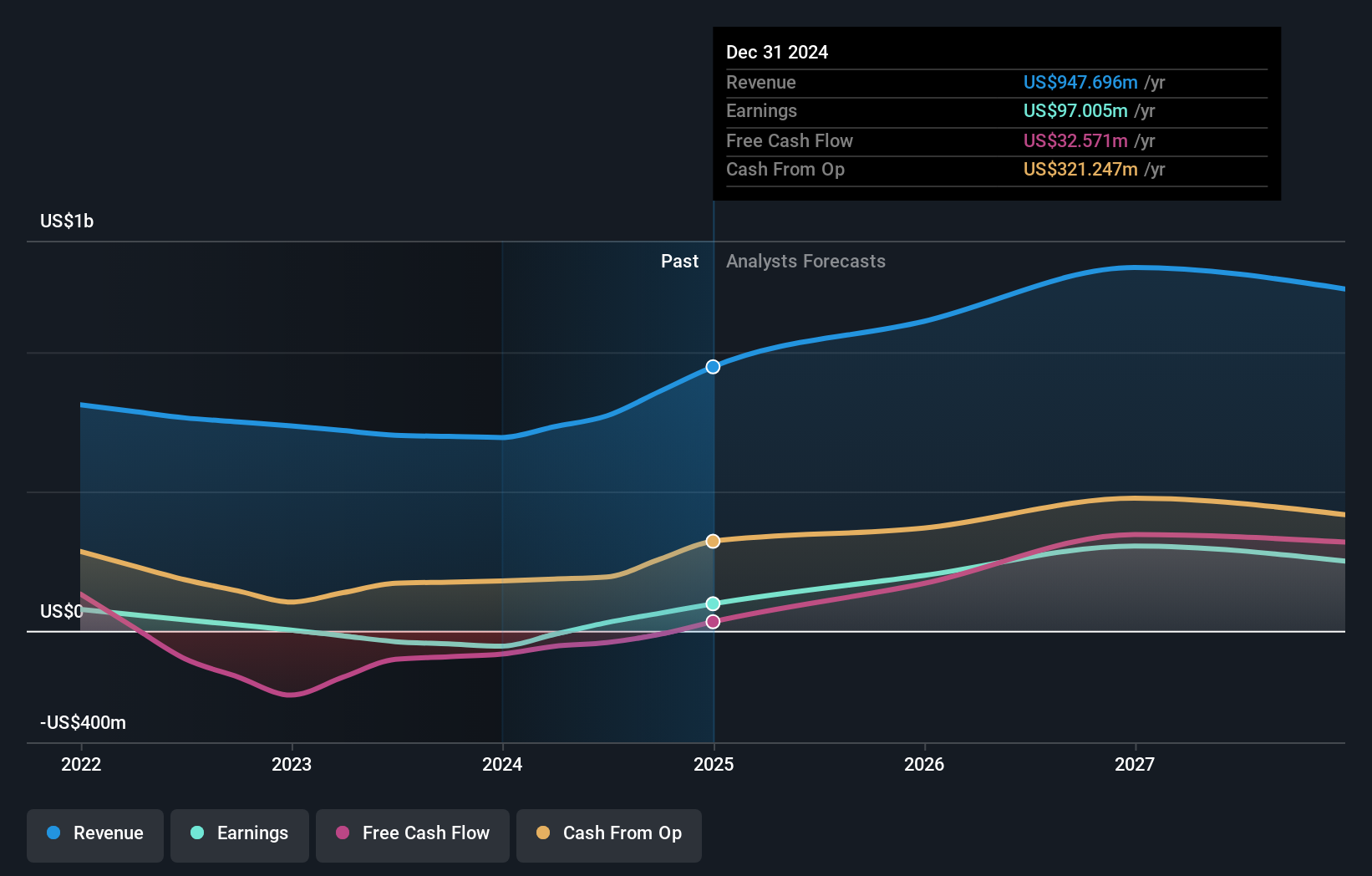

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver across Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile with a market cap of £2.52 billion.

Operations: The company's revenue segments consist of $320.31 million from San Jose, $186.58 million from Mara Rosa, and $568.64 million from Inmaculada.

Insider Ownership: 38.4%

Hochschild Mining is set for significant earnings growth, forecasted at 40.8% annually, surpassing the UK market average. Despite a volatile share price and lower production figures compared to last year, it trades at 55.8% below its estimated fair value, suggesting potential undervaluation. The company maintains high insider ownership which may align management with shareholder interests, supporting its strategic focus on growing revenue faster than the market while reiterating stable production guidance for gold equivalents in 2025.

- Get an in-depth perspective on Hochschild Mining's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Hochschild Mining implies its share price may be lower than expected.

Playtech (LSE:PTEC)

Simply Wall St Growth Rating: ★★★★☆☆

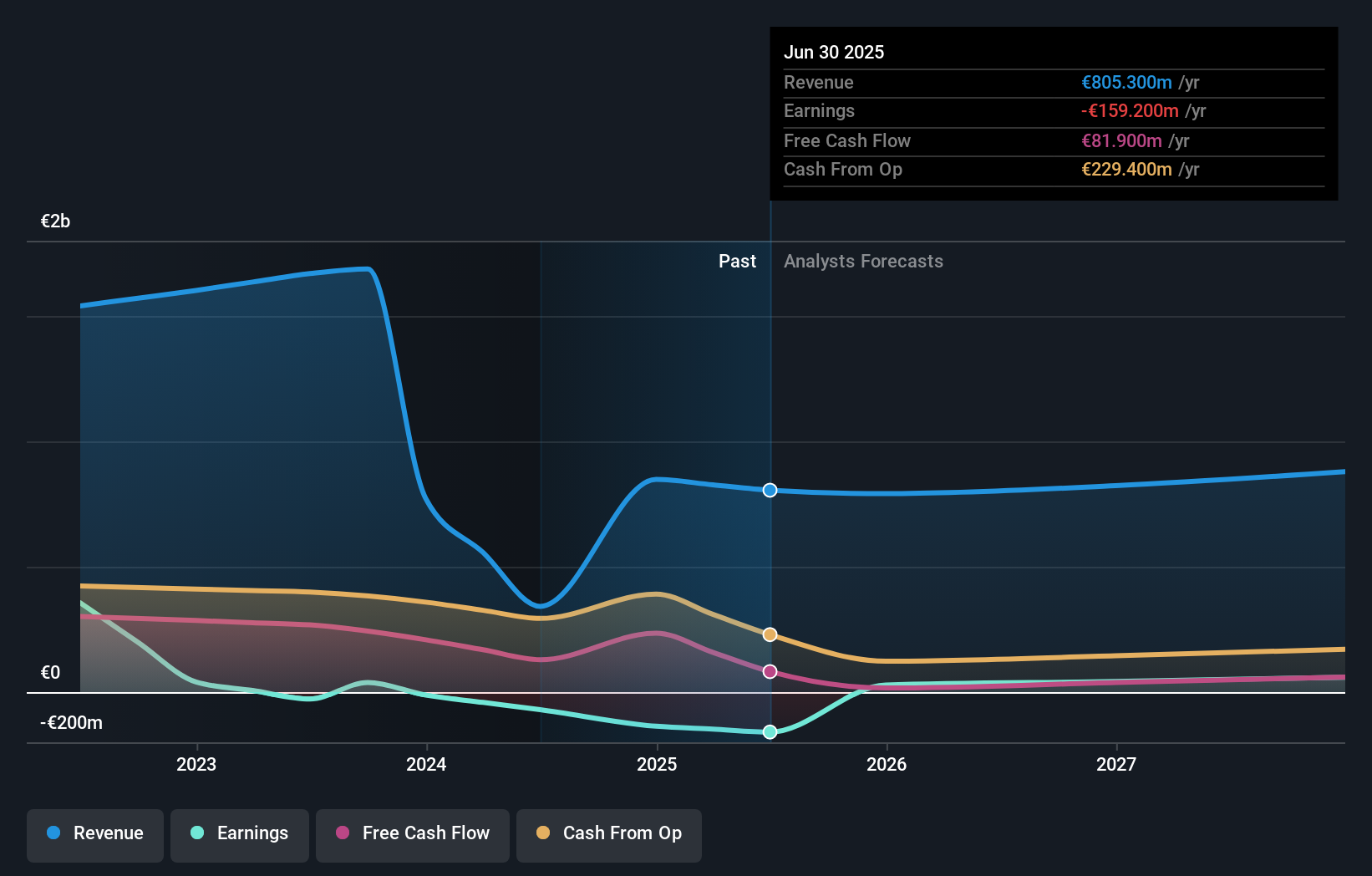

Overview: Playtech plc is a technology company that provides gambling software, services, content, and platform technologies across Italy, Mexico, the United Kingdom, Europe, Latin America, and other international markets with a market cap of approximately £799.12 million.

Operations: Playtech's revenue segments include €719.70 million from B2B operations, €17.10 million from HAPPYBET, and €72.20 million from Sun Bingo and other B2C activities.

Insider Ownership: 10.2%

Playtech's revenue is forecast to grow at 5.8% annually, outpacing the UK market average. Despite high share price volatility and a low return on equity forecast of 4%, it trades at 41% below its estimated fair value, indicating potential undervaluation. The company is expected to transition to profitability within three years, with earnings growth projected at 48.81% per year, suggesting robust future prospects amidst substantial insider ownership aligning interests with shareholders.

- Delve into the full analysis future growth report here for a deeper understanding of Playtech.

- Our valuation report unveils the possibility Playtech's shares may be trading at a discount.

Make It Happen

- Dive into all 55 of the Fast Growing UK Companies With High Insider Ownership we have identified here.

- Seeking Other Investments? Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报