Investors Give Mexedia Società Per Azioni S.B. (EPA:ALMEX) Shares A 35% Hiding

To the annoyance of some shareholders, Mexedia Società Per Azioni S.B. (EPA:ALMEX) shares are down a considerable 35% in the last month, which continues a horrid run for the company. The good news is that in the last year, the stock has shone bright like a diamond, gaining 202%.

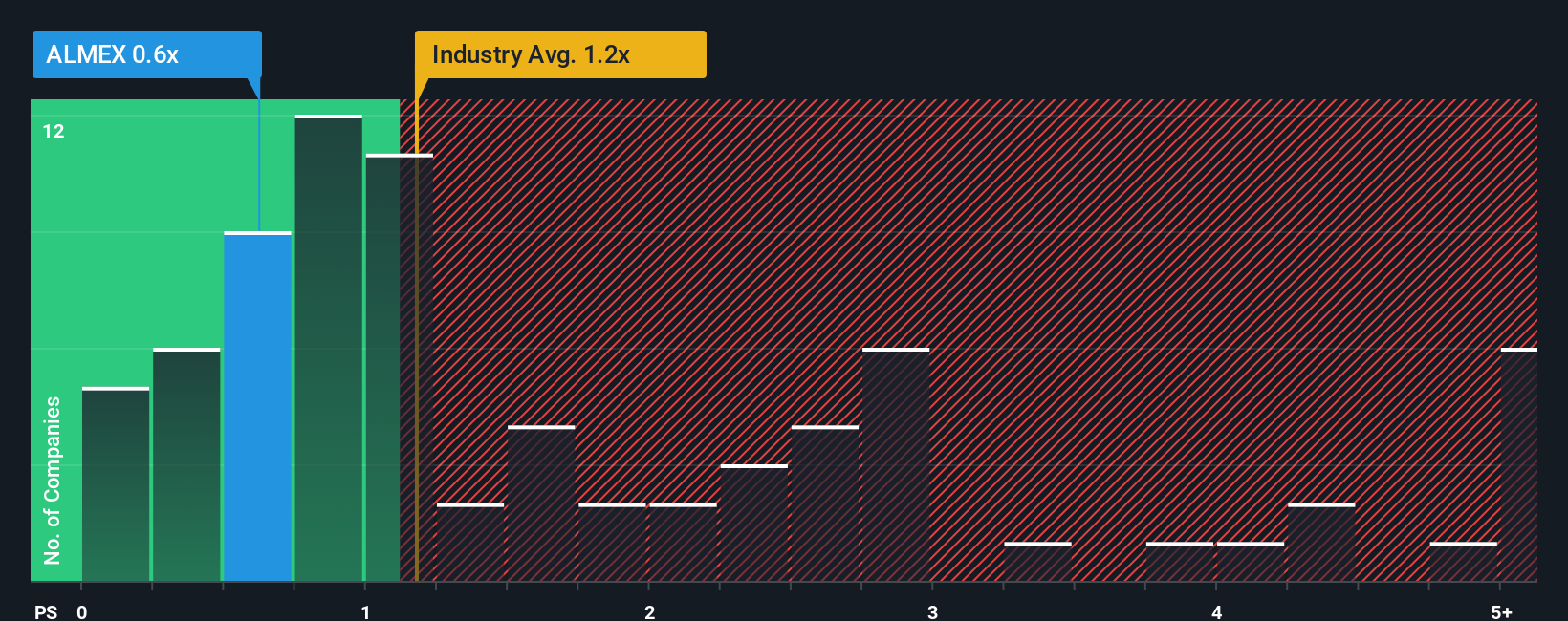

Since its price has dipped substantially, when close to half the companies operating in France's Telecom industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Mexedia Società Per Azioni S.B as an enticing stock to check out with its 0.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Mexedia Società Per Azioni S.B

How Mexedia Società Per Azioni S.B Has Been Performing

Mexedia Società Per Azioni S.B could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Mexedia Società Per Azioni S.B will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Mexedia Società Per Azioni S.B's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's top line. As a result, revenue from three years ago have also fallen 18% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 38% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 1.8% per annum, which is noticeably less attractive.

In light of this, it's peculiar that Mexedia Società Per Azioni S.B's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Mexedia Società Per Azioni S.B's P/S?

Mexedia Società Per Azioni S.B's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Mexedia Società Per Azioni S.B currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 1 warning sign for Mexedia Società Per Azioni S.B you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报