High Growth Tech Stocks in Asia to Watch January 2026

As 2026 begins, Asian markets are experiencing varied momentum, with China's manufacturing sector showing signs of recovery and South Korea's exports reaching record highs. In this dynamic environment, identifying high growth tech stocks involves looking for companies that can leverage regional economic trends and technological advancements to drive innovation and capture market share.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Zhongji Innolight | 36.62% | 38.27% | ★★★★★★ |

| Fositek | 37.25% | 52.10% | ★★★★★★ |

| Gold Circuit Electronics | 31.06% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 35.50% | 33.23% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Yidu Tech (SEHK:2158)

Simply Wall St Growth Rating: ★★★★☆☆

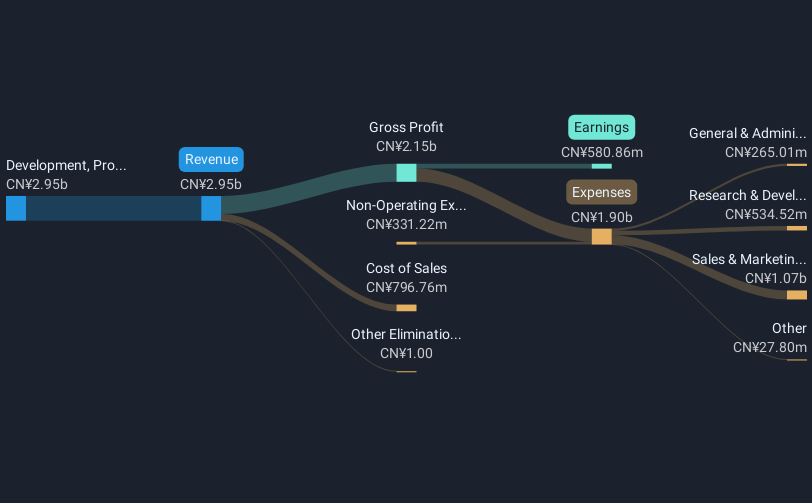

Overview: Yidu Tech Inc. is an investment holding company that offers healthcare solutions leveraging big data and artificial intelligence technologies in various countries, including China, with a market cap of HK$6.03 billion.

Operations: Yidu Tech generates revenue through three main segments: Life Sciences Solutions (CN¥240.75 million), Big Data Platform and Solutions (CN¥365.40 million), and Health Management Platform and Solutions (CN¥137.49 million). The company leverages big data and AI technologies to provide healthcare solutions across multiple countries, including China, Brunei, and Singapore.

Yidu Tech, a player in the high-growth tech sector in Asia, has demonstrated resilience and potential for significant growth. With a reported sales increase to CNY 358.11 million from CNY 329.45 million year-over-year and a substantial reduction in net loss to CNY 14.6 million from CNY 43.45 million, the company shows promising financial recovery trends. Despite current unprofitability, Yidu's revenue is projected to grow at an annual rate of 17.7%, outpacing the Hong Kong market's average of 8.4%. Moreover, earnings are expected to surge by an impressive 94.18% annually, positioning Yidu favorably for future profitability within three years as it navigates through the competitive healthcare services landscape where it currently underperforms with a modest forecasted return on equity of only 1.9%.

- Dive into the specifics of Yidu Tech here with our thorough health report.

Gain insights into Yidu Tech's historical performance by reviewing our past performance report.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog active pharmaceutical ingredients (APIs) and injections in China with a market capitalization of approximately CN¥42.55 billion.

Operations: Gan & Lee Pharmaceuticals generates revenue primarily from the development, production, and sales of insulin and related products, amounting to CN¥3.85 billion. The company's operations focus on the biopharmaceutical sector within China.

Gan & Lee Pharmaceuticals, amidst a robust Asian tech landscape, is making significant strides with its innovative diabetes treatments. The company recently announced a licensing agreement with Lupin for Bofanglutide, potentially the first fortnightly GLP-1 receptor agonist, poised to transform obesity and diabetes management. This follows their insulin glargine's endorsement by the EMA as biosimilar to Lantus®, underscoring Gan & Lee's commitment to expanding its global footprint in chronic disease care. With an impressive 35.8% increase in revenue year-over-year and earnings up by 61.3%, Gan & Lee not only outpaces regional growth rates but also solidifies its role in shaping future healthcare solutions.

Accton Technology (TWSE:2345)

Simply Wall St Growth Rating: ★★★★★★

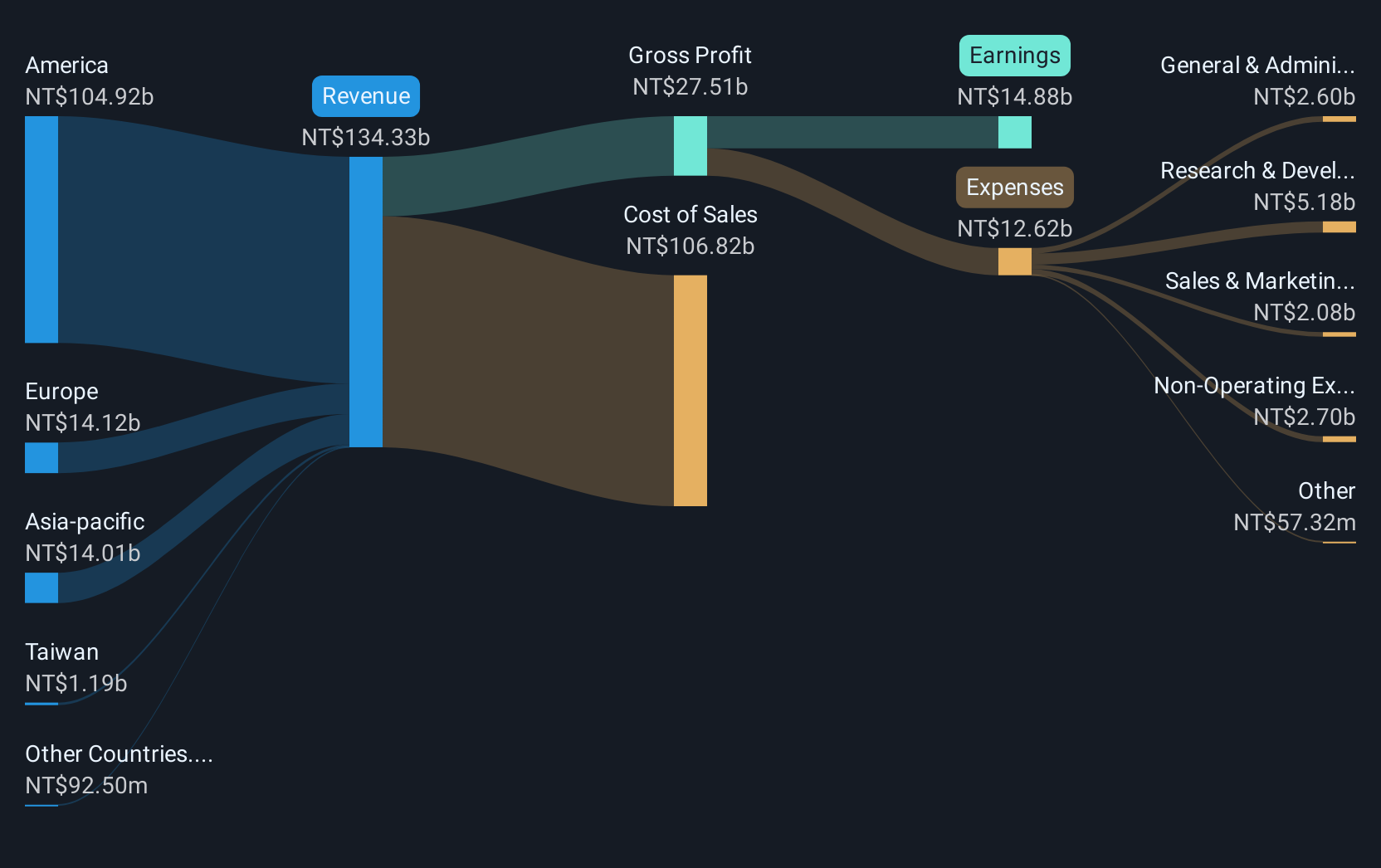

Overview: Accton Technology Corporation is engaged in the development, manufacturing, and sale of computer network systems and wireless LAN hardware and software products across Taiwan, the United States, the Asian-Pacific region, Europe, and other international markets with a market capitalization of NT$673.48 billion.

Operations: The primary revenue stream for Accton Technology comes from its computer network segment, generating NT$215.27 billion. The company operates across multiple regions, including Taiwan, the United States, and Europe.

Accton Technology's recent strategic alliance with Edgecore Networks, 1Finity, and Liqid to develop a cutting-edge datacenter solution underscores its innovative edge in Asia's tech sector. This collaboration aims to enhance long-distance photonic network connectivity, crucial for modern datacenters requiring high transmission rates and low latency. Financially, Accton has shown robust growth with third-quarter revenue soaring to TWD 72.95 billion from TWD 28.19 billion year-over-year, while net income tripled to TWD 7.83 billion. These figures reflect a significant annualized revenue growth of 24.1% and earnings growth of 24.9%, positioning Accton well for future expansions in high-demand tech segments.

Summing It All Up

- Click through to start exploring the rest of the 183 Asian High Growth Tech and AI Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报