Asian Penny Stock Highlights: Ley Choon Group Holdings And 2 Other Noteworthy Picks

As global markets navigate a complex economic landscape, Asian equities continue to capture investor attention with their diverse opportunities. Penny stocks, often representing smaller or newer companies, remain an intriguing segment for investors seeking growth at lower price points. Despite the term's vintage connotations, these stocks can offer significant value when backed by strong financials and clear growth potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.45 | HK$896.85M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.50 | THB1.05B | ✅ 3 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Panjawattana Plastic (SET:PJW) | THB2.04 | THB1.18B | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.105 | SGD54.97M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.64 | SGD14.33B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.64 | HK$20.52B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$137.01M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.40 | HK$51.08B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.82 | NZ$235.47M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 958 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ley Choon Group Holdings (Catalist:Q0X)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ley Choon Group Holdings Limited is an investment holding company that offers underground utilities infrastructure construction services in Singapore and Sri Lanka, with a market capitalization of SGD150.58 million.

Operations: The company's revenue is primarily generated from its Pipes and Roads segment, contributing SGD176.34 million, and its Construction Materials segment, which adds SGD30.97 million.

Market Cap: SGD150.58M

Ley Choon Group Holdings Limited, with a market capitalization of SGD150.58 million, has demonstrated stability by maintaining no debt and avoiding shareholder dilution over the past year. The company generates significant revenue from its Pipes and Roads segment (SGD176.34 million) and Construction Materials segment (SGD30.97 million), though recent earnings showed a slight decline in net income to SGD6.08 million for the half-year ended September 2025 compared to the previous year. Its experienced management team contrasts with an inexperienced board, while short-term assets comfortably cover both short- and long-term liabilities, supporting financial resilience in volatile markets.

- Click here to discover the nuances of Ley Choon Group Holdings with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Ley Choon Group Holdings' track record.

Sipai Health Technology (SEHK:314)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sipai Health Technology Co., Ltd. is a medical technology and health management company operating in the People's Republic of China, with a market cap of HK$2.07 billion.

Operations: Sipai Health Technology generates revenue primarily from its Specialty Pharmacy Business, which accounts for CN¥2.83 billion, followed by the Physician Research Assistance Business at CN¥425.36 million and the Health Insurance Services Business at CN¥166.43 million.

Market Cap: HK$2.07B

Sipai Health Technology, with a market cap of HK$2.07 billion, operates primarily through its Specialty Pharmacy Business generating CN¥2.83 billion in revenue. Despite being unprofitable and not expected to achieve profitability in the next three years, the company has reduced losses by 53.1% annually over five years and forecasts a 15.27% annual revenue growth rate. It trades at 70.9% below estimated fair value and remains debt-free with sufficient cash runway for over three years based on current free cash flow, while its experienced management team supports strategic stability amidst recent board changes.

- Get an in-depth perspective on Sipai Health Technology's performance by reading our balance sheet health report here.

- Understand Sipai Health Technology's earnings outlook by examining our growth report.

Adicon Holdings (SEHK:9860)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Adicon Holdings Limited is an investment holding company that offers medical testing services in the People’s Republic of China, with a market cap of HK$3.20 billion.

Operations: The company's revenue is primarily derived from its Healthcare Facilities & Services segment, totaling CN¥2.72 billion.

Market Cap: HK$3.2B

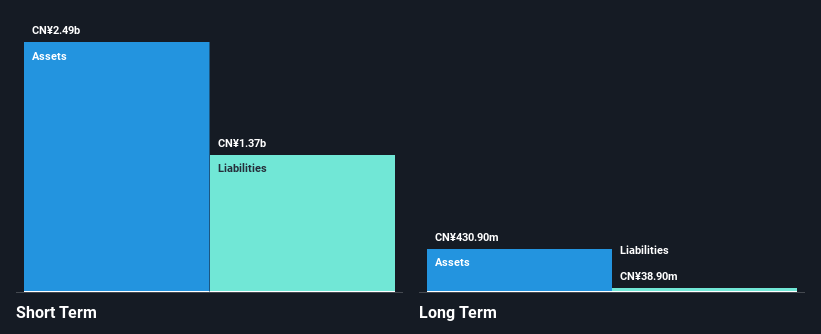

Adicon Holdings, with a market cap of HK$3.20 billion, derives its CN¥2.72 billion revenue from healthcare services in China. Despite being unprofitable and experiencing increased losses over the past five years, it maintains stable weekly volatility at 6% and has a satisfactory net debt to equity ratio of 32.5%. The company’s short-term assets (CN¥2.9 billion) exceed both short-term liabilities (CN¥1.9 billion) and long-term liabilities (CN¥865.8 million). Although Mr. Zhu Jonathan resigned from the board recently, Adicon's management team remains experienced with an average tenure of 4.2 years, supporting potential strategic initiatives moving forward.

- Navigate through the intricacies of Adicon Holdings with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Adicon Holdings' future.

Turning Ideas Into Actions

- Dive into all 958 of the Asian Penny Stocks we have identified here.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 29 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报