Asian Dividend Stocks: Yagami And 2 Top Picks For Income

As the Asian markets navigate a mixed economic landscape, with Japan experiencing a slight decline and China showing modest improvement in manufacturing, investors are increasingly seeking stable income opportunities through dividend stocks. In this environment, selecting stocks that offer consistent dividends can provide a reliable income stream amidst market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.61% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.35% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.21% | ★★★★★★ |

| NCD (TSE:4783) | 3.60% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.86% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.63% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.48% | ★★★★★★ |

Click here to see the full list of 994 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

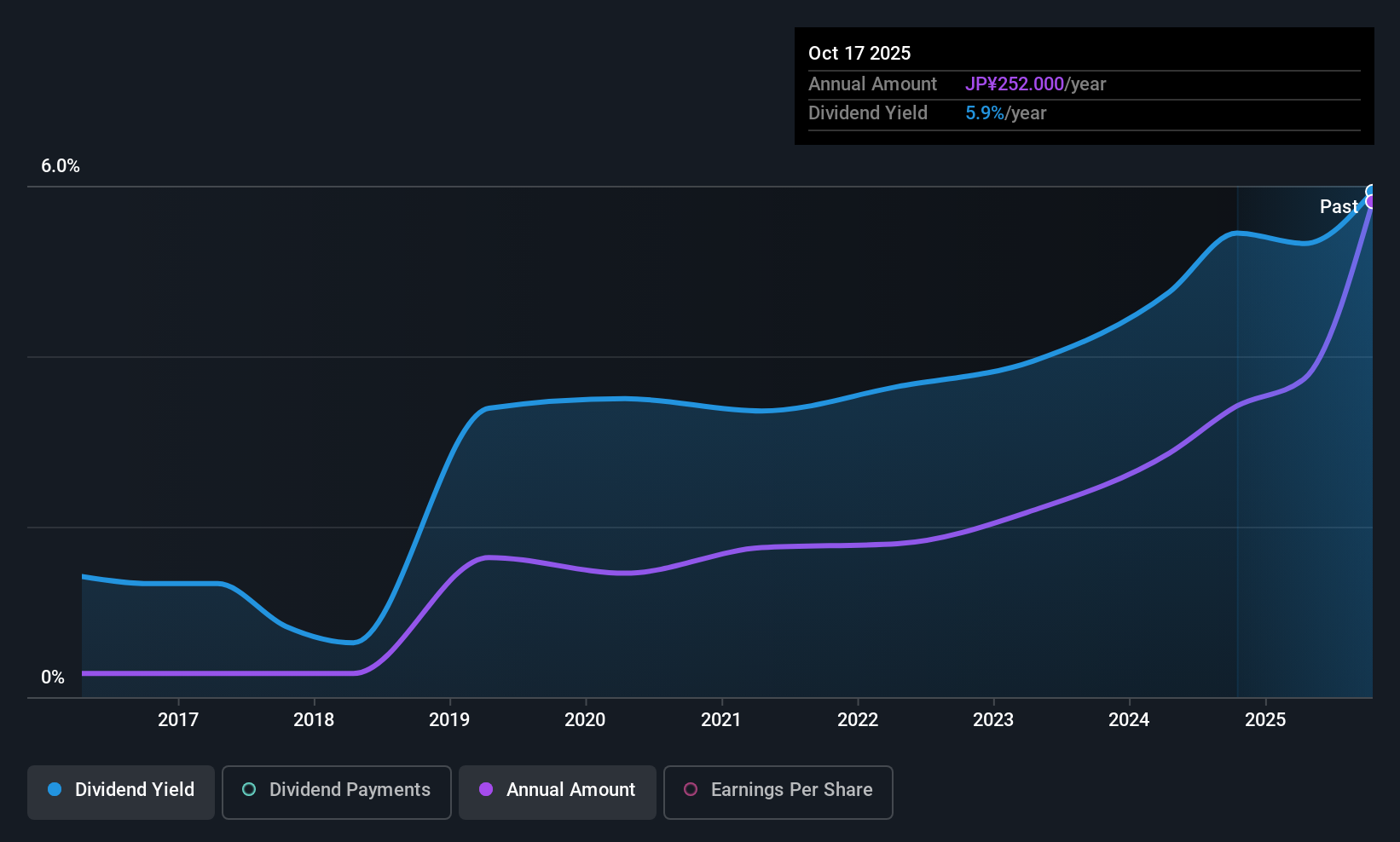

Yagami (NSE:7488)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yagami Inc. is a specialized trading company focusing on the educational market in Japan, China, and internationally, with a market cap of ¥25.78 billion.

Operations: Yagami Inc.'s revenue is derived from its operations in Industrial Equipment (¥2.73 billion), Scientific Equipment (¥5.53 billion), and Health and Medical Equipment (¥2.78 billion).

Dividend Yield: 5.8%

Yagami's dividends have grown steadily over the past decade, maintaining reliability with minimal volatility. Despite a strong dividend yield of 5.78%, placing it in the top quartile of Japanese dividend payers, sustainability is a concern due to high cash payout ratios (141.9%) and earnings coverage issues. While dividends are covered by earnings at an 86% payout ratio, they are not well-supported by free cash flow, raising questions about long-term viability.

- Click here to discover the nuances of Yagami with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Yagami's share price might be too optimistic.

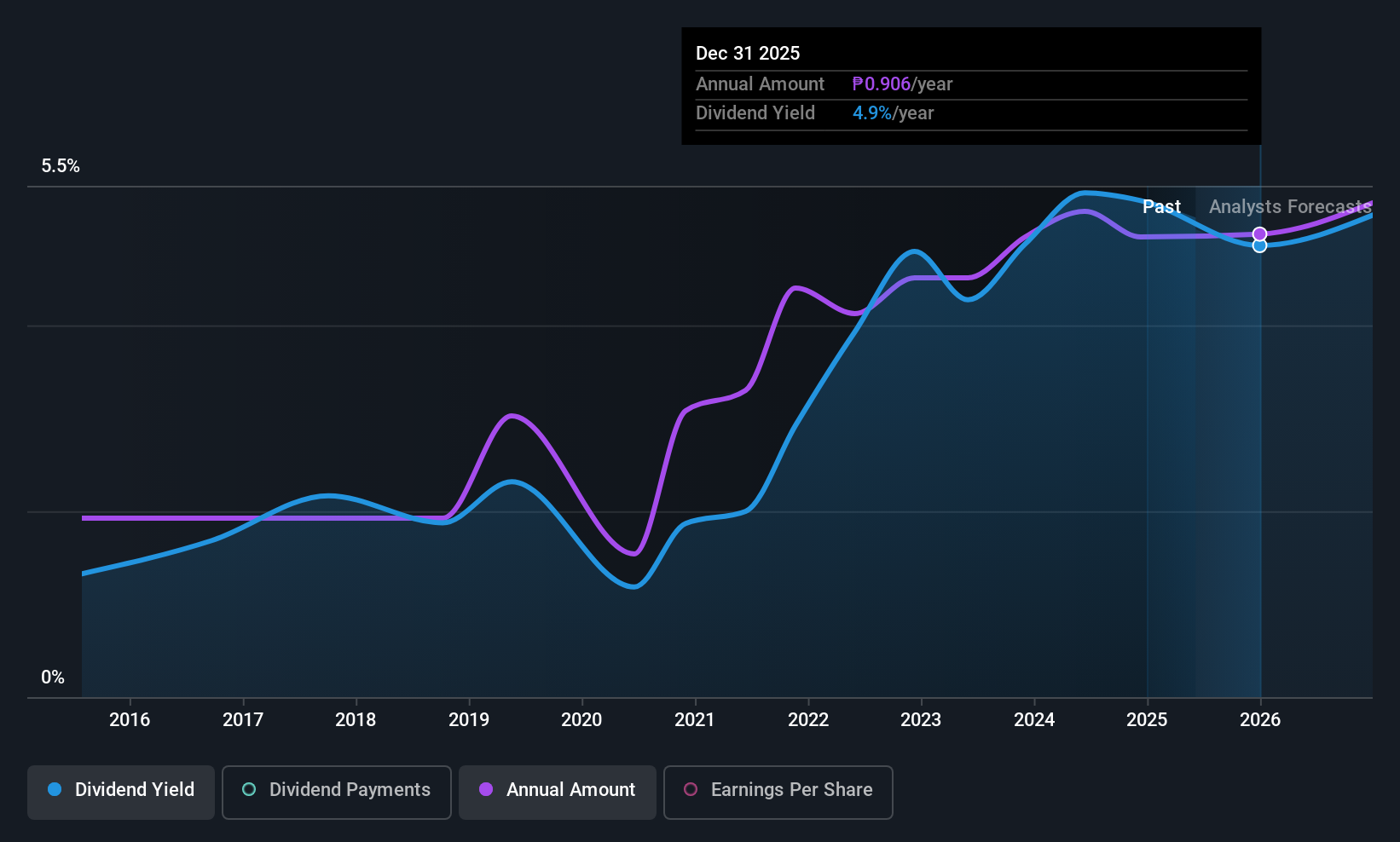

First Gen (PSE:FGEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Gen Corporation, with a market cap of ₱68.48 billion, operates in the power generation sector in the Philippines through its subsidiaries.

Operations: First Gen Corporation's revenue primarily comes from its subsidiaries, with significant contributions of $0.46 billion from FGP Corp., $0.90 billion from First Gas Power Corporation, $0.75 billion from Energy Development Corporation and its subsidiaries, and $0.09 billion from First Gen Hydro Power Corporation & Fresh River Lakes Corporation, alongside a smaller contribution of $0.07 billion from First Natgas Power Corp.

Dividend Yield: 4.2%

First Gen Corporation's dividend payments have been volatile over the past decade, with recent decreases highlighting instability. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 18.6% and 16.8%, respectively. The current dividend yield of 4.2% is lower than top-tier payers in the Philippines market but still represents a reasonable return given its low price-to-earnings ratio of 4.4x compared to the broader market's 9x.

- Take a closer look at First Gen's potential here in our dividend report.

- Our valuation report unveils the possibility First Gen's shares may be trading at a discount.

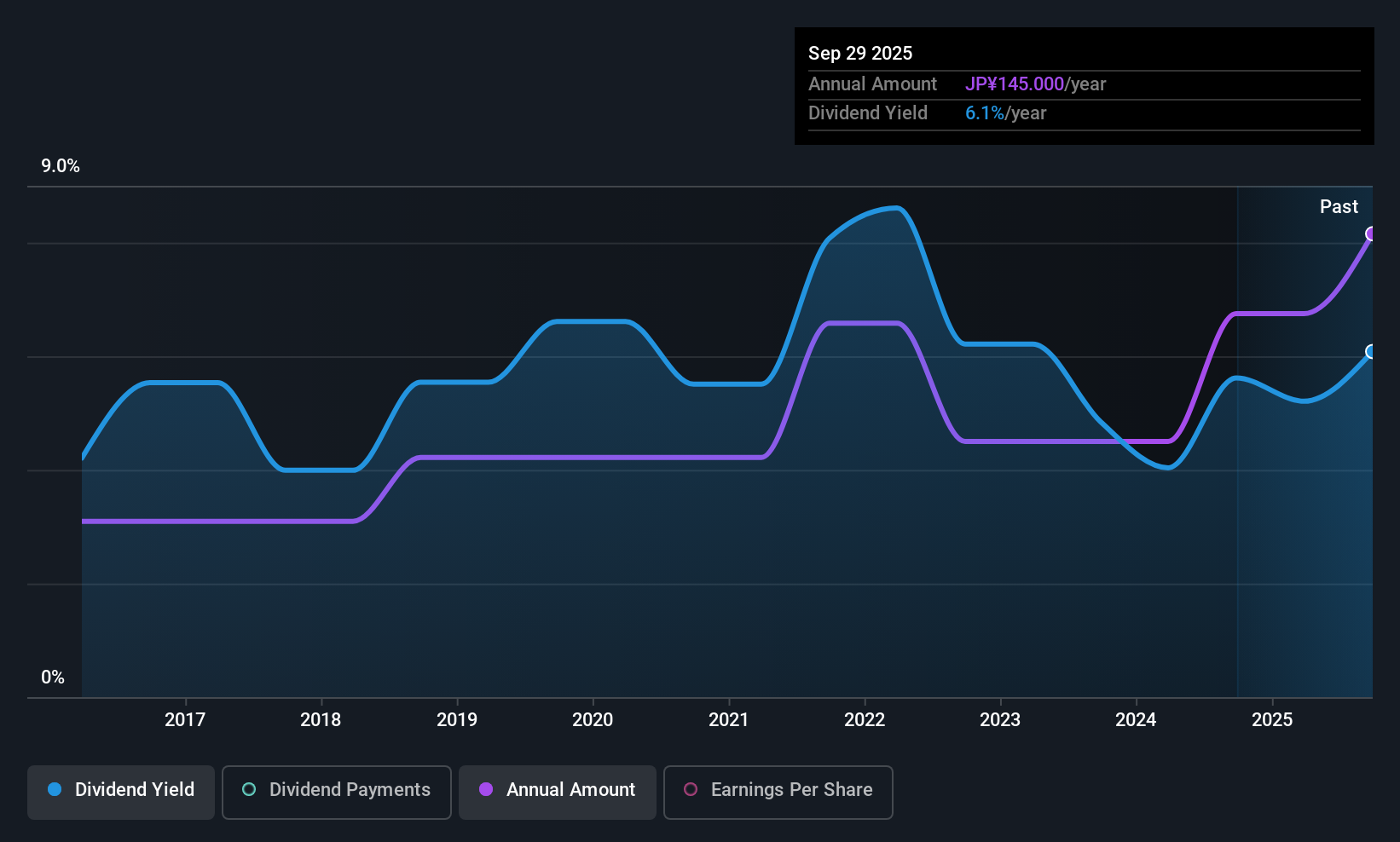

IwaiCosmo Holdings (TSE:8707)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IwaiCosmo Holdings, Inc., along with its subsidiaries, offers financial services utilizing information technology in Japan and has a market cap of ¥82.21 billion.

Operations: IwaiCosmo Holdings, Inc., through its subsidiaries, generates revenue primarily from Iwai Cosmo Securities Co., Ltd. with ¥27.39 billion and Iwai Cosmo Holdings Co., Ltd. with ¥3.36 billion in Japan.

Dividend Yield: 5.3%

IwaiCosmo Holdings recently announced a significant dividend increase to JPY 60 per share, up from JPY 20 last year, highlighting its commitment to returning value to shareholders. However, the company's dividends have been volatile over the past decade and are not well covered by free cash flow due to a high cash payout ratio of 173.1%. Despite this volatility, earnings cover dividend payments with a reasonable payout ratio of 53.3%, and the stock offers an attractive yield of 5.29%, among the top in Japan's market.

- Get an in-depth perspective on IwaiCosmo Holdings' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that IwaiCosmo Holdings is trading behind its estimated value.

Taking Advantage

- Unlock our comprehensive list of 994 Top Asian Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报