A Look At Louisiana-Pacific (LPX) Valuation After Recent Share Price Weakness

Event context and recent stock move

Louisiana-Pacific (LPX) shares have recently been under pressure, with the stock showing negative moves over the past week, month and past 3 months. This has prompted investors to reassess what the current price may already reflect.

At a last close of US$79.15, Louisiana-Pacific’s recent one day return of about a 0.1% decline, a 2% decline over the past week and a 6% decline over the month sit alongside a negative total return over the past year.

See our latest analysis for Louisiana-Pacific.

The recent 1 day share price return of a 7% decline, alongside a 12.15% share price return decline over 90 days and a 24.8% negative total shareholder return over 1 year, suggests momentum has been fading despite a 122.3% total shareholder return over 5 years, as the market reassesses Louisiana-Pacific’s growth potential and risk profile.

If recent weakness in building products has you rethinking your ideas, it could be a good moment to broaden your search through fast growing stocks with high insider ownership.

With LPX down over the past year but still showing a 5 year total return above 100%, and trading below analysts’ average price target, you have to ask: is this weakness an opportunity, or is future growth already priced in?

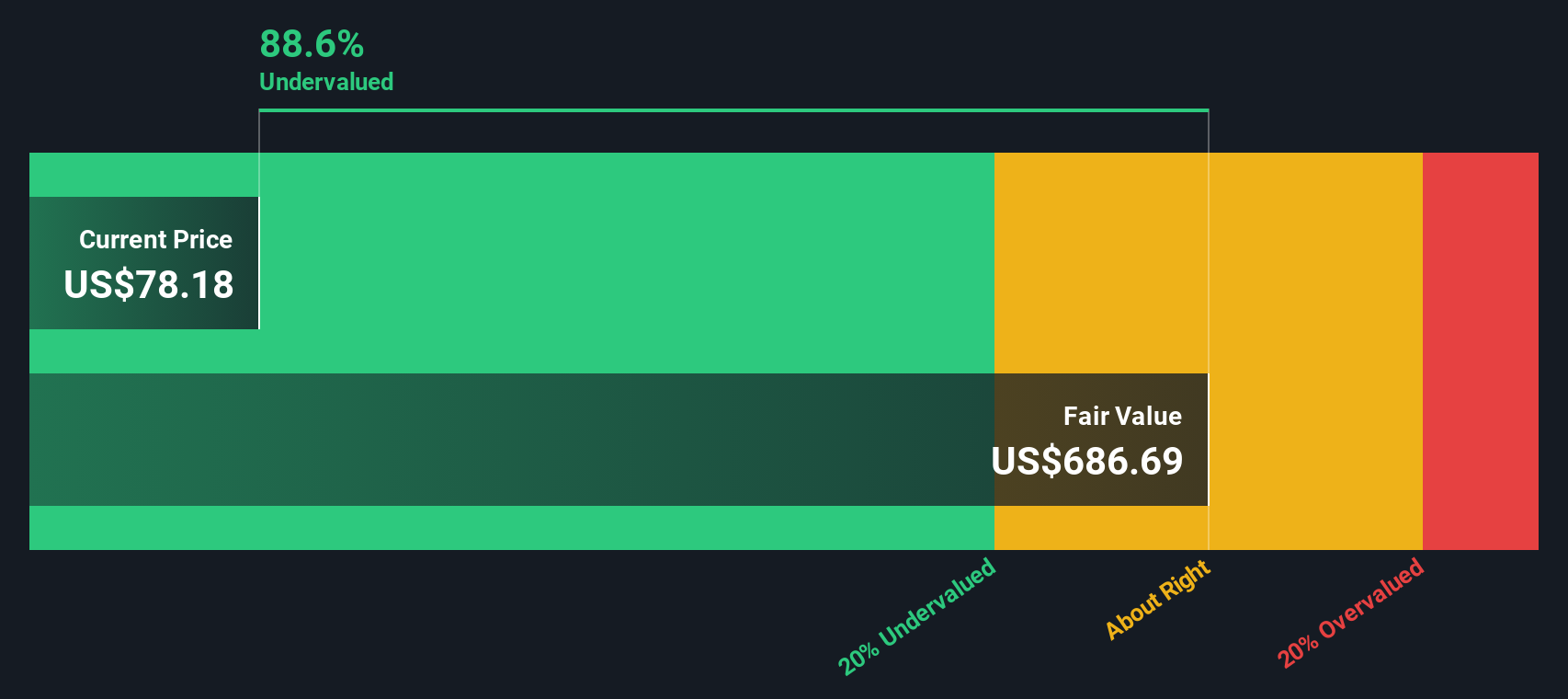

Most Popular Narrative: 25.2% Undervalued

With Louisiana-Pacific last closing at US$79.15 and the most followed narrative suggesting fair value near US$105.88, the gap between price and narrative valuation is clear and hard to ignore.

Ongoing investments in mill automation, process efficiency, and disciplined cost controls, especially during cyclical weakness in OSB, position LP to expand margins and earnings as capacity utilization increases and the overall demand environment normalizes.

Curious how a modest revenue outlook can still support a much higher value? The narrative leans heavily on richer margins and a future earnings multiple that is closer to premium industrial names than traditional building products. Want to see which earnings and margin assumptions have to line up to justify that view?

Result: Fair Value of $105.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could easily be challenged if housing starts stay weak for longer or if OSB pricing and volumes remain under pressure for an extended period.

Find out about the key risks to this Louisiana-Pacific narrative.

Another View: Market Multiple Sends a Different Signal

Our DCF-based fair value of US$25.92 paints a very different picture to the US$105.88 narrative estimate, with the SWS DCF model suggesting Louisiana-Pacific is overvalued at the current US$79.15 share price. When two methods point in opposite directions like this, which one earns more of your trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Louisiana-Pacific Narrative

If you prefer to evaluate the numbers yourself and reach your own conclusion, you can build a tailored LPX story in just a few minutes by starting with Do it your way.

A great starting point for your Louisiana-Pacific research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If LPX has sharpened your thinking, do not stop here. The simplest way to pressure test your next move is to line up fresh ideas side by side.

- Target potential bargains by focusing on these 885 undervalued stocks based on cash flows that the market may be pricing cautiously compared to their cash flow profiles.

- Ride powerful tech trends by zeroing in on these 26 AI penny stocks at the intersection of artificial intelligence and real revenue potential.

- Strengthen your income stream by filtering for these 12 dividend stocks with yields > 3% that could complement growth focused positions in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报