Is Bitmine Immersion Technologies (BMNR) Pricing Make Sense After 406% One-Year Surge

- If you are wondering whether Bitmine Immersion Technologies' current share price lines up with its underlying value, you are not alone.

- The stock last closed at US$30.36, with returns of 11.8% over the past 7 days, a 15.3% decline over 30 days, a 2.7% decline year to date, a 406.1% gain over 1 year, a 116.9% gain over 3 years, and a 60.0% decline over 5 years. This points to a very mixed recent experience for shareholders.

- Recent coverage around Bitmine Immersion Technologies has focused on its position within software and related technologies, along with shifting sentiment toward companies in this space. These themes help frame why the share price has seen sharp moves over shorter periods alongside very large gains over the last year.

- Right now, our valuation framework gives Bitmine Immersion Technologies a value score of 0 out of 6, which suggests the usual checks do not yet flag the stock as undervalued. Next, we will walk through different valuation approaches and finish with a broader way to think about what the current price might really be telling you.

Bitmine Immersion Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bitmine Immersion Technologies Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a share could be worth by projecting all future dividends per share and discounting them back to today. It is most informative when dividends are both meaningful and well supported by earnings.

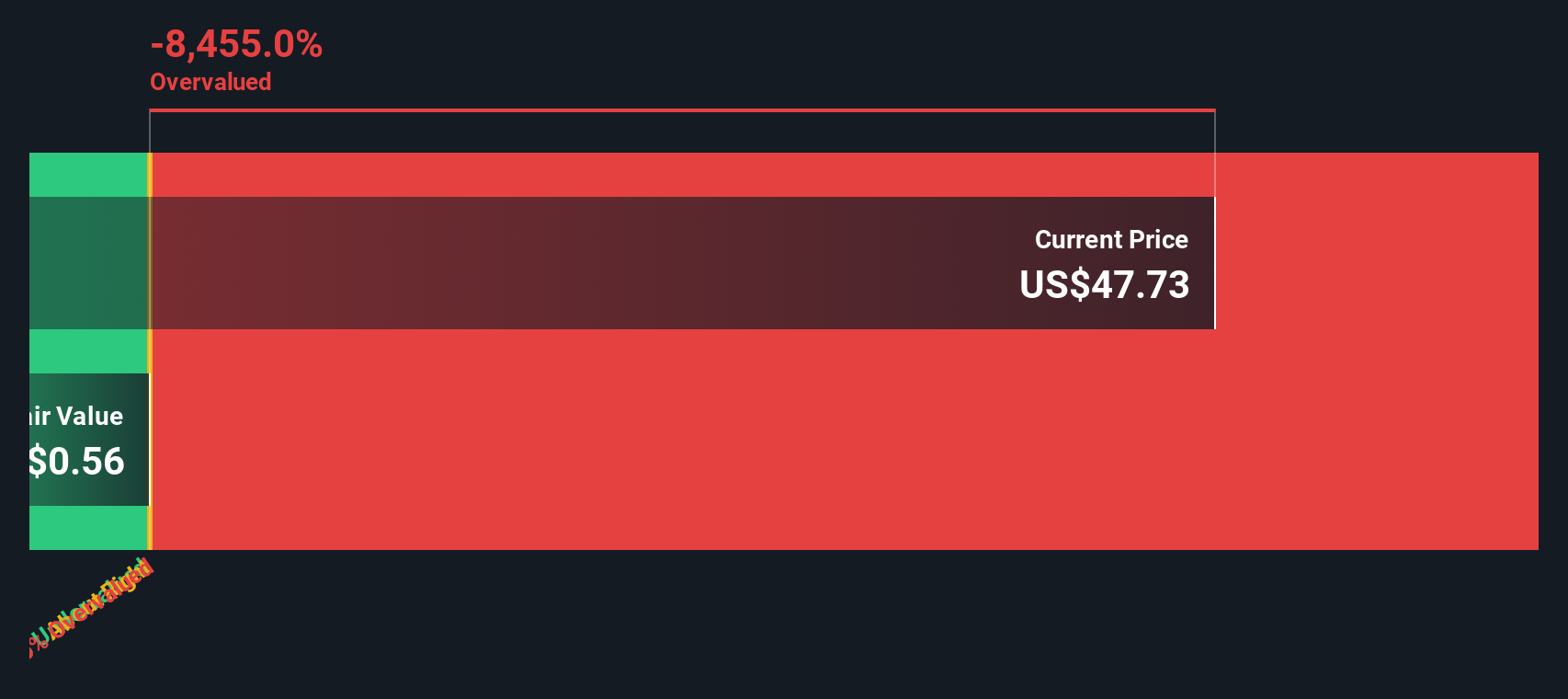

For Bitmine Immersion Technologies, the DDM uses a current annual dividend per share of US$0.01 and assumes a 3.26% dividend growth rate, based on the risk free rate. At the same time, the company records a return on equity of 52.19% in the red, which raises questions about how sustainable any ongoing dividends might be without stronger underlying profitability.

Putting these inputs together, the model arrives at an estimated intrinsic value of about US$0.18 per share. When this is compared with the recent share price of US$30.36, this framework implies the stock is very significantly above the level suggested by the dividend stream alone, with the DDM indicating it is very substantially overvalued.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Bitmine Immersion Technologies may be overvalued by 17116.0%. Discover 885 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Bitmine Immersion Technologies Price vs Earnings

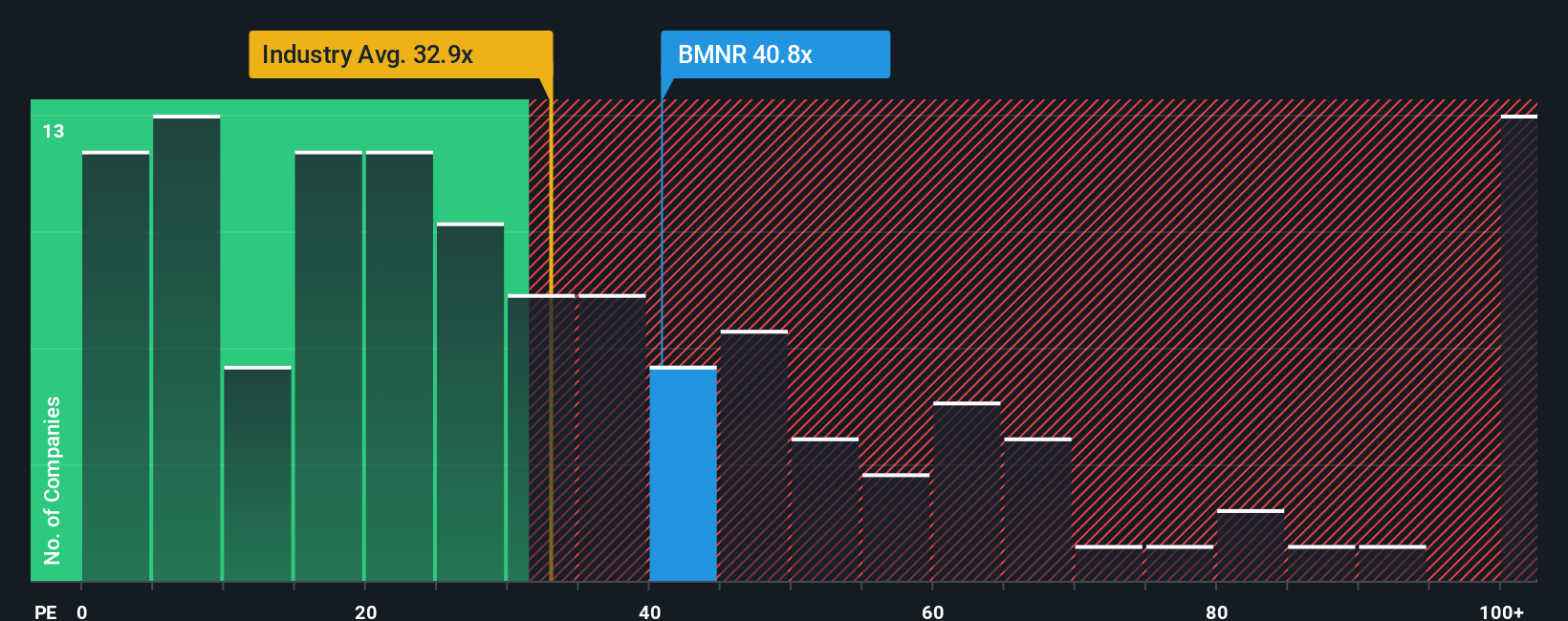

For companies that are generating earnings, the P/E ratio is a straightforward way to see how much you are paying for each dollar of profit. A higher P/E often reflects stronger growth expectations or a lower perception of risk, while a lower P/E can point to weaker growth expectations or higher risk.

Bitmine Immersion Technologies currently trades on a P/E of 39.40x. That sits above the broader Software industry average P/E of 32.68x and also above the selected peer group average of 18.41x. On simple comparisons, the stock is priced more expensively than both its sector and peers.

Simply Wall St’s Fair Ratio concept goes a step further than these basic benchmarks. It estimates what a more tailored P/E might look like for Bitmine Immersion Technologies given factors such as its earnings profile, industry, profit margins, size and specific risks. Because it adjusts for these company level characteristics, the Fair Ratio can provide a more tailored anchor than a blunt peer or industry comparison, which may include businesses with very different growth outlooks or risk profiles. Here, the Fair Ratio is not provided, so it is not possible to directly compare it with the current 39.40x P/E or judge whether that level looks high, low or broadly in line with this framework.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1449 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bitmine Immersion Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which Simply Wall St hosts on the Community page used by millions of investors.

A Narrative is your clear, written story for a company, where you set out what you think its future revenue, earnings and margins could look like, then link that story to a financial forecast and a fair value estimate.

Instead of looking at the P/E or a single model in isolation, Narratives help you compare your own fair value with the current market price and decide whether the gap between the two is big enough for you to consider buying or selling.

Because Narratives on Simply Wall St are connected directly to live data, your story and fair value are refreshed when new information like earnings reports or major news is added.

For Bitmine Immersion Technologies, one investor might build a very optimistic Narrative that assumes strong revenue growth and high margins that support a fair value well above US$30.36. Another might create a cautious Narrative with modest growth and lower margins that imply a fair value closer to the DDM estimate of about US$0.18.

Do you think there's more to the story for Bitmine Immersion Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报