Texas Capital Bancshares (TCBI) Valuation Check After Recent Share Price Momentum

Texas Capital Bancshares (TCBI) is back in focus after recent share price moves, with the stock closing at $95.41 as investors reassess its value using the latest financial and return figures.

See our latest analysis for Texas Capital Bancshares.

The recent move to $95.41 comes after a 5.38% 7 day share price return and a 12.12% 90 day share price return. The 1 year total shareholder return of 24.49% and 3 year total shareholder return of 53.29% point to momentum that has been building rather than fading.

If Texas focused banking is already on your radar, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership for other potential ideas.

With TCBI trading at $95.41, only about 2% below the average analyst price target yet showing an estimated 31% discount to intrinsic value, investors may ask whether there is still an opportunity here or whether the market has already priced in future growth.

Most Popular Narrative: 0% Overvalued

The most followed narrative puts Texas Capital Bancshares' fair value at about $95.36 per share, almost identical to the recent $95.41 close, which makes its underlying assumptions worth a closer look.

The ongoing build-out of fee-based businesses such as investment banking, trading, and treasury products is rapidly growing non-interest income streams, making overall earnings more resilient and scalable. Early success in cross-selling wealth management and other alternative investment solutions to newly-acquired high-quality commercial clients is anticipated to increase non-interest revenue and further deepen client relationships, which can smooth earnings through economic cycles.

Curious how this fair value hangs together when earnings, margins, and valuation multiples are all shifting at once? The full narrative lays out a detailed earnings ramp, a firm view on future profitability, and the exact valuation multiple it thinks the market could settle on. If you want to see how those moving parts combine to justify a price right around today’s level, the complete story is worth a read.

Result: Fair Value of $95.36 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if Texas-focused credit pressures pick up or if rising tech and compliance spending weighs more heavily on margins than expected.

Find out about the key risks to this Texas Capital Bancshares narrative.

Another View: Market Ratios Tell a Different Story

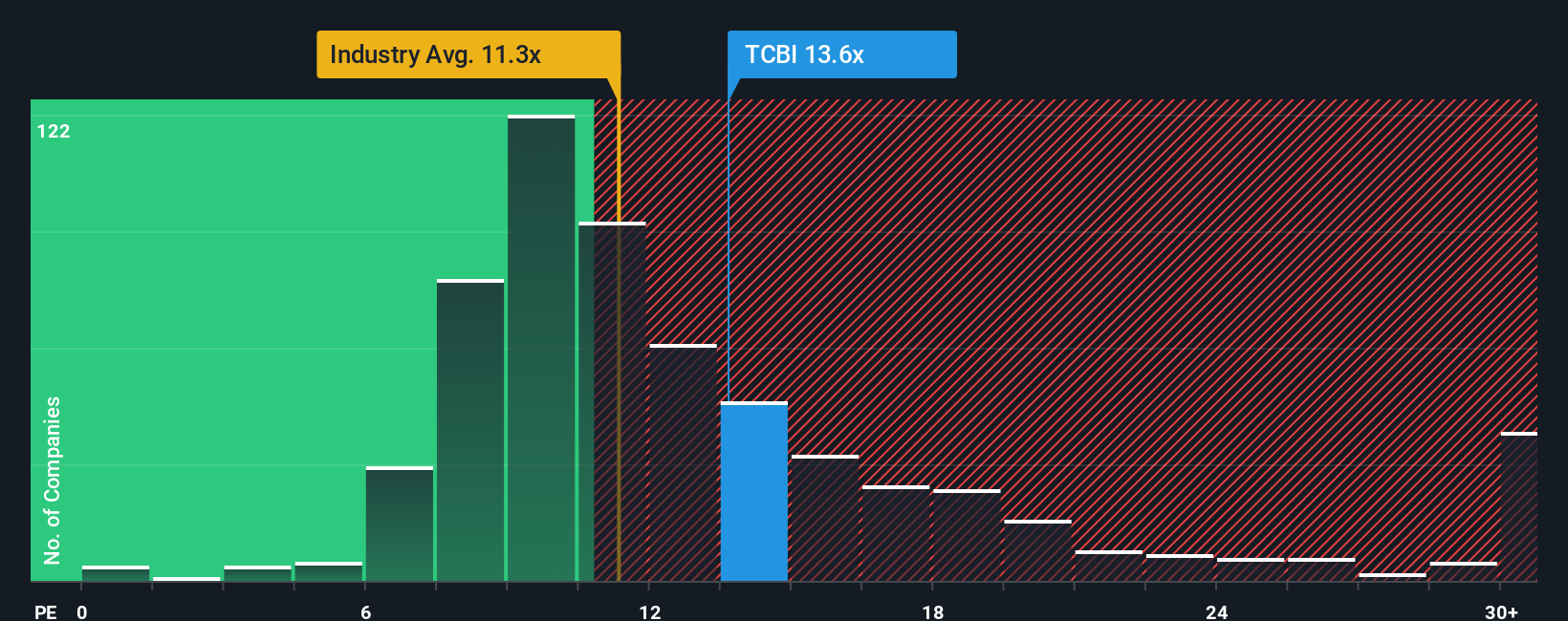

Our SWS DCF model puts Texas Capital Bancshares at a 31.5% discount to fair value. However, the current P/E of 15.4x looks expensive next to the US Banks industry average of 11.9x and a fair ratio of 13x. Is this a genuine gap, or simply valuation risk building?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Texas Capital Bancshares Narrative

If you read this and think the assumptions feel off, or simply prefer testing your own inputs and views, you can build a custom valuation narrative in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Texas Capital Bancshares.

Looking for more investment ideas?

If Texas Capital Bancshares has caught your attention, do not stop here. Broaden your opportunity set with a few focused stock ideas built from clear, data driven screens.

- Spot early stage potential by scanning these 3553 penny stocks with strong financials that already show stronger financial foundations than many of their peers.

- Tap into long term technology shifts through these 26 AI penny stocks targeting companies tied to artificial intelligence themes.

- Zero in on price mismatches using these 885 undervalued stocks based on cash flows that highlight stocks priced below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报