YAKUODO HOLDINGS (TSE:7679) Q3 EPS Drop Tests Defensive Drugstore Growth Narrative

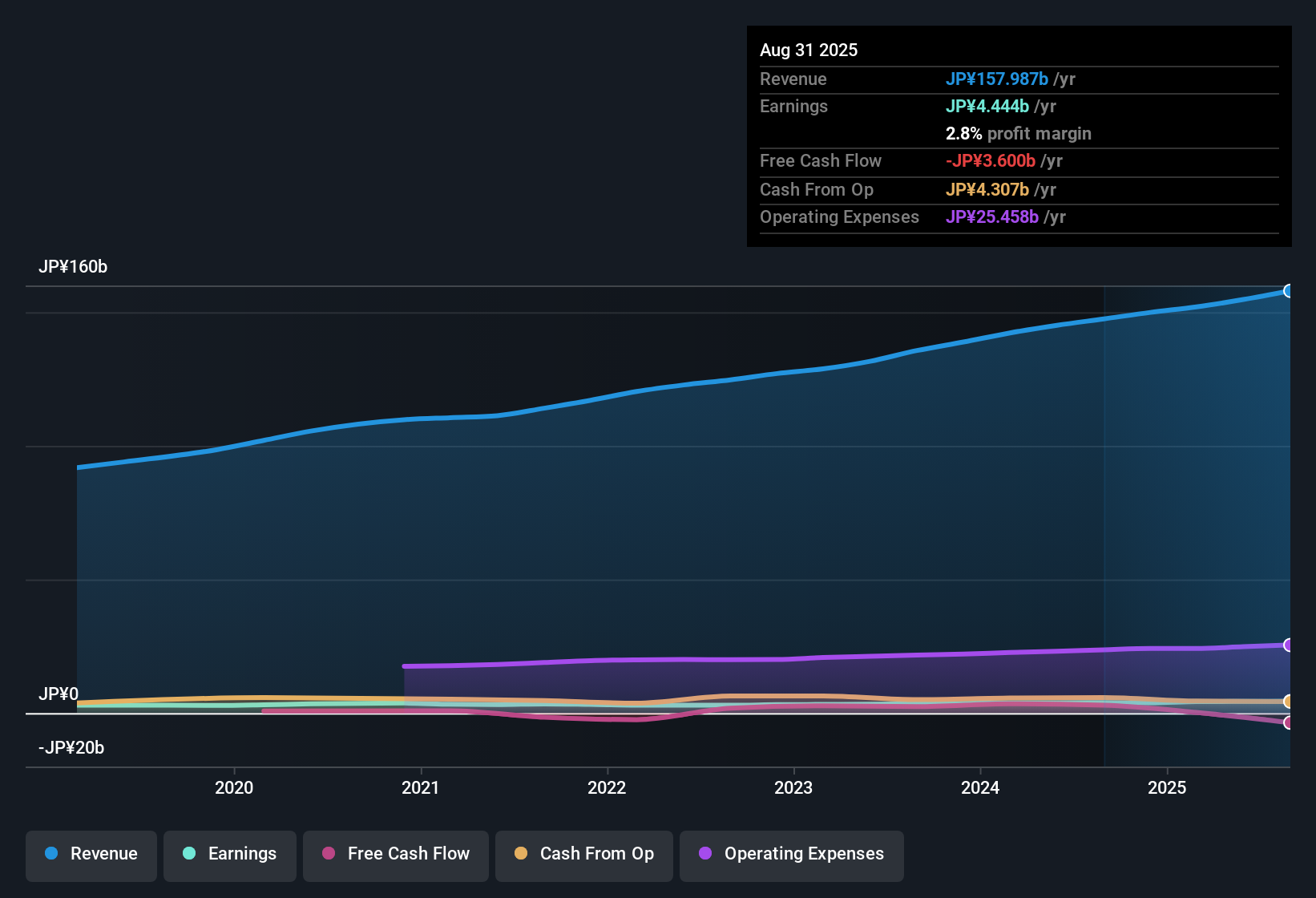

YAKUODO HOLDINGS (TSE:7679) has released its Q3 2026 numbers, with revenue at ¥40.8b and basic EPS of ¥44.06, set against trailing 12 month EPS growth of 11.3% and five year annualized EPS growth of 6.9%. The company has seen revenue move from ¥37.7b in Q3 2025 to ¥40.8b in Q3 2026. Over the same period, quarterly basic EPS shifted from ¥51.80 to ¥44.06. Investors will be weighing these figures alongside a net profit margin that sits at 2.7% versus 2.6% a year earlier as they judge how resilient the earnings profile looks.

See our full analysis for YAKUODO HOLDINGS.With the headline results on the table, the next step is to see how these margins and earnings trends line up with the prevailing stories investors follow about the business, and where those narratives might be challenged by the latest data.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM EPS Growth Sets The Backdrop

- Over the last 12 months, basic EPS on a trailing basis is ¥219.31, with one year EPS growth of 11.3% and a five year annualized EPS growth rate of 6.9%, which frames how Q3 sits within a longer earnings run.

- What stands out for a bullish view is that this trailing growth record and the assessment of high quality earnings sit alongside a Q3 basic EPS of ¥44.06, which is lower than the ¥72.50 in Q2 2026. As a result:

- Supporters of a bullish angle can point to the 11.3% trailing EPS growth and ¥4.3b of trailing net income as evidence that the recent quarter is part of a broader, positive pattern rather than a one off data point.

- At the same time, critics of that bullish angle may highlight the step down from ¥72.50 to ¥44.06 within 2026 when they question how consistent that growth path looks from one quarter to the next.

Margins Hold Steady Around 2.7%

- Net profit margin for the trailing 12 months sits at 2.7%, slightly above the 2.6% reported a year earlier, and Q3 2026 net income of ¥857m compares with ¥1,416m in Q2 and ¥1,015m in Q3 2025, which shows how much of the recent profit comes through that modest margin level.

- What is interesting for a bullish style narrative built around defensive retail is that a 2.7% margin is relatively thin, yet it has held close to the prior 2.6%. In this context:

- Supporters of the bullish angle on a defensive drugstore model may see the steady 2.7% vs 2.6% margin, plus trailing revenue of ¥161.0b, as evidence that the business has been able to sustain profitability while operating across health, beauty and daily necessity categories.

- On the other side, anyone testing that bullish case could point out that the Q3 2026 net income of ¥857m is below the Q2 2026 figure of ¥1,416m, which suggests that even within a broadly steady margin range, earnings per quarter can move around and are worth tracking carefully.

P/E Discount Versus DCF Gap

- The shares trade on a trailing P/E of 9.5x, below the peer average of 14x, below the JP Consumer Retailing industry average of 13.5x, and below the cited broader market P/E of 14.6x, while the current share price of ¥2,102 is above a DCF fair value of ¥690.48.

- What is most debated in a more cautious, bearish leaning view is the tension between those low relative multiples and the DCF fair value. In this debate:

- Supporters of the bearish angle may focus on the gap between the ¥2,102 share price and the ¥690.48 DCF fair value, arguing that this model based approach suggests the stock trades above that intrinsic value estimate despite the low P/E.

- Investors who lean against a bearish stance might counter that the 9.5x P/E relative to 14x peers and 13.5x for the industry leaves room for different valuation frameworks to reach different conclusions even when they start from the same trailing EPS of ¥219.31.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on YAKUODO HOLDINGS's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

YAKUODO HOLDINGS shows thinner quarterly earnings with basic EPS moving from ¥72.50 in Q2 2026 to ¥44.06 in Q3 2026 despite relatively steady margins.

If that kind of uneven earnings path makes you cautious, you could instead look at companies with more consistent expansion. Consider checking out stable growth stocks screener (2144 results) today and compare options that aim for smoother performance through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报