Assessing Disco (TSE:6146) Valuation After Strong Capital Inflows And AI Supply Chain Tailwinds

Why Disco drew fresh capital on the Tokyo market

Disco (TSE:6146) saw a net inflow of ¥16.08b on 6 January, putting it alongside Toyota Motor and Mitsubishi UFJ Financial Group among the most heavily bought names on the TSE Main Market.

The move comes as investors focus on Disco’s role supplying precision cutting, grinding, and polishing systems to chip makers linked to AI, data centers, and advanced semiconductor manufacturing trends.

See our latest analysis for Disco.

The strong 7 day share price return of 15.57% and 30 day gain of 17.30%, alongside Disco’s prominent capital inflows, come after a more muted 90 day share price return of 3.61%. At the same time, the 1 year total shareholder return of 15.86% and very large 3 and 5 year total shareholder returns point to momentum that has been built over a longer horizon.

If Disco’s recent move has you looking across the chip supply chain, this could be a good moment to size up other high growth tech and AI stocks that are catching market interest.

With Disco’s shares already up strongly over the past year and trading above analysts’ average target, the key question now is whether the current price still leaves room for upside or if the market is already pricing in future growth.

Price-to-Earnings of 47.8x: Is it justified?

At a last close of ¥55,670, Disco is trading on a P/E of 47.8x, which places the shares at a clear premium to both peers and broader semiconductor names.

The P/E multiple tells you how much investors are paying today for each unit of current earnings, which is particularly watched for profitable chip equipment suppliers like Disco. A higher P/E usually reflects expectations for stronger earnings growth or a quality premium, rather than the current earnings level alone.

For Disco, earnings have been growing and are forecast to continue growing, yet the current 47.8x P/E sits well above the JP Semiconductor industry average of 22.5x and the peer average of 34.1x. It is also higher than an estimated fair P/E of 33.6x that our fair ratio work points to as a level the market could move toward if the premium were to compress.

Explore the SWS fair ratio for Disco

Result: Price-to-Earnings of 47.8x (OVERVALUED)

However, stretched expectations, a P/E well above industry averages, and a share price above analyst targets could unwind quickly if chip equipment demand or earnings forecasts disappoint.

Find out about the key risks to this Disco narrative.

Another view using our DCF model

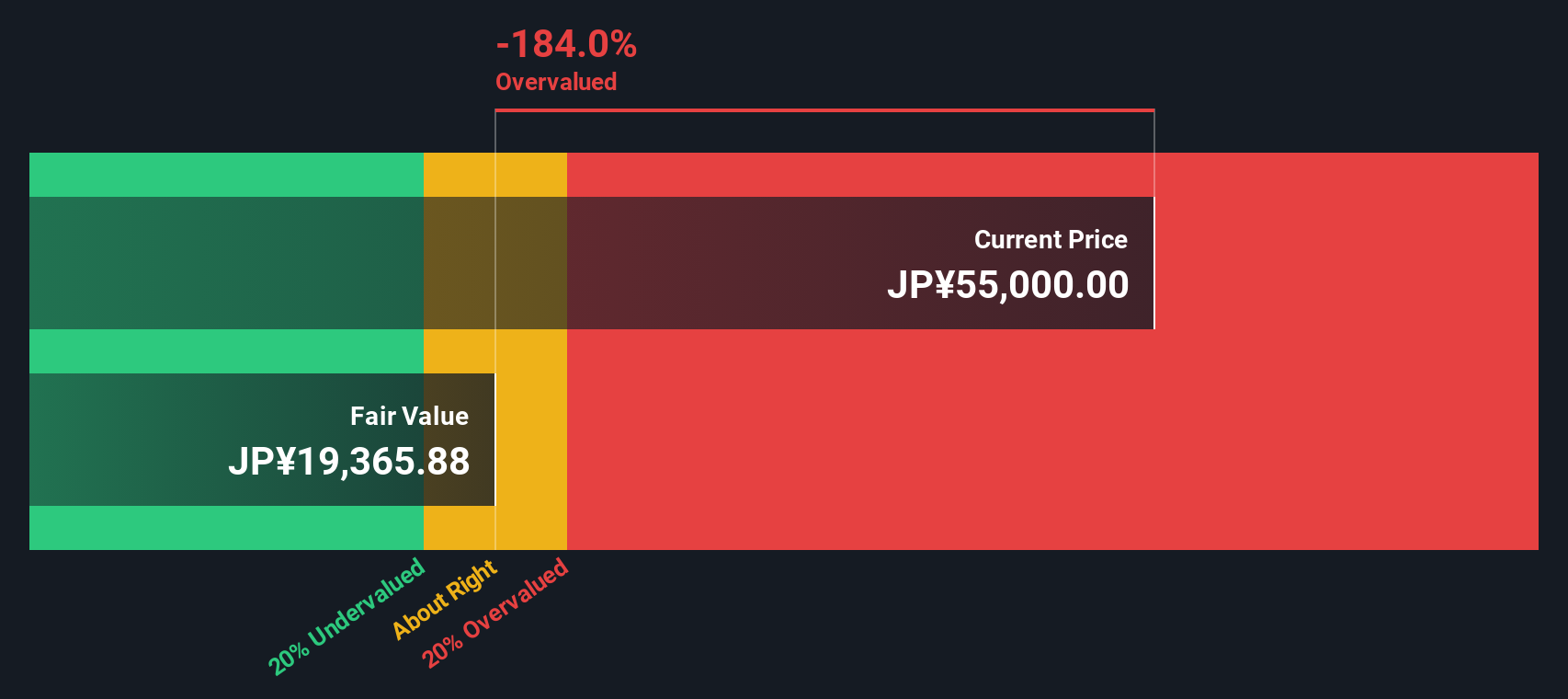

While the 47.8x P/E points to a rich price tag, our DCF model tells a different story. On that view, Disco at ¥55,670 sits well above an estimated fair value of ¥19,302.93. This suggests valuation risk if growth or margins fall short of what the market currently appears to expect.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Disco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Disco Narrative

If you see the numbers differently or prefer to test your own assumptions, you can shape a full Disco thesis in just a few minutes, starting with Do it your way.

A great starting point for your Disco research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas beyond Disco?

If Disco has sharpened your interest in semiconductor opportunities, do not stop here. Use the screener to uncover other names that might fit your portfolio goals.

- Spot potential mispricings early by scanning these 885 undervalued stocks based on cash flows that could offer more appealing entry points than the headline names everyone already watches.

- Explore opportunities related to machine learning and automation by checking out these 26 AI penny stocks that are building the tools and platforms behind next generation computing.

- Add extra income potential to your watchlist by reviewing these 12 dividend stocks with yields > 3% that combine regular payouts with listed equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报