Investing Legend Warren Buffett Made This Surprising Buy Before Retiring. Is This Stock Right for You?

Key Points

Warren Buffett recently retired as CEO of Berkshire Hathaway, after building a market-beating track record.

Buffett opened a new position in a tech giant in the third quarter of 2025.

Warren Buffett has held the spotlight on the investing stage for 60 years. That's because, at the helm of Berkshire Hathaway, he's helped drive market-beating returns over that time. We don't yet have the report for the 2025 full year, but over the previous 59 years, Berkshire Hathaway delivered a compounded annual gain of almost 20%. That's compared to about 10% for the S&P 500.

So it's no surprise that when Buffett speaks, investors listen -- and hope to gain some inspiration as they build their own portfolios. Buffett retired at the end of 2025, handing over his role of Berkshire Hathaway chief executive officer to Greg Abel, but before doing so, he made a surprising move. He bought shares of a company in an industry he doesn't often invest in: technology.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Could this tech player be right for you, too? Let's find out.

Image source: The Motley Fool.

Buffett's future plans

So, first of all, it's important to note that Buffett isn't completely disappearing from the investing scene. Though he's no longer CEO, he remains chairman of Berkshire Hathaway and even plans to go into the office regularly. So we still may hear more about investing from Buffett in the future.

In the meantime, we can consider his final moves as CEO of Berkshire Hathaway, in the third and fourth quarters of 2025. We don't yet have the report of his trades in the last period, so today, we'll look at the third quarter.

In that period, Buffett opened a new position in Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), buying 17,846,142 shares. It makes up 1.6% of his portfolio as the 10th biggest position.

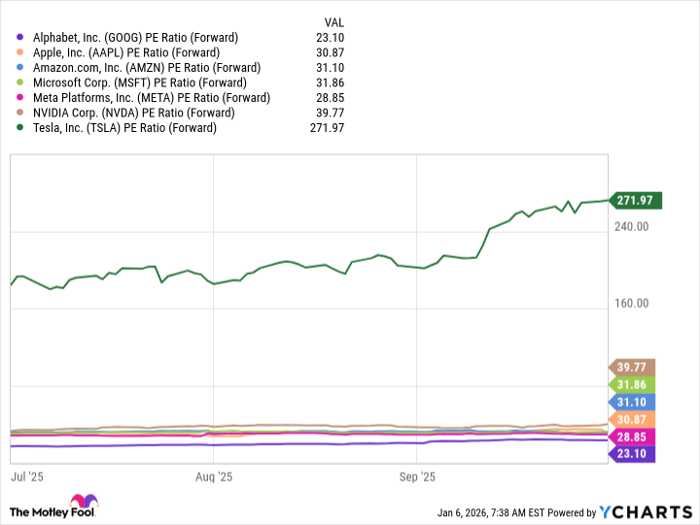

Though Buffett's largest position is in tech giant Apple, as mentioned, he doesn't typically invest in tech companies -- so the purchase of Alphabet is noteworthy. Still, Alphabet does fit in with Buffett's general investing principles. During the third quarter, it was the cheapest of the Magnificent Seven tech stocks that have led market gains in recent years. Buffett is known for scooping up quality stocks at bargain prices.

GOOG PE Ratio (Forward) data by YCharts

And even if we look at the stock alone, without comparing it to peers, at that level it was a bargain for a well-established tech player that also is well positioned to benefit from the AI boom.

A strong moat

That brings me to my next point. Buffett surely likes Alphabet for its moat, or competitive advantage that helps it maintain its leadership position. Here, I'm talking about Google Search. This search engine has long been No. 1 worldwide, with about 90% market share. People are used to "Googling" something they need to know, and this routine is unlikely to change.

Importantly, the Google platform drives Alphabet's revenue as advertisers come here to advertise their products and services. And this has resulted in a long track record of growth.

On top of this, Alphabet also may have a promising future in AI. The company has developed its own large language model, Gemini, that it's using internally to improve its advertising platform and offering to customers of its cloud business -- Google Cloud -- for their needs. Google Cloud also provides its customers with a broad range of AI products and services, and this is driving growth. In the latest quarter, Google Cloud's revenue jumped 34% to more than $15 billion. And overall revenue soared past $100 billion for the first time ever in a quarter.

Now, let's consider whether this surprising Buffett buy makes a good investment for you. As mentioned, Alphabet offers a well-established business and a solid moat -- elements that cautious investors like. And the company also is making strides in the high-growth area of AI, a market that's expected to reach into the trillions of dollars a few years down the road. This makes the stock a good fit for aggressive investors, too.

As for valuation, it's climbed since Buffett's purchase, but it's still reasonable at 28x forward earnings estimates. All of this means that one of Buffett's last decisions as CEO, the purchase of Alphabet, represents yet another smart move that you might follow -- whether you're a cautious or aggressive investor.

Adria Cimino has positions in Amazon and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nasdaq

Nasdaq 华尔街日报

华尔街日报