Unisem (M) Berhad's (KLSE:UNISEM) Popularity With Investors Is Clear

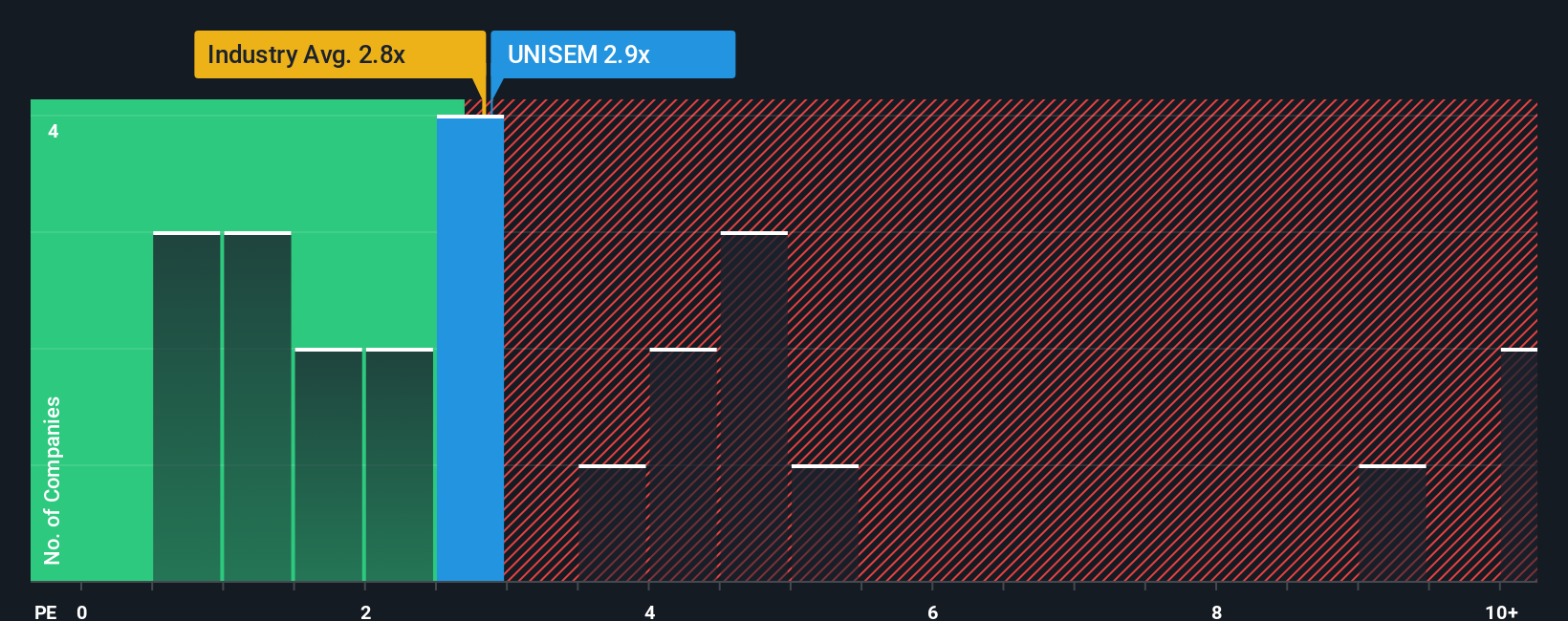

It's not a stretch to say that Unisem (M) Berhad's (KLSE:UNISEM) price-to-sales (or "P/S") ratio of 2.9x right now seems quite "middle-of-the-road" for companies in the Semiconductor industry in Malaysia, where the median P/S ratio is around 2.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Unisem (M) Berhad

What Does Unisem (M) Berhad's Recent Performance Look Like?

Unisem (M) Berhad's revenue growth of late has been pretty similar to most other companies. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. Those who are bullish on Unisem (M) Berhad will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Unisem (M) Berhad.Do Revenue Forecasts Match The P/S Ratio?

Unisem (M) Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 10% as estimated by the eight analysts watching the company. With the industry predicted to deliver 11% growth , the company is positioned for a comparable revenue result.

With this information, we can see why Unisem (M) Berhad is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Unisem (M) Berhad's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Unisem (M) Berhad's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Semiconductor industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Unisem (M) Berhad (1 is potentially serious!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报