GS Engineering & Construction Corporation's (KRX:006360) Shareholders Might Be Looking For Exit

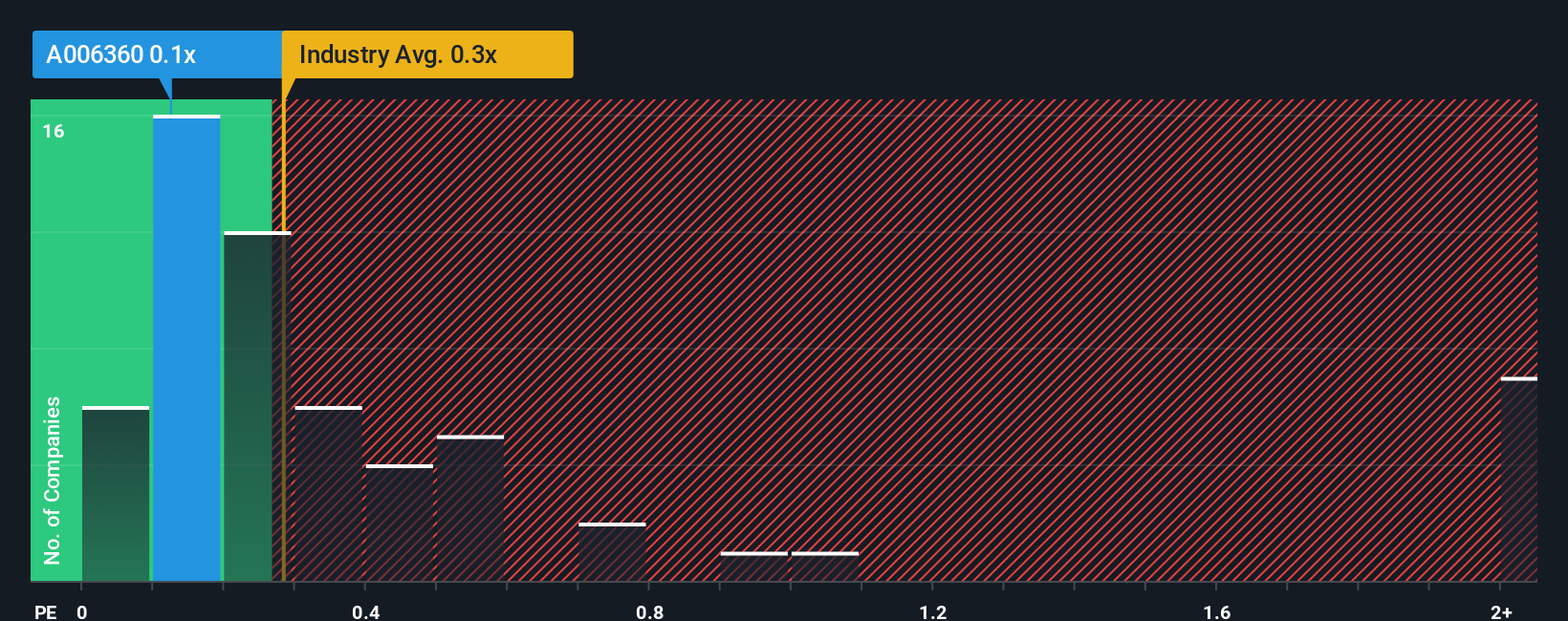

There wouldn't be many who think GS Engineering & Construction Corporation's (KRX:006360) price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S for the Construction industry in Korea is similar at about 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for GS Engineering & Construction

How GS Engineering & Construction Has Been Performing

Recent revenue growth for GS Engineering & Construction has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. Those who are bullish on GS Engineering & Construction will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on GS Engineering & Construction will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

GS Engineering & Construction's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Fortunately, a few good years before that means that it was still able to grow revenue by 17% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 1.9% as estimated by the analysts watching the company. Meanwhile, the broader industry is forecast to expand by 4.2%, which paints a poor picture.

With this information, we find it concerning that GS Engineering & Construction is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

While GS Engineering & Construction's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with GS Engineering & Construction, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报