Toronto Dominion Bank (TSX:TD) Valuation Check As New Funding Plans And CEO Conference Spotlight Draw Interest

Toronto-Dominion Bank (TSX:TD) is back in focus after announcing new fixed income offerings and confirming its CEO will speak at the RBC Capital Markets Canadian Bank CEO Conference, drawing fresh attention to the bank’s funding plans.

See our latest analysis for Toronto-Dominion Bank.

These funding moves come after a strong run in the shares, with a 16.4% 90 day share price return and a 1 year total shareholder return of 74.5%. This suggests momentum has been building as investors reassess risk and income prospects.

If TD’s recent funding and conference spotlight has you rethinking your financials exposure, it could be a good time to broaden your search with fast growing stocks with high insider ownership.

TD’s shares have surged; however, the current price still sits at a reported 23% discount to one estimate of intrinsic value, while trading slightly above the average analyst target. Is this a genuine opportunity, or is future growth already priced in?

Most Popular Narrative: 2.2% Overvalued

At a last close of CA$130.73 versus a most-followed fair value estimate of about CA$127.87, the narrative currently sees TD as slightly ahead of fundamentals, with the difference coming from how future earnings power is modeled.

Strong revenue growth, digital innovation, strategic restructuring, and diversified operations position TD for sustained profitability and shareholder returns in evolving financial markets. Catalysts About Toronto-Dominion Bank Provides various financial products and services in Canada, the United States, and internationally.

Curious what earnings path and profit margins back that valuation call, and why the assumed future P/E is lower than many peers? The full narrative spells out how revenue, margin shifts, and a specific discount rate are combined to reach its fair value.

Result: Fair Value of $127.87 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, steady demand across core Canadian, U.S., and wealth businesses, as well as faster progress on AI, digital, and cost cuts, could support higher revenue and margins than this cautious narrative assumes.

Find out about the key risks to this Toronto-Dominion Bank narrative.

Another View: Market Ratios Tell A Different Story

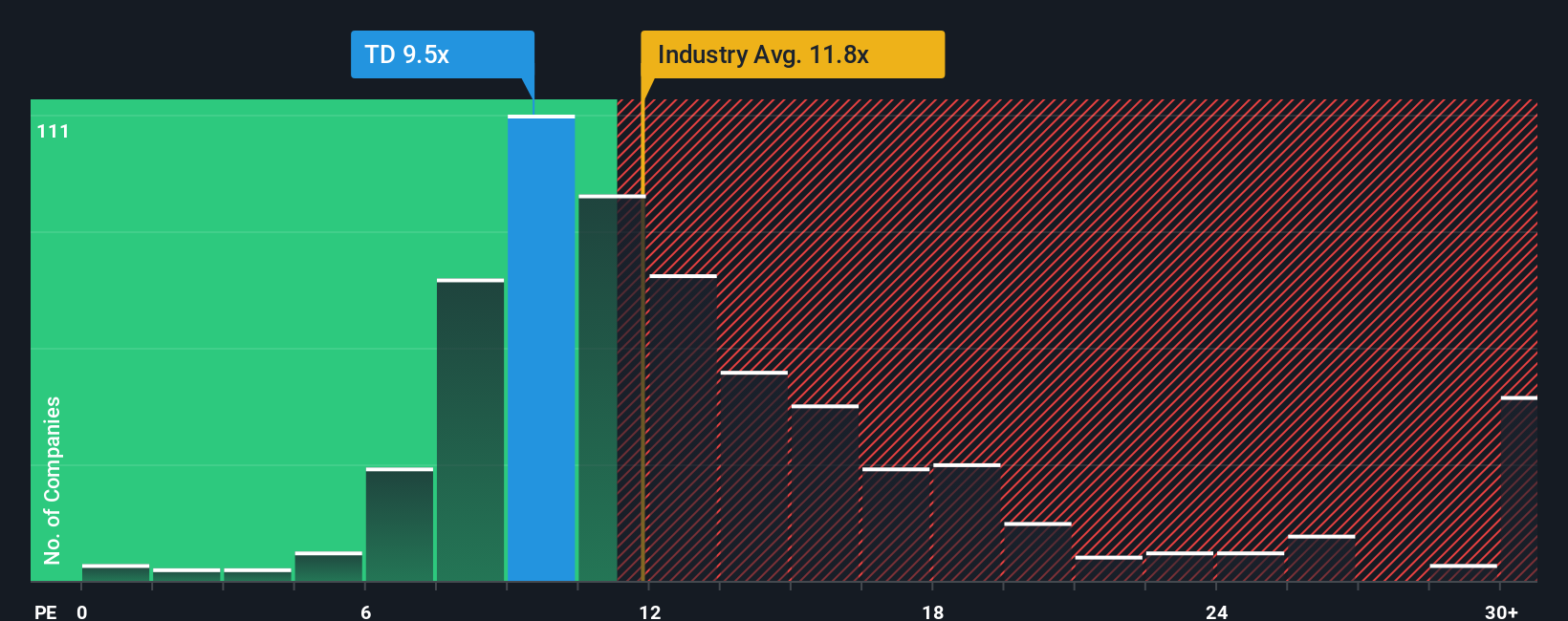

While the most-followed fair value estimate pegs Toronto-Dominion Bank as about 2.2% overvalued, the current P/E of 11.1x paints a different picture. It sits below the peer average of 16x, below the North American Banks industry at 12x, and below a fair ratio of 13.1x suggested by regression analysis.

That gap implies the market is pricing TD more cautiously than both its peers and the fair ratio the P/E could move toward, even after strong 1 year and 5 year total returns. Is that caution a sign of lingering risk, or room for sentiment to catch up if earnings hold up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toronto-Dominion Bank Narrative

If you feel these views do not quite fit your own, you can review the same data, shape your own story in minutes, and Do it your way.

A great starting point for your Toronto-Dominion Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If TD caught your attention, do not stop here. The market is full of other opportunities, and ignoring them could mean missing out on ideas that suit you better.

- Spot potential value opportunities early by reviewing these 877 undervalued stocks based on cash flows that may trade below what their cash flows suggest.

- Target income-focused opportunities by checking out these 11 dividend stocks with yields > 3% that offer meaningful yields supported by financial data.

- Get ahead of emerging themes by scanning these 79 cryptocurrency and blockchain stocks tied to blockchain and digital asset trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报