Klaviyo (KVYO) Valuation Check As Shares Trade Near US$29 With Mixed Returns And Revenue Growth

Klaviyo (KVYO) has been drawing investor interest as its shares trade around $29.04, with recent returns mixed over the past week, month, and past 3 months, and a sharply negative 1 year total return.

See our latest analysis for Klaviyo.

The latest move to around $29.04 comes after a 90 day share price return of 11.14%, while the 1 year total shareholder return of a 30.39% decline points to fading momentum despite earlier strength.

If Klaviyo’s recent swings have you reassessing your options, this could be a useful moment to size up other high growth tech and AI stocks that are catching investors’ attention.

With Klaviyo posting revenue growth of 16.25% alongside a net loss of US$65.77m, and trading around a 50% discount to the average analyst price target, is there genuine value here, or is the market already pricing in all the future growth?

Most Popular Narrative: 33.3% Undervalued

With Klaviyo last closing at US$29.04 against a narrative fair value of about US$43.52, the story centers on what needs to happen in the business to close that gap.

The rapid innovation and rollout of new AI first products including Conversational Agent, Helpdesk, and analytics expands Klaviyo's addressable market from just marketing automation into broader B2C CRM and customer service, setting up significant opportunities for higher ARPU and long term revenue growth. The trend of marketing stack consolidation, with brands seeking integrated platforms to unify data and automate consumer engagement across marketing and service, favors Klaviyo's data centric ecosystem, lowering customer churn and driving higher net margins through improved retention and cross sell opportunities.

Curious what kind of revenue path, margin shift, and future earnings multiple have to line up to justify that gap to fair value? The narrative spells out a very specific glide path for topline growth, the timing of a turn to profitability, and a future valuation multiple that sits well above a typical software peer. Want to see exactly which assumptions carry the most weight in that story?

Result: Fair Value of $43.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are clear pressure points, including potential gross margin strain from higher infrastructure and messaging costs, as well as tough competition from larger cloud suites and AI native marketing tools.

Find out about the key risks to this Klaviyo narrative.

Another View: Pricing Signals Look Less Generous

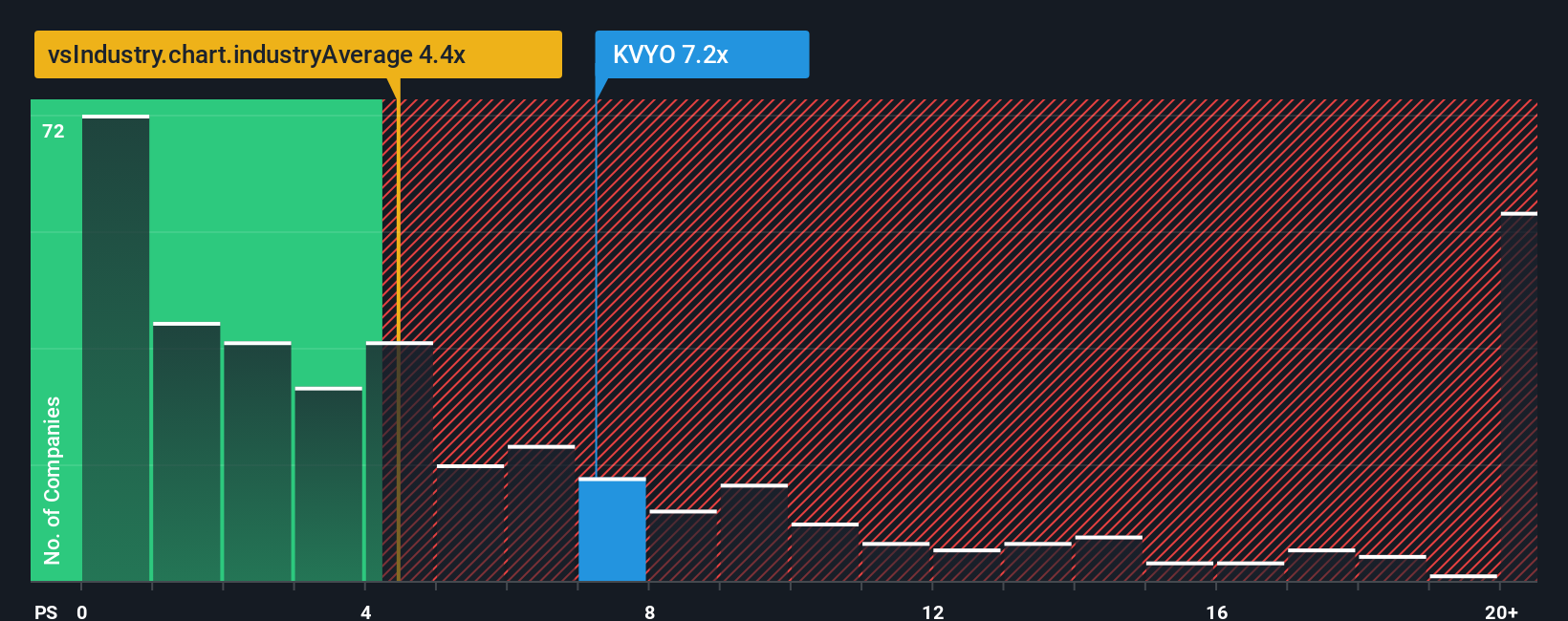

While the narrative fair value of about US$43.52 suggests Klaviyo may be undervalued, the current P/S of 7.6x tells a tighter story. It sits above the US Software industry at 4.8x and only slightly above a 7.5x fair ratio. This leaves limited room for error if growth or profitability expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Klaviyo Narrative

If you look at the numbers and reach a different conclusion, or prefer to shape your own view from scratch, you can build a full Klaviyo story in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Klaviyo.

Looking for more investment ideas?

If you are serious about upgrading your watchlist, do not stop at a single stock. Use the Simply Wall St Screener to surface fresh opportunities right now.

- Target potential value plays by reviewing these 877 undervalued stocks based on cash flows that align with your return expectations and risk comfort.

- Tap into future facing themes by scanning these 26 AI penny stocks that are tied to real business fundamentals, not just headlines.

- Boost your income focus by screening these 11 dividend stocks with yields > 3% that might help support a more reliable cash flow profile from your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报