Assessing ASML Holding (NasdaqGS:ASML) Valuation After Strong Recent Share Price Momentum

ASML Holding (NasdaqGS:ASML) has been drawing attention after a period of strong price moves, with the stock up over the past week, month and past 3 months, prompting investors to reassess its current valuation.

See our latest analysis for ASML Holding.

The recent rally sits on top of a longer stretch of strength, with the share price now at $1,242.19 and supported by a 65.3% 1 year total shareholder return and a 100.7% 3 year total shareholder return. This suggests momentum has been building rather than fading.

If ASML Holding has caught your eye, it can be helpful to see what else is moving in related areas of the market, starting with high growth tech and AI stocks.

With ASML Holding now trading around $1,242 and its recent shareholder returns in focus, investors are asking a key question: is the current price still leaving room for upside, or is the market already pricing in future growth?

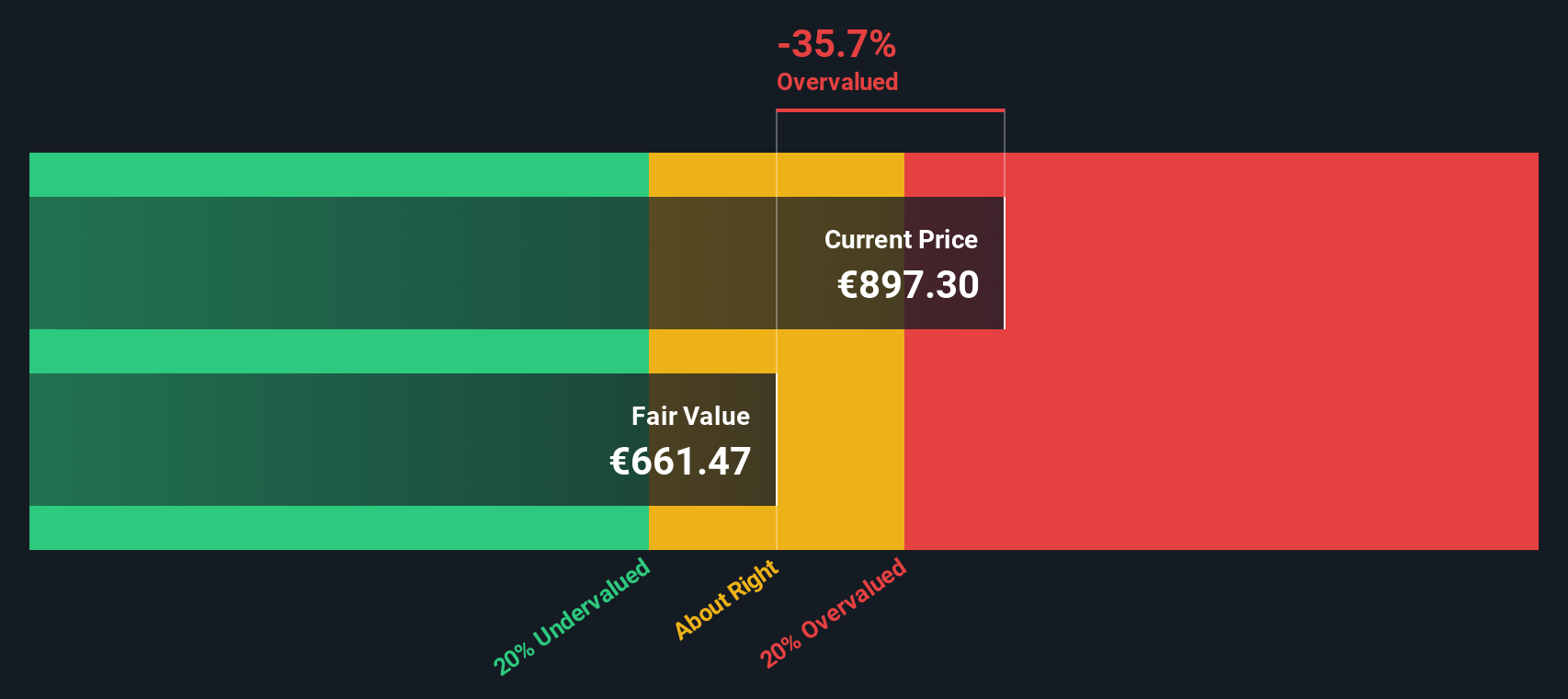

Most Popular Narrative: 23.9% Overvalued

According to Investingwilly's narrative, ASML Holding's fair value of $1,002.53 sits below the recent close of $1,242.19, putting the current price in the spotlight.

ASML Holding N.V. is a Dutch company and the world’s only supplier of extreme ultraviolet (EUV) lithography machines, a critical technology used to produce the world’s most advanced computer chips. These machines are essential for manufacturing cutting edge semiconductors found in everything from AI chips and smartphones to data centers and advanced computing systems.

Curious how one model gets to a lower fair value despite strong margins and a premium profit multiple? The narrative leans heavily on sustained profitability and a rich future earnings multiple to justify its view. The full write up shows exactly how those assumptions translate into that fair value line.

Result: Fair Value of $1,002.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could be challenged if export restrictions tighten further or if chipmakers slow equipment spending, putting pressure on bookings and assumptions about long term growth.

Find out about the key risks to this ASML Holding narrative.

Another Way To Look At The Price

ASML looks expensive on our SWS DCF model, which points to a fair value of $912.61 versus the current $1,242.19 share price. That gap supports the idea that optimism may already be reflected in the stock. The real question is how comfortable you are paying up for quality.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ASML Holding Narrative

If you see the story differently, or just want to test your own assumptions against the numbers, you can build a custom view in minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ASML Holding.

Looking for more investment ideas?

If ASML is on your radar, it is worth broadening your watchlist so you are not relying on a single story when new opportunities show up.

- Spot potential turnaround candidates early by scanning these 3556 penny stocks with strong financials that already back their story with solid financials.

- Ride the AI wave more deliberately by focusing on these 26 AI penny stocks that sit at the intersection of growth potential and market attention.

- Aim for price and fundamentals to line up by zeroing in on these 877 undervalued stocks based on cash flows that stand out on discounted cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报