Cadence Design Systems (CDNS) Valuation After Chiplet Ecosystem Launch With Arm And Samsung Foundry

Cadence Design Systems (CDNS) has launched a Chiplet Spec-to-Packaged Parts ecosystem focused on physical AI, data center, and high performance computing, in partnership with Arm, Samsung Foundry, and several IP providers.

See our latest analysis for Cadence Design Systems.

The Chiplet Spec-to-Packaged Parts launch lands after a softer 90-day share price return of 10.10% and a 30-day share price return decline of 6.78%, while the 3-year total shareholder return of 91.48% and 5-year total shareholder return of 135.30% show how powerful the longer term trend has been.

If this kind of AI focused story has your attention, it could be a good moment to broaden your search and look at high growth tech and AI stocks as well.

With a recent 30 day share price decline of 6.78% but multi year total returns above 90%, is Cadence now trading below what its fundamentals suggest, or is the market already pricing in years of future growth?

Most Popular Narrative: 18.1% Undervalued

With Cadence Design Systems last closing at US$314.64 against a narrative fair value of about US$384.20, the valuation story hinges on strong AI and high performance compute design demand.

The analysts have a consensus price target of $369.573 for Cadence Design Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $410.0, and the most bearish reporting a price target of just $200.0.

Want to see what sits behind that fair value gap? Revenue expansion, fatter margins and a rich future P/E are all baked in. The exact mix might surprise you.

Result: Fair Value of $384.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat AI story could be knocked off course if geopolitical tensions affect Cadence's China exposure or if key partnerships fail to deliver as expected.

Find out about the key risks to this Cadence Design Systems narrative.

Another View: Market Multiple Sends A Different Signal

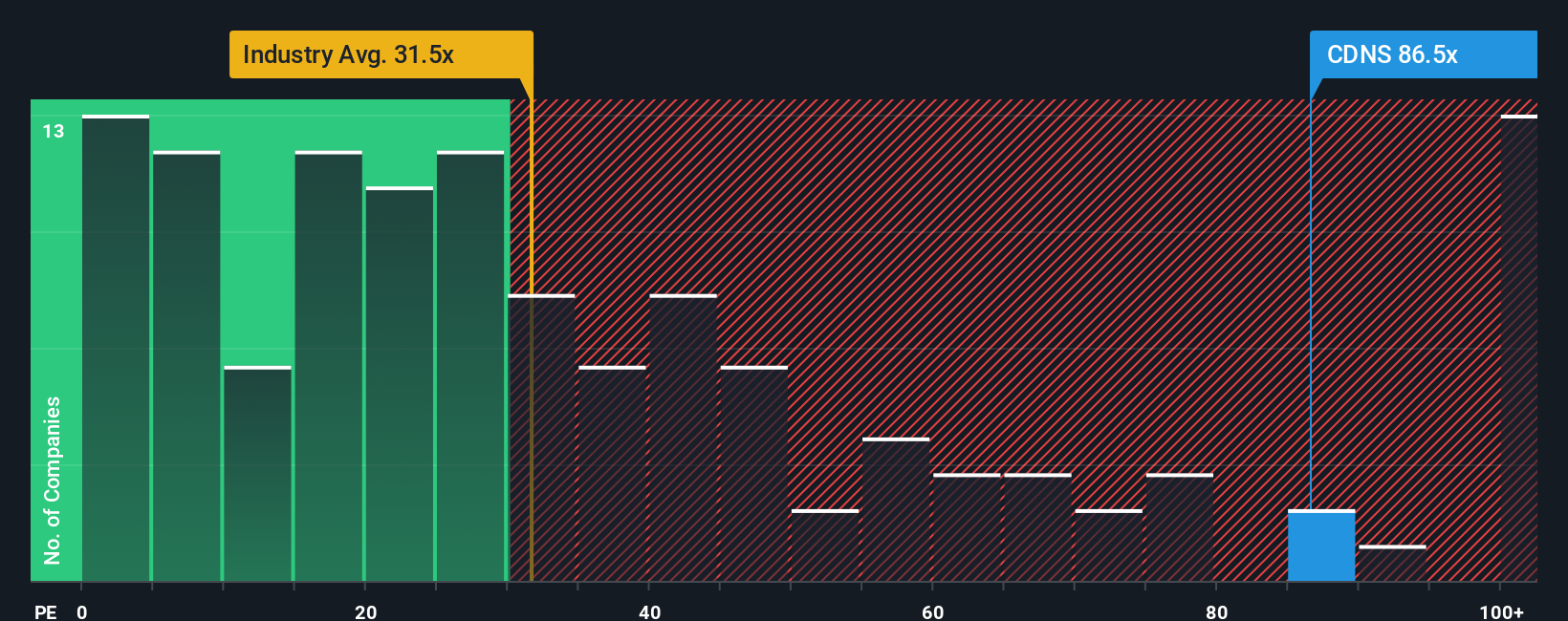

That 18.1% narrative discount paints Cadence as undervalued, but the market ratio tells a tougher story. At a P/E of 80.7x versus 32.7x for the US Software industry and 61.2x for peers, and a fair ratio of 39x, the shares look richly priced. Is this a quality premium or valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cadence Design Systems Narrative

If this story does not line up with your view or you would rather test the numbers yourself, you can build a full narrative in minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Cadence Design Systems.

Looking for more investment ideas?

If you are serious about putting your capital to work, do not stop at one stock; broaden your watchlist now or you risk missing the next opportunity.

- Spot potential value with momentum by reviewing these 877 undervalued stocks based on cash flows that line up strong cash flow expectations with current prices.

- Back themes shaping the future of automation and software by scanning these 25 AI penny stocks that focus on artificial intelligence driven revenue models.

- Add diversification with yield potential by checking out these 11 dividend stocks with yields > 3% that offer income above 3% alongside equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报